Comcast 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

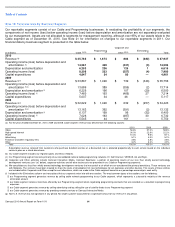

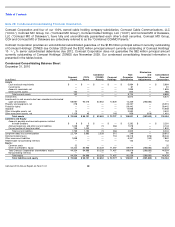

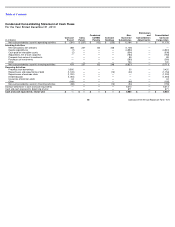

Note 19: Financial Data by Business Segment

Our reportable segments consist of our Cable and Programming businesses. In evaluating the profitability of our segments, the

components of net income (loss) below operating income (loss) before depreciation and amortization are not separately evaluated

by our management. Assets are not allocated to segments for management reporting, although over 95% of our assets relate to the

Cable segment as of December 31, 2010. See Note 21 for information on changes to our reportable segments in 2011. Our

financial data by business segment is presented in the table below.

(in millions)

Cable

Programming

Corporate and

Other

Eliminations

Total

2010

Revenue

$

35,762

$

1,674

$

883

$

(382

)

$

37,937

Operating income (loss) before depreciation and

amortization

14,561

469

(431

)

(3

)

14,596

Depreciation and amortization

6,253

236

126

1

6,616

Operating income (loss)

8,308

233

(557

)

(4

)

7,980

Capital expenditures

4,847

34

80

—

4,961

2009

Revenue

$

33,867

$

1,496

$

739

$

(346

)

$

35,756

Operating income (loss) before depreciation and

amortization

13,686

389

(359

)

(2

)

13,714

Depreciation and amortization

6,226

196

107

(29

)

6,500

Operating income (loss)

7,460

193

(466

)

27

7,214

Capital expenditures

5,037

34

46

—

5,117

2008

Revenue

$

32,622

$

1,426

$

632

$

(257

)

$

34,423

Operating income (loss) before depreciation and

amortization

13,163

362

(391

)

(2

)

13,132

Depreciation and amortization

6,137

199

96

(32

)

6,400

Operating income (loss)

7,026

163

(487

)

30

6,732

Capital expenditures

5,545

44

161

—

5,750

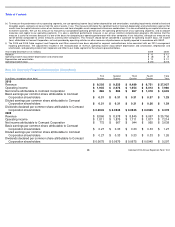

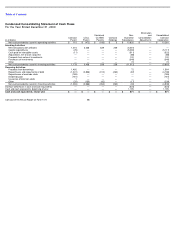

(a)

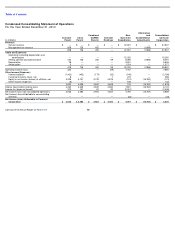

For the years ended December 31, 2010, 2009 and 2008, Cable segment revenue was derived from the following sources:

2010

2009

2008

Video

54.6

%

57.2

%

58.8

%

High-speed Internet

24.0

%

22.9

%

22.2

%

Phone

10.3

%

9.6

%

8.1

%

Advertising

5.1

%

4.3

%

5.2

%

Franchise and other regulatory fees

2.8

%

2.8

%

2.8

%

Other

3.2

%

3.2

%

2.9

%

Total

100.0

%

100.0

%

100.0

%

Subscription revenue received from customers who purchase bundled services at a discounted rate is allocated proportionally to each service based on the individual

service’s price on a stand-alone basis.

(b)

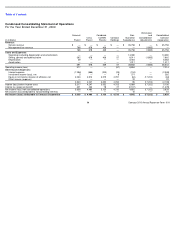

Our Cable segment includes our regional sports and news networks.

(c)

Our Programming segment consists primarily of our consolidated national cable programming networks, E!, Golf Channel, VERSUS, G4 and Style.

(d)

Corporate and Other activities include Comcast Interactive Media, Comcast Spectacor, a portion of operating results of our less than wholly owned technology

development ventures (see “(e)” below), corporate activities and all other businesses not presented in our Cable or Programming segments.

(e)

We consolidate our less than wholly owned technology development ventures that we control or of which we are considered the primary beneficiary. These ventures are

with Motorola. The ventures have been created to share the costs of development of new technologies for set

-

top boxes and other devices. The results of these entities

are included within Corporate and Other except for cost allocations, which are made to the Cable segment based on our percentage ownership in each entity.

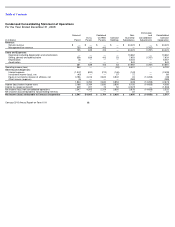

(f)

Included in the Eliminations column are transactions that our segments enter into with one another. The most common types of transactions are the following:

4

our Programming segment generates revenue by selling cable network programming to our Cable segment, which represents a substantial majority of the revenue

elimination amount

4

our Cable segment receives incentives offered by our Programming segment when negotiating programming contracts that are recorded as a reduction to programming

expenses

4

our Cable segment generates revenue by selling advertising and by selling the use of satellite feeds to our Programming segment

4

our Cable segment generates revenue by providing network services to Comcast Interactive Media

(g)

Non-U.S. revenue was not significant in any period. No single customer accounted for a significant amount of our revenue in any period.

Comcast 2010 Annual Report on Form 10-K

84

(a)(b) (c) (d)(e) (f)

(g)

(h)

(g)(i)

(h)(i)

(i)

(i)

(g)(i)

(h)(i)

(i)

(i)