Comcast 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

45

Comcast 2010 Annual Report on Form 10-

K

Investing Activities

Net cash used in investing activities consists primarily of cash

paid for capital expenditures, intangible assets, acquisitions

and investments.

Capital Expenditures

Our most significant recurring investing activity has been

capital expenditures in our Cable segment, and we expect

that this will continue in the future. A significant portion of our

capital expenditures is based on the level of customer growth

and technologies being deployed. The table below

summarizes the capital expenditures we incurred in our

Cable segment from 2008 through 2010.

Cable capital expenditures decreased 3.8% and 9.2% in

2010 and 2009, respectively, primarily due to fewer

residential unit additions and improved equipment pricing,

partially offset by increased investment in our business

services and strategic initiatives such as our all digital

conversion and the continued deployment of DOCSIS 3.0

wideband technology.

Capital expenditures in our Programming segment were not

significant in 2010, 2009 or 2008. In 2008, our Corporate and

Other business activities included approximately $137 million

of capital expenditures related to the consolidation of offices

and the relocation of our corporate headquarters.

Capital expenditures for 2011 and for subsequent years will

depend on numerous factors, including acquisitions,

competition, changes in technology, regulatory changes and

the timing and rate of deployment of new services.

Acquisitions

On January 28, 2011, we closed the NBCUniversal

transaction (see Note 21 to our consolidated financial

statements). Our 2010 and 2009 acquisitions were not

significant. In 2008, acquisitions were primarily related to our

acquisition of an additional interest in Comcast SportsNet

Bay Area, our acquisition of the remaining interest in G4 that

we did not already own, and our acquisitions of Plaxo and

DailyCandy.

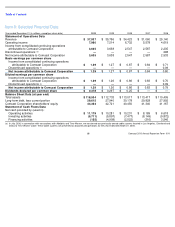

Year ended December 31 (in

millions)

2010

2009

2008

Customer premises

equipment

$

2,715

$

2,934

$

3,147

Scalable infrastructure

800

855

1,024

Line extensions

100

120

212

Support capital

373

421

522

Upgrades (capacity

expansion)

363

356

407

Business services

496

351

233

Total

$

4,847

$

5,037

$

5,545

Proceeds from Sales of Investments

In 2008, proceeds from the sales of investments were

primarily related to the disposition of available-for-sale debt

securities.

Purchases of Investments

In 2010, purchases of investments consisted primarily of the

purchase of an equity method investment in the Houston

Regional Sports Network. In 2009, purchases of investments

consisted primarily of our additional investment in Clearwire.

In 2008, purchases of investments consisted primarily of the

funding of our initial investment in Clearwire.

Financing Activities

Net cash used in financing activities consists primarily of

proceeds from borrowings, offset by our repurchases and

repayments of debt, repurchases of our common stock and

dividend payments. Proceeds from borrowings fluctuate from

year to year based on the amounts paid to fund acquisitions

and debt repayments.

We have made, and may from time to time in the future

make, optional repayments on our debt obligations, which

may include repurchases of our outstanding public notes and

debentures, depending on various factors, such as market

conditions. In 2009, we made $1.6 billion of optional

repurchases of our outstanding public bonds and ZONES

debt.

In July 2009, we completed a cash tender to repurchase

approximately $1.3 billion aggregate principal amount of

certain of our outstanding notes for approximately $1.5

billion. We recognized additional interest expense of

approximately $180 million primarily associated with the

premiums incurred in the tender offer. The premiums related

to the tender offer are included in other financing activities.

See Note 9 to our consolidated financial statements for

further discussion of our financing activities, including details

of our debt repayments and borrowings.

Share Repurchases and Dividends

In 2010, we repurchased approximately 70 million shares of

our Class A Special common stock under our share

repurchase authorization for approximately $1.2 billion. As of

December 31, 2010, we had approximately $2.1 billion of

availability remaining under our share repurchase

authorization. We intend to complete repurchases under the

current share repurchase authorization by the end of 2011,

subject to market conditions.