Costco 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

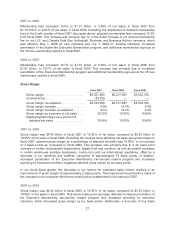

FIVE YEAR OPERATING AND FINANCIAL HIGHLIGHTS

The following selected financial and operating data are derived from our consolidated financial

statements and should be read in conjunction with “Management’s Discussion and Analysis of

Financial Condition and Results of Operations,” and our consolidated financial statements.

SELECTED FINANCIAL DATA

(dollars in thousands, except per share and warehouse data)

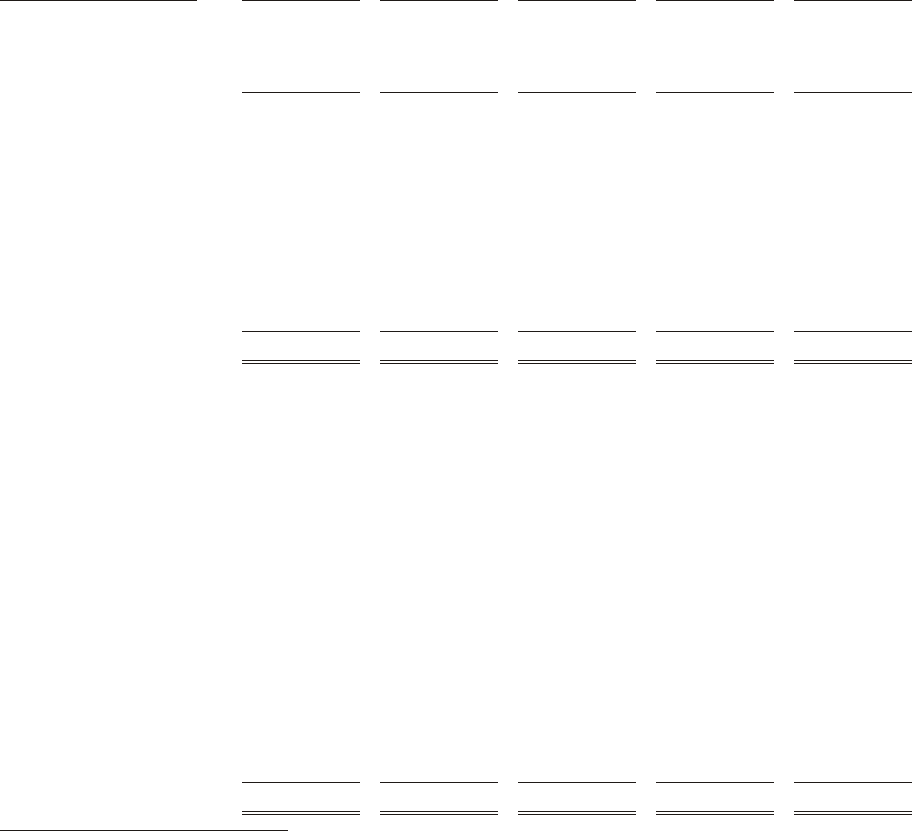

As of and for the fiscal year

ended(1)

Sept. 2, 2007

(52 weeks)

Sept. 3, 2006

(53 weeks)

Aug. 28, 2005

(52 weeks)

Aug. 29, 2004

(52 weeks)

Aug. 31, 2003

(52 weeks)

RESULTS OF

OPERATION

Net sales ............... $63,087,601 $58,963,180 $51,879,070 $47,148,627 $41,694,561

Merchandise costs ....... 56,449,702 52,745,497 46,346,961 42,092,016 37,235,383

Gross Margin ........ 6,637,899 6,217,683 5,532,109 5,056,611 4,459,178

Membership fees ........ 1,312,554 1,188,047 1,073,156 961,280 852,853

Operating income ........ 1,608,586 1,625,632 1,474,303 1,385,648 1,156,628

Net income ............. 1,082,772 1,103,215 1,063,092 882,393 721,000

Net income per diluted

share ................ 2.37 2.30 2.18 1.85 1.53

Dividends per share ...... $ 0.55 $ 0.49 $ 0.43 $ 0.20 $ —

Increase in comparable

warehouse sales(2)

United States ........ 5% 7% 6% 9% 4%

International ......... 9% 11% 11% 14% 10%

Total ............... 6% 8% 7% 10% 5%

BALANCE SHEET DATA

Net property and

equipment ........ $ 9,519,780 $ 8,564,295 $ 7,790,192 $ 7,219,829 $ 6,960,008

Total assets ......... 19,606,586 17,495,070 16,665,205 15,092,548 13,191,688

Short-term

borrowings ........ 53,832 41,385 54,356 21,595 47,421

Current portion of long-

term debt ......... 59,905 308,523 3,225 305,594 7,051

Long-term debt,

excluding current

portion ........... 2,107,978 215,369 710,675 993,746 1,289,649

Stockholders’ equity . . $ 8,623,341 $ 9,143,439 $ 8,881,109 $ 7,624,810 $ 6,554,980

WAREHOUSE

INFORMATION

Warehouses in

Operation(3)

Beginning of year .... 458 433 417 397 374

Opened(4) .......... 30 28 21 20 29

Closed(4) ........... — (3) (5) — (6)

End of Year ......... 488 458 433 417 397

(1) Certain reclassifications have been made to prior fiscal years to conform to the presentation adopted in the

current fiscal year.

(2) Includes net sales at warehouses open greater than one year, including relocated locations.

(3) Excludes warehouses operated in Mexico through a 50% owned joint venture.

(4) Includes relocations.

23