Comcast 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NBCUniversal

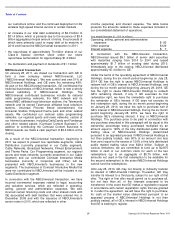

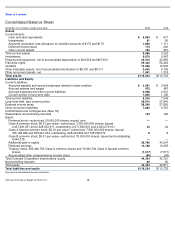

The table below presents the contractual obligations related to the NBCUniversal contributed businesses as of December 31, 2010,

excluding NBCUniversal’

s payment of $7.4 billion to GE at the close of the NBCUniversal transaction on January 28, 2011 and

other acquisition-related obligations.

Payments of $1.6 billion of participations and residuals are not included in the table above because we cannot make a reliable

estimate of the period in which the obligations will become payable. Additionally, we have not reflected incremental obligations that

may arise as a result of the NBCUniversal transaction.

Payment Due by Period

(in millions)

Total

Year 1

Years 2-

3

Years 4-

5

More than 5

Debt obligations

$

9,100

$

—

$

—

$

1,900

$

7,200

Purchase obligations

8,568

3,370

3,877

950

371

Operating leases

1,455

252

386

261

556

Other long-term obligations

852

444

296

62

50

Total

$

19,975

$

4,066

$

4,559

$

3,173

$

8,177

(a)

Excludes interest payments and the principal amount due on an $816 million senior secured note as described under Station Venture Note below.

(b)

Purchase obligations consist primarily of the commitments to acquire film and television programming, including U.S. television rights to the future Olympic Games, NBC’

s

Sunday Night Football through the 2013-

2014 season and the NFL Super Bowl in 2012; and obligations under various creative talent and employment agreements,

including obligations to actors, producers, television personalities and executives, and various other television commitments.

(c)

Other long-term obligations consist primarily of programming obligations payable under NBCUniversal’s license arrangements.

47

Comcast 2010 Annual Report on Form 10-

K

(a)

(b)

(c)

Station Venture Note

NBCUniversal owns an economic interest of approximately

79% and a 50% voting interest in Station Venture Holdings,

LLC (“Station Venture”). Station Venture, through its

ownership interests in Station Venture Operations, LP

(“Station LP”), holds an indirect interest in the NBC Network

affiliated local television stations in Dallas, Texas and San

Diego, California. The remaining interests in these television

stations are held by LIN TV, Corp (“LIN TV”). Station Venture

is the obligor on an $816 million senior secured note due in

2023, which is non-recourse to NBCUniversal and is due to

General Electric Capital Corporation, a subsidiary of GE. The

note is collateralized by substantially all of the assets of

Station Venture and Station LP, and is guaranteed by LIN

TV. In connection with the closing of the NBCUniversal

transaction, GE has indemnified NBCUniversal for all

liabilities NBCUniversal incurs as a result of the note, or

under any related credit support, risk of loss or similar

arrangement in existence prior to the closing of the

NBCUniversal transaction on January 28, 2011. As a result of

the indemnification from GE, we have not included the $816

million note in NBCUniversal’s debt obligations in the table

above.

NBCUniversal Guarantees

NBCUniversal has certain contingent commitments that are

not included in the table above. NBCUniversal guarantees an

obligation of its 50% joint venture, Universal City

Development Partners, (“UCDP”), which owns Universal

Studios Florida and Islands of Adventure in Orlando, Florida.

UCDP pays fees to a consultant equal to a percentage of

revenue from NBCUniversal facilities located in Orlando and

from defined comparable projects outside Orlando.

NBCUniversal directly pays the fees due under the consulting

agreement on behalf of UCDP with respect to Universal

Studios Japan and Universal Studios Singapore. The

consulting agreement does not have a termination date and

the consultant has an option to terminate the consulting

agreement in exchange for a lump sum payment established

by a formula in the consulting agreement. The consultant’s

right to elect a lump sum payment cannot be exercised prior

to June 2017. If UCDP cannot pay the fees owed under the

consulting agreement or, if elected, the lump sum payment

for termination of the consulting agreement, NBCUniversal

could be liable for the entire unpaid amounts.

Additionally, affiliates of the Blackstone Group L.P. hold a

50% interest in UCDP through their equity interests in

UCDP’s general and limited partners. Those Blackstone

Group affiliates entered into a five-year loan agreement in

November 2009 with a syndicate of lenders in the amount of

$305 million, including prefunded interest and amortization,

which is secured by their equity interests in UCDP.

NBCUniversal guaranteed the loan on a deficiency basis and

received a fee for the guarantee. Future distributions, other

than tax distributions, from UCDP to the Blackstone Group

affiliate borrowers are applied to the repayment of the loan.

NBCUniversal Film Financing

NBCUniversal enters into film co-financing arrangements with

third parties, including both studio and non-studio entities, to

jointly finance or distribute many of its film productions.

These arrangements can take various forms. In most cases,

the form of the arrangement involves the grant of an

economic interest in a film to an investor. Investors typically

assume the full risks and rewards of ownership proportionate

to their ownership in the film. Accordingly, NBCUniversal’s

proceeds in these arrangements are accounted for as a

reduction of the capitalized cost of the film. Any