Costco 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

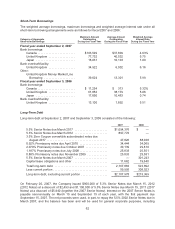

Note 4—Leases

The Company leases land and/or buildings at 104 of the 488 warehouses open at September 2, 2007,

and certain other office and distribution facilities under operating leases. The remaining terms of these

operating leases range from approximately one to 41 years, with the exception of one lease in the U.S.

that has a remaining life of 77 years and one lease in the Company’s United Kingdom subsidiary,

which has a remaining lease term of 144 years. These leases generally contain one or more of the

following options which the Company can exercise at the end of the initial lease term: (a) renewal of

the lease for a defined number of years at the then-fair market rental rate or rate stipulated in the lease

agreement; (b) purchase of the property at the then-fair market value; or (c) right of first refusal in the

event of a third party purchase offer. Certain leases provide for periodic rental increases based on the

price indices, and some of the leases provide for rents based on the greater of minimum guaranteed

amounts or sales volume. Contingent rents have not been material. The Company accounts for its

leases with step-rent provisions on a straight-line basis over the original term of the lease.

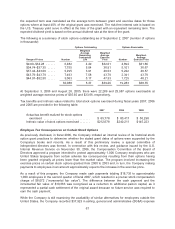

Aggregate rental expense for fiscal 2007, 2006 and 2005 was $143,448, $134,406 and $127,770,

respectively. The amount for 2005 excludes $15,999 in rent expense associated with the correction

made in the second quarter of fiscal 2005 to the Company’s method of accounting for ground leases

that did not require rental payments during the period of construction.

The Company has sub-leases related to certain of its operating lease agreements. During fiscal 2007,

2006 and 2005, the Company recognized sub-lease income of $9,008, $9,425 and $7,773,

respectively, included in interest income and other in the consolidated statements of income.

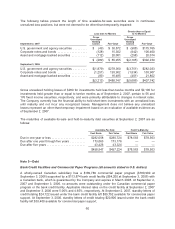

Future minimum payments, net of sub-lease income of $149,407 for all years combined, during the

next five fiscal years and thereafter under non-cancelable leases with terms of at least one year, at

September 2, 2007, were as follows:

2008 .................................................... $ 137,225

2009 .................................................... 127,068

2010 .................................................... 115,393

2011 .................................................... 110,750

2012 .................................................... 98,973

Thereafter ................................................ 1,305,035

Total minimum payments ............................... $1,894,444

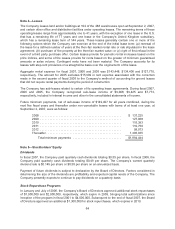

Note 5—Stockholders’ Equity

Dividends

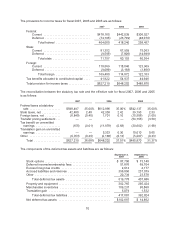

In fiscal 2007, the Company paid quarterly cash dividends totaling $0.55 per share. In fiscal 2006, the

Company paid quarterly cash dividends totaling $0.49 per share. The Company’s current quarterly

dividend rate is $0.145 per share or $0.58 per share on an annualized basis.

Payment of future dividends is subject to declaration by the Board of Directors. Factors considered in

determining the size of the dividends are profitability and expected capital needs of the Company. The

Company presently expects to continue to pay dividends on a quarterly basis.

Stock Repurchase Programs

In January and July of 2006, the Company’s Board of Directors approved additional stock repurchases

of $1,000,000 and $2,000,000, respectively, which expire in 2009, bringing total authorizations since

inception of the program in fiscal 2001 to $4,500,000. Subsequent to the end of fiscal 2007, the Board

of Directors approved an additional $1,300,000 for stock repurchases, which expires in 2010.

64