Comcast 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

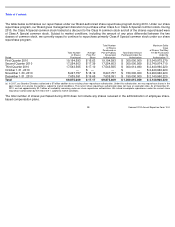

Cable Segment Operating Expenses

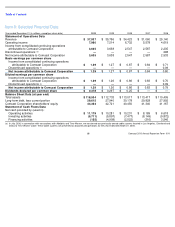

Cable Segment Selling, General and Administrative Expenses

Year ended December 31 (in millions)

2010

2009

2008

% Change

2009 to 2010

% Change

2008 to 2009

Video programming

$

7,438

$

7,046

$

6,479

5.6

%

8.8

%

Technical labor

2,263

2,295

2,188

(1.4

)%

4.9

%

High-speed Internet

499

524

526

(4.9

)%

(0.4

)%

Phone

566

567

699

(0.1

)%

(18.8

)%

Other

3,498

3,090

2,965

13.3

%

4.2

%

Total operating expenses

$

14,264

$

13,522

$

12,857

5.5

%

5.2

%

(a)

Reclassifications have been made to the prior years’ amounts to conform to classifications used in 2010.

Year ended December 31 (in millions)

2010

2009

2008

% Change

2009 to 2010

% Change

2008 to 2009

Customer service

$

1,815

$

1,861

$

1,757

(2.5

)%

5.9

%

Marketing

1,883

1,603

1,628

17.4

%

(1.6

)%

Administrative and other

3,239

3,195

3,217

1.4

%

(0.7

)%

Total selling, general and administrative expenses

$

6,937

$

6,659

$

6,602

4.2

%

0.8

%

(a)

Reclassifications have been made to the prior years’ amounts to conform to classifications used in 2010.

41

Comcast 2010 Annual Report on Form 10-

K

ming license agreements with multichannel video providers

and through the sale of advertising. These networks were

contributed to NBCUniversal at the close of the

NBCUniversal transaction on January 28, 2011.

Franchise and Other Regulatory Fees

Our franchise and other regulatory fee revenue represents

the pass-through to our customers of the fees required to be

paid to federal, state and local authorities. Under the terms of

our franchise agreements, we are generally required to pay

to the

franchising authority an amount based on our gross video

revenue. The increases in franchise and other regulatory fees

collected from our cable customers in 2010 and 2009 were

primarily due to increases in the revenue on which the fees

apply.

Cable Segment Expenses

We continue to focus on controlling the growth of expenses.

Our operating margin (operating income before depreciation

and amortization as a percentage of revenue) for 2010, 2009

and 2008 was 40.7%, 40.4% and 40.3%, respectively.

(a)

(a)

(a)

(a)

(a)

Video programming expenses, our largest operating

expense, are the fees we pay to programming networks to

license the programming we distribute to our video

customers. These expenses are affected by changes in the

fees charged by programming networks, the number of video

customers we serve and the number of channels and

programs we provide. Video programming expenses

increased in 2010 and 2009, primarily due to increased rates,

additional digital customers and additional programming

options offered. The increase in 2009 was also due to the

introduction of fees incurred for retransmission of broadcast

networks. We anticipate that our video programming

expenses will continue to increase as the fees charged by

programming networks increase, as new fees for

retransmission of broadcast networks are incurred, and as

we provide additional channels and video on demand

programming options to our customers.

Technical labor expenses include the internal and external

labor costs to complete service call and installation activities

in the home as well as network operations, fulfillment and

provisioning costs. These expenses remained relatively

stable in 2010. Technical labor expenses increased in 2009

primarily due to increases in customer service activity levels,

which required additional personnel to handle service calls

and provide in-home customer support, and due

to activity associated with the transition by broadcasters from

analog to digital transmission and our all digital conversion.

High-speed Internet expenses and phone expenses include

certain direct costs for providing these services but do not

fully reflect the amount of operating expenses that would be

necessary to provide these services on a stand-alone basis.

Other related costs associated with providing these services

are generally shared among all our cable services and are

not allocated to these items. The decreases in high-speed

Internet expenses in 2010 and 2009 were primarily due to

lower support service costs that were the result of operating

efficiencies. Phone expenses in 2010 remained consistent

with 2009 expenses despite increases in customer volume.

Phone expenses decreased in 2009 primarily due to lower

support service costs that were the result of operating

efficiencies.

Other operating expenses include franchise fees, pole

rentals, plant maintenance, vehicle-related costs, expenses

related to our regional sports and news networks, advertising

representation and commission fees, and expenses

associated with our business services. These expenses

increased in 2010 and 2009 primarily due to increases in

advertising activity, the continued expansion of business

services, and other service enhancement initiatives.

(a)

(a)

(a)

(a)