Comcast 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

facilities and unused irrevocable standby letters of credit

totaling $431 million to cover potential fundings under various

agreements .

ZONES

At maturity, holders of our 2.0% Exchangeable Subordinated

Debentures due 2029 (“ZONES”) are entitled to receive in

cash an amount equal to the higher of the principal amount of

the outstanding ZONES of $247 million or the market value of

approximately 3.3 million shares of Sprint Nextel common

stock and 228,807 shares of CenturyLink common stock.

Before maturity, each of the ZONES is exchangeable at the

holder’s option for an amount of cash equal to 95% of the

aggregate market value of one share of Sprint Nextel

common stock and 0.0685 shares of CenturyLink common

stock.

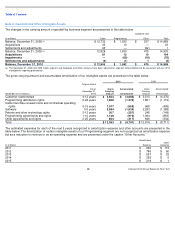

We separate the accounting for the ZONES into derivative

and debt components. The following table presents the

change in the carrying value of the debt component and the

change in the fair value of the derivative component (see

Note 6).

Note 10: Derivative Financial Instruments

We use derivative financial instruments to manage our

exposure to the risks associated with fluctuations in interest

rates, equity prices and foreign exchange rates.

We manage our exposure to fluctuations in interest rates by

using derivative financial instruments such as interest rate

exchange agreements (“swaps”), interest rate lock

agreements (“rate locks”) and interest rate collars (“collars”).

We sometimes enter into rate locks or collars to hedge the

risk that the cash flows related to the interest payments on an

anticipated issuance or assumption of fixed-rate debt may be

adversely affected by interest rate fluctuations.

We manage our exposure to and benefits from price

fluctuations in the common stock of some of our investments

by using equity derivative financial instruments embedded in

other contracts, such as prepaid forward sale agreements,

(in millions)

Debt

Component

Derivative

Component

Total

Balance,

January 1,

2010

$

109

$

15

$

124

Change in debt

component to

interest

expense

5

—

5

Change in

derivative

component to

investment

income (loss),

net

—

(

5

)

(5

)

Repurchases

(14

)

(2

)

(16

)

Balance,

December 31,

2010

$

100

$

8

$

108

We manage our exposure to foreign exchange risk related to

our foreign currency denominated borrowings by using cross-

currency swaps, effectively converting these borrowings to

U.S. dollar denominated borrowings.

We manage the credit risks associated with our derivative

financial instruments through diversification and the

evaluation and monitoring of the creditworthiness of the

counterparties. Although we may be exposed to losses in the

event of nonperformance by the counterparties, we do not

expect such losses, if any, to be significant. We have

agreements with certain counterparties that include collateral

provisions. These provisions require a party with an

aggregate unrealized loss position in excess of certain

thresholds to post cash collateral for the amount in excess of

the threshold. The threshold levels in our collateral

agreements are based on our and the counterparties’ credit

ratings. As of December 31, 2010, neither we nor any of the

counterparties were required to post collateral under the

terms of the agreements.

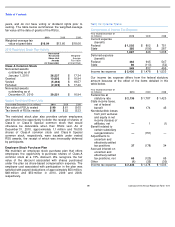

As of December 31, 2010, our derivative financial

instruments designated as hedges included (i) the derivative

component of one of our prepaid forward sale agreements,

which is recorded to other noncurrent liabilities, (ii) our

interest rate swap agreements, which are recorded to other

current or noncurrent assets, and (iii) our cross-currency

swaps, which are recorded to other noncurrent liabilities. As

of December 31, 2010, our derivative financial instruments

not designated as hedges were (i) the derivative component

of our indexed debt instruments (our ZONES debt), which is

recorded to long-term debt, and (ii) the derivative component

of certain of our prepaid forward sale agreements, which is

recorded to other current and noncurrent liabilities. See Note

11 for further details on the fair values of our derivative

financial instruments as of December 31, 2010 and 2009.

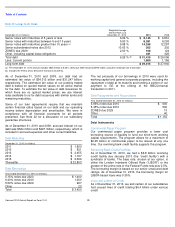

Fair Value Hedges

For derivative financial instruments used to hedge exposure

to interest rate risk that are designated and effective as fair

value hedges, such as fixed to variable swaps, changes in

the fair value of the derivative financial instrument

substantially offset changes in the fair value of the underlying

debt, each of which is recorded to interest expense.

Using swaps, we agree to exchange, at specified dates, the

difference between fixed and variable interest amounts

calculated by reference to an agreed-upon notional principal

amount. In the ordinary course of business, some of our

swaps could be subject to termination provisions if we do not

maintain investment grade credit ratings. The amount to be

paid or received upon termination, if any, would be based on

the fair value of the outstanding contracts at that time. As of

both December 31, 2010 and 2009, the estimated fair value

of those swaps was an asset of $26 million. The table below

summarizes the terms of our existing swaps.