Comcast 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

65

Comcast 2010 Annual Report on Form 10-

K

and foreign currency exchange rates. Our objective is to

manage the financial and operational exposure arising from

these risks by offsetting gains and losses on the underlying

exposures with gains and losses on the derivatives used to

economically hedge them. Derivative financial instruments

are recorded in our consolidated balance sheet at fair value.

We formally document, at inception of the relationship,

derivative financial instruments designated to hedge the

exposure to changes in the fair value of a recognized asset

or liability or an unrecognized firm commitment (“fair value

hedge”) or the exposure to changes in cash flows of a

forecasted transaction (“cash flow hedge”), and evaluate

them for effectiveness at the time they are designated, as

well as throughout the hedging period.

For derivative financial instruments designated as fair value

hedges, changes in the fair value of the derivative financial

instrument substantially offset changes in the fair value of the

hedged item, each of which is recorded to the same line in

our consolidated statement of operations. When fair value

hedges are terminated, sold, exercised or have expired, any

gain or loss resulting from changes in the fair value of the

hedged item is deferred and recognized in earnings over the

remaining life of the hedged item. When the hedged item is

settled or sold, the unamortized adjustment in the carrying

amount of the hedged item is recognized in earnings. For

derivative financial instruments designated as cash flow

hedges, the effective portion of the change in fair value of the

derivative financial instrument is reported in accumulated

other comprehensive income (loss) and recognized as an

adjustment to earnings over the period in which the hedged

item affects earnings. When the hedged item is settled or

becomes probable of not occurring, any remaining unrealized

gain or loss from the hedge is recognized in earnings. Cash

flows from hedging activities are classified under the same

category as the cash flows from the hedged items in our

consolidated statement of cash flows. The ineffective portion

of changes in fair value for designated hedges is recognized

on a current basis in earnings.

For those derivative financial instruments that are not

designated as a hedge, changes in fair value are recognized

on a current basis in earnings. Derivative financial

instruments embedded in other contracts are separated from

their host contract. The derivative component is recorded at

its estimated fair value in our consolidated balance sheet and

changes in its fair value are recorded each period in

earnings.

We do not engage in any speculative or leveraged derivative

transactions. All derivative transactions must comply with the

derivatives policy approved by our Board of Directors.

See Note 10 for further discussion of our derivative financial

instruments.

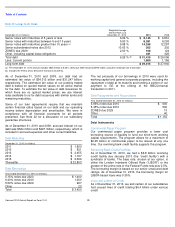

Note 3: Recent Accounting Pronouncements

Consolidation of Variable Interest Entities

In June 2009, the Financial Accounting Standards Board

(“FASB”) updated the accounting guidance related to the

consolidation of VIEs. The updated guidance (i) requires an

ongoing reassessment of whether an enterprise is the

primary beneficiary of a VIE, (ii) changes the quantitative

approach previously required for determining the primary

beneficiary of a VIE and replaces it with a qualitative

approach, and (iii) requires additional disclosure about an

enterprise’s involvement in VIEs. We adopted the updated

guidance on January 1, 2010 and it did not impact our

consolidated financial statements.

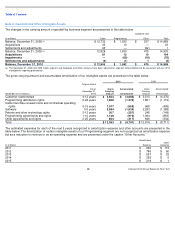

Note 4: Earnings Per Share

Basic earnings per common share attributable to Comcast

Corporation shareholders (“basic EPS”) is computed by

dividing net income attributable to Comcast Corporation by

the weighted-average number of common shares outstanding

during the period.

Our potentially dilutive securities include potential common

shares related to our stock options and our RSUs. Diluted

earnings per common share attributable to Comcast

Corporation shareholders (“diluted EPS”) considers the

impact of potentially dilutive securities using the treasury

stock method. Diluted EPS excludes the impact of potential

common shares related to our stock options in periods in

which the option exercise price is greater than the average

market price of our Class A common stock or our Class A

Special common stock, as applicable.

Diluted EPS for 2010, 2009 and 2008 excludes

approximately 168 million, 195 million and 159 million,

respectively, of potential common shares related to our

share-based compensation plans, because the inclusion of

the potential common shares would have had an antidilutive

effect.