Comcast 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Comcast 2010 Annual Report on Form 10-K

44

We anticipate that we will continue to use a substantial

portion of our cash flows to fund our capital expenditures, to

invest in business opportunities, to meet our debt repayment

obligations and to return capital to shareholders.

We traditionally maintain significant availability under our

lines of credit and our commercial paper program to meet our

short-term liquidity requirements. As of December 31, 2010,

amounts available under all of our credit facilities totaled

approximately $6.4 billion. As of the closing of the

NBCUniversal transaction on January 28, 2011,

NBCUniversal had a $750 million three-year revolving credit

facility.

We and our Cable subsidiaries that have provided

guarantees are subject to the covenants and restrictions set

forth in the indentures governing our public debt securities

and in the credit agreements governing our bank credit

facilities (see Note 22 to our consolidated financial

statements). We and the guarantors are in compliance with

the covenants, and we believe that neither the covenants nor

the restrictions in our indentures or loan documents will limit

our ability to operate our businesses or raise additional

capital. We test our compliance with our credit facilities’

covenants on an ongoing basis. The only financial covenant

in our $6.8 billion revolving credit facility due 2013 pertains to

leverage (ratio of debt to operating income before

depreciation and amortization). As of December 31, 2010, we

met this financial covenant by a significant margin. We do not

expect to have to further reduce debt or improve operating

results in order to continue to comply with this financial

covenant.

In connection with the NBCUniversal transaction, we were

required to make a cash payment of $6.2 billion. We funded

this payment with cash on hand and $650 million of

commercial paper borrowings. The cash paid will be adjusted

after the close to reflect final balances of certain working

capital accounts and other closing adjustments. The

transaction also calls for the payment to GE, in the future, of

certain tax benefits to the extent realized by us. Beginning in

2011, we will consolidate $9.1 billion of NBCUniversal senior

debt securities with maturities ranging from 2014 to 2041. We

do not guarantee NBCUniversal’s debt obligations. Any future

redemptions of GE’s stake in NBCUniversal Holdings are

expected to be funded primarily through NBCUniversal’s

cash flows from operating activities and its borrowing

capacity. If any borrowings by NBCUniversal to fund either of

GE’s two potential redemptions would result in NBCUniversal

exceeding a certain leverage ratio or losing investment grade

status or if it cannot otherwise fund such redemptions, we are

committed to fund up to $2.875 billion in cash or our common

stock for each of the two potential redemptions (for an

aggregate of up to $5.75 billion, with amounts not used in the

first redemption to be available for the second redemption) to

the extent NBCUniversal Holdings cannot fund the

redemptions.

Operating Activities

Components of Net Cash Provided by Operating Activities

The changes in operating assets and liabilities in 2010 and

2009 primarily relate to the timing of payments of operating

items and payroll. In 2009, there was a significant reduction

in accrued liabilities due to a payroll period occurring at the

end of the year.

The decrease in interest payments in 2010 was primarily due

to the effects of early extinguishment costs associated with

the repayment of our debt obligations in connection with a

cash tender offer in July 2009. The decrease in interest

payments in 2009 was primarily due to decreases in interest

rates on debt subject to variable interest rate swap

agreements, the effects of our debt repayments and the

maturity of certain higher rate debt in 2008.

The increase in income tax payments in 2010 was primarily

due to increases in 2010 taxable income, partially offset by

tax payments made in 2009 that related to prior years. The

increase in income tax payments in 2009 was primarily due

to increases in 2009 taxable income, the settlements of

uncertain tax positions and a tax payment made in 2009 that

related to 2008, partially offset by the net benefits of

approximately $341 million from the 2008 and 2009

economic stimulus legislation.

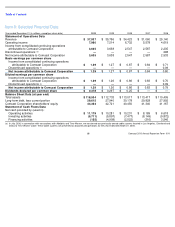

Year ended December 31 (in millions)

2010

2009

2008

Operating income

$

7,980

$

7,214

$

6,732

Depreciation and

amortization

6,616

6,500

6,400

Operating income

before depreciation

and amortization

14,596

13,714

13,132

Noncash share-based

compensation

300

257

258

Changes in operating

assets and liabilities

(20

)

(450

)

(251

)

Cash basis operating

income

14,876

13,521

13,139

Payments of interest

(1,983

)

(2,040

)

(2,256

)

Payments of income taxes

(1,864

)

(1,303

)

(762

)

Proceeds from interest,

dividends and other

nonoperating items

154

103

125

Excess tax benefit under

share-based

compensation presented

in financing activities

(4

)

—

(

15

)

Net cash provided by

operating activities

$

11,179

$

10,281

$

10,231