Comcast 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Critical Accounting Judgments and Estimates

The preparation of our financial statements requires us to

make estimates that affect the reported amounts of assets,

liabilities, revenue and expenses, and the related disclosure

of contingent assets and contingent liabilities. We base our

judgments on our historical experience and on various other

assumptions that we believe are reasonable under the

circumstances, the results of which form the basis for making

estimates about the carrying values of assets and liabilities

that are not readily apparent from other sources. Actual

results may differ from these estimates under different

assumptions or conditions.

We believe our judgments and related estimates associated

with the valuation and impairment testing of our cable

franchise rights and the accounting for income taxes are

critical in the preparation of our financial statements.

Management has discussed the development and selection

of these critical accounting judgments and estimates with the

Audit Committee of our Board of Directors, and the Audit

Committee has reviewed our disclosures relating to them,

which are presented below.

Refer to Note 2 to our consolidated financial statements for a

discussion of our accounting policies with respect to these

and other items.

Valuation and Impairment Testing of Cable Franchise

Rights

Our largest asset, our cable franchise rights, results from

agreements we have with state and local governments that

allow us to construct and operate a cable business within a

specified geographic area. The value of a franchise is derived

from the economic benefits we receive from the right to solicit

new customers and to market new services, such as

advanced video services and high-speed Internet and phone

services, in a particular service area. The amounts we record

for cable franchise rights are primarily a result of cable

system acquisitions. Typically when we acquire a cable

system, the most significant asset we record is the value of

the cable franchise rights. Often these cable system

acquisitions include multiple franchise areas. We currently

serve approximately 6,400 franchise areas in the United

States.

We have concluded that our cable franchise rights have an

indefinite useful life since there are no legal, regulatory,

contractual, competitive, economic or other factors which limit

the period over which these rights will contribute to our cash

flows. Accordingly, we do not amortize our cable franchise

rights but assess the carrying value of our cable franchise

rights annually, or more frequently whenever events or

changes in circumstances indicate that the carrying amount

may exceed the fair value (“impairment testing”). We

estimate the fair value of our cable franchise rights primarily

based on a discounted cash flow analysis that involves

significant judgment. When analyzing the fair values

indicated under the discounted cash flow models, we also

consider multiples of operating income before depreciation

and amortization generated by under-

lying assets, current market transactions and profitability

information.

If we were to determine that the value of our cable franchise

rights was less than the carrying amount, we would recognize

an impairment charge for the difference between the

estimated fair value and the carrying value of the assets. For

purposes of our impairment testing, we have grouped the

recorded values of our various cable franchise rights into our

Cable divisions or units of account. We evaluate the unit of

account periodically to ensure our impairment testing is

performed at an appropriate level.

Since the adoption of the accounting guidance related to

goodwill and intangible assets in 2002, we have not recorded

any significant impairment charges to cable franchise rights

as a result of our impairment testing. A future change in the

unit of account could result in the recognition of an

impairment charge.

We could also record impairment charges in the future if

there are changes in long-term market conditions, in

expected future operating results, or in federal or state

regulations that prevent us from recovering the carrying value

of these cable franchise rights. Assumptions made about

increased competition and economic conditions could also

impact the valuations used in future annual impairment

testing and result in a reduction of fair values from those

determined in the July 1, 2010 annual impairment testing.

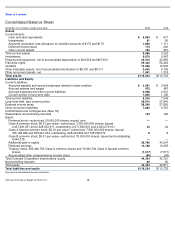

The table below illustrates the impairment related to our

Cable divisions that would have occurred had the

hypothetical reductions in fair value existed at the time of our

last annual impairment testing.

The Cable divisions represent the unit of account we use to

test for impairment. In November 2010, our Cable division

management structure was reorganized from four divisions to

three, with certain regions from the prior divisions being

moved to a different division within the new management

structure. We re-performed our impairment testing

immediately before the reorganization and no impairment

was indicated.

Income Taxes

We base our provision for income taxes on our current period

income, changes in our deferred income tax assets and

liabilities, income tax rates, changes in estimates of our

uncertain tax posi-

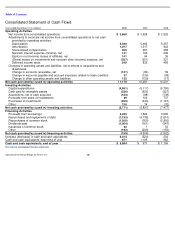

Percent Hypothetical Reduction in Fair Value and Related

Impairment

(in millions)

10%

15%

20%

25%

Eastern

Division

$

(711

)

$

(1,566

)

$

(2,421

)

$

(3,276

)

NorthCentral

Division

—

(

843

)

(1,778

)

(2,713

)

Southern

Division

—

—

—

—

West

Division

—

—

—

(

869

)

$

(711

)

$

(2,409

)

$

(4,199

)

$

(6,858

)