Comcast 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Interest rate risk deferred losses relate to interest rate lock and collar agreements entered into to fix the interest rates of certain of

our debt obligations in advance of their issuance. Unless we retire this debt early, these unrealized losses will be reclassified as an

adjustment to interest expense, primarily through 2022, in the period in which the related interest expense is recognized in

earnings. As of December 31, 2010, we expect $23 million of unrealized losses, $15 million net of deferred taxes, to be reclassified

as an adjustment to interest expense over the next 12 months. The foreign exchange risk deferred losses in 2010 relates to cross-

currency swaps on foreign currency denominated debt due in 2029. Ineffectiveness related to our cash flow hedges was not

material for 2010 or 2009.

See Note 14 for the components of accumulated other comprehensive income (loss).

Nondesignated

In 2010, 2009 and 2008, certain derivative financial instruments relating to equity price risk and interest rate risk were not

designated as fair value or cash flow hedges. Changes in fair value for these instruments are recognized on a current basis in

earnings.

Equity derivative financial instruments embedded in other contracts, such as our ZONES debt, are separated from their host

contract. The derivative component is recorded at its estimated fair value in our consolidated balance sheet and changes in its

value are recorded each period to investment income (loss), net.

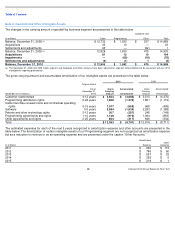

Amount of Gain (Loss) Recognized in Income

— Nondesignated

Year ended December 31 (in millions)

2010

2009

Investment Income (Expense):

Unrealized gains (losses) on securities underlying prepaid forward sale agreements

$

800

$

951

Mark to market adjustments on derivative component of prepaid forward sale agreements

(623

)

(778

)

Mark to market adjustments on derivative component of ZONES

7

8

Other Income (Expense):

Mark to market adjustments on interest rate collars

15

—

Total gain (loss)

$

199

$

181

73

Comcast 2010 Annual Report on Form 10-

K

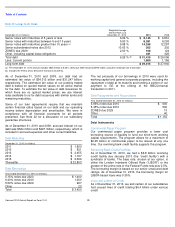

Note 11: Fair Value Measurements

The accounting guidance related to financial assets and

financial liabilities (“financial instruments”) establishes a

hierarchy that prioritizes fair value measurements based on

the types of inputs used for the various valuation techniques

(market approach, income approach and cost approach). The

levels of the hierarchy are described below:

•

Level 1: consists of financial instruments whose values are

based on quoted market prices for identical financial

instruments in an active market

•

Level 2: consists of financial instruments that are valued

using models or other valuation methodologies. These

models use inputs that are observable either directly or

indirectly; Level 2 inputs include (i) quoted prices for similar

assets or liabilities in active markets, (ii) quoted prices for

identical or similar assets or liabilities in markets that are

not active, (iii) pricing models whose inputs are observable

for substantially the full term of the financial

Our assessment of the significance of a particular input to the

fair value measurement requires judgment and may affect the

valuation of financial instruments and their classification

within the fair value hierarchy. Financial instruments are

classified in their entirety based on the lowest level of input

that is significant to the fair value measurement. There have

been no changes in the classification of any financial

instruments within the fair value hierarchy in the periods

presented. Our financial instruments that are accounted for at

fair value on a recurring basis are presented in the table

below.

instrument and (iv) pricing models whose inputs are

derived principally from or corroborated by observable

market data through correlation or other means for

substantially the full term of the financial instrument

•

Level 3: consists of financial instruments whose values are

determined using pricing models that use significant inputs

that are primarily unobservable, discounted cash flow

methodologies, or similar techniques, as well as

instruments for which the determination of fair value

requires significant management judgment or estimation