Comcast 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

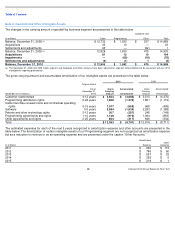

Recurring Fair Value Measures

The table below presents the changes in equity resulting from net income attributable to Comcast Corporation and transfers to or

from noncontrolling interests.

Fair Value as of December 31, 2010

Fair Value as of December 31, 2009

(in millions)

Level 1

Level 2

Level 3

Total

Level 1

Level 2

Level 3

Total

Assets

Trading securities

$

2,688

$

—

$

—

$

2,688

$

1,855

$

—

$ —

$

1,855

Available

-for-sale securities

126

—

—

126

76

—

—

76

Equity warrants

—

—

1

1

—

—

2

2

Interest rate swap agreements

—

232

—

232

—

143

—

143

$

2,814

$

232

$

1

$

3,047

$

1,931

$

143

$

2

$

2,076

Liabilities

Derivative component of ZONES

$

—

$

8

$

—

$

8

$

—

$

15

$ —

$

15

Derivative component of prepaid forward sale

agreements

—

1,021

—

1,021

—

349

—

349

Interest rate swap agreements

—

—

—

—

—

1

—

1

Cross-currency swaps

—

29

—

29

—

—

—

—

$

—

$

1,058

$

—

$

1,058

$

—

$

365

$ —

$

365

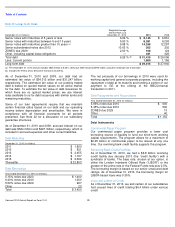

Year ended December 31 (in millions)

2010

2009

Net income attributable to Comcast Corporation

$

3,635

$

3,638

Transfers from (to) noncontrolling interests:

Increase in Comcast Corporation additional paid-in capital resulting from the purchase of noncontrolling

interest

11

30

Decrease in Comcast Corporation additional paid-in capital resulting from the purchase of

noncontrolling interest

—

(

69

)

Changes from net income attributable to Comcast Corporation and transfers from (to) noncontrolling

interests

$

3,646

$

3,599

Comcast 2010 Annual Report on Form 10-K

74

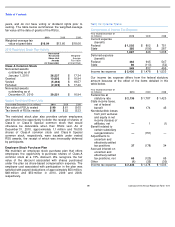

We have assets and liabilities required to be recorded at fair

value on a nonrecurring basis when certain circumstances

occur. In 2010, we recorded impairment charges to goodwill

of $76 million representing the amount of excess of the

reporting unit carrying amount of goodwill over its implied fair

value, which was determined using Level 3 measures.

Note 12: Noncontrolling Interests

Certain of our subsidiaries that we consolidate are not wholly

owned. Some of the agreements with the minority partners of

these subsidiaries contain redemption features whereby

interests held by the minority partners are redeemable either

(i) at the option of the holder or (ii) upon the occurrence of an

event that is not solely within our control. If interests were to

be redeemed under these agreements, we would generally

be required to purchase the interest at fair value on the date

of redemption. These interests are presented on the balance

sheet outside of equity under the caption “Redeemable

noncontrolling interests.” Noncontrolling interests that do not

contain such redemption features are presented in equity.

In 2010, we acquired all of the noncontrolling interest of one

of our technology ventures, which had a carrying value of

approximately $20 million, for approximately $9 million. The

difference between the amount paid and the carrying value

resulted in an increase of approximately $11 million to

additional paid-in capital of Comcast Corporation.

In 2009, we acquired all of the noncontrolling interest of one

of our technology ventures, which had a carrying value of

approximately $35 million, for approximately $5 million and

rights to existing intellectual property. The difference between

the amount paid and the carrying value resulted in an

increase of approximately $30 million to additional paid-in

capital of Comcast Corporation.

Also in 2009, through a series of transactions, we acquired all

of the noncontrolling interest of one of our regional sports

networks, which had a carrying value of approximately

$4 million, for approximately $73 million. The difference

between the amount paid and the carrying value resulted in a

decrease of approximately $69 million to additional paid-in

capital of Comcast Corporation.