Comcast 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

37

Comcast 2010 Annual Report on Form 10-

K

NBCUniversal Transaction

On January 28, 2011, we closed our transaction with GE to

form a new company named NBCUniversal, LLC

(“NBCUniversal Holdings”). We now control and own 51% of

NBCUniversal Holdings, and GE owns the remaining 49%.

As part of the NBCUniversal transaction, GE contributed the

historical businesses of NBCUniversal, which is now a wholly

owned subsidiary of NBCUniversal Holdings. The

NBCUniversal contributed businesses include its national

cable programming networks, the NBC network and its

owned NBC affiliated local television stations, the Telemundo

network and its owned Telemundo affiliated local television

stations, Universal Pictures filmed entertainment, the

Universal Studios Hollywood theme park and other related

assets. We contributed our national cable programming

networks, our regional sports and news networks, certain of

our Internet businesses, including DailyCandy and Fandango

and other related assets (“Comcast Content Business”). In

addition to contributing the Comcast Content Business to

NBCUniversal, we made a cash payment of $6.2 billion at the

closing.

As a result of the NBCUniversal transaction, beginning in

2011 we expect to present five reportable segments, Cable

Distribution (currently presented in our Cable segment),

Cable Networks, Broadcast Networks, Filmed Entertainment

and Theme Parks. Our Programming segment, our regional

sports and news networks (currently presented in our Cable

segment) and our contributed Comcast Interactive Media

businesses (currently in Corporate and Other) will be

presented with NBCUniversal’s businesses in the new

segments. The businesses of Comcast Interactive Media that

were not contributed to NBCUniversal will be included in our

Cable Distribution segment.

In connection with the NBCUniversal transaction, we have

incurred incremental expenses related to legal, accounting

and valuation services, which are reflected in operating,

selling, general and administrative expenses. We also

incurred certain financing costs and other shared costs with

GE associated with debt facilities that were entered into in

December 2009 and with the issuance of NBCUniversal’s

senior notes in 2010, which are reflected in other

our customers online; and the continued deployment of 4G

wireless high

-

speed Internet service in certain markets

•

an increase in our total debt outstanding of $2.3 billion to

$31.4 billion, which is primarily due to the issuance of $3.4

billion aggregate principal amount of notes, the proceeds of

which were primarily used to repay debt at its maturity in

2010 and finance the NBCUniversal transaction in 2011

•

the repurchase of approximately 70 million shares of our

Class A Special common stock under our share

repurchase authorization for approximately $1.2 billion

•

the declaration and payment of dividends of $1.1 billion

income (expense) and interest expense. The table below

presents the amounts related to these expenses included in

our consolidated statement of operations.

In connection with the NBCUniversal transaction,

NBCUniversal issued $9.1 billion of senior debt securities

with maturities ranging from 2014 to 2041 and repaid

approximately $1.7 billion of existing debt during 2010.

Immediately prior to the closing, NBCUniversal distributed

approximately $7.4 billion to GE.

Under the terms of the operating agreement of NBCUniversal

Holdings, during the six month period beginning on July 28,

2014 GE has the right to cause NBCUniversal Holdings to

redeem half of GE’s interest in NBCUniversal Holdings, and

during the six month period beginning January 28, 2018, GE

has the right to cause NBCUniversal Holdings to redeem

GE’s remaining interest, if any. If GE exercises its first

redemption right, we have the immediate right to purchase

the remainder of GE’s interest. If GE does not exercise its

first redemption right, during the six month period beginning

on January 28, 2016, we have the right to purchase half of

GE’s interest in NBCUniversal Holdings. During the six month

period beginning January 28, 2019, we have the right to

purchase GE’s remaining interest, if any, in NBCUniversal

Holdings. The purchase price to be paid in connection with

any purchase described in this paragraph will be equal to the

ownership percentage being purchased multiplied by an

amount equal to 120% of the fully distributed public market

trading value of NBCUniversal Holdings (determined

pursuant to an appraisal process if NBCUniversal Holdings is

not then publicly traded), less 50% of an amount (not less

than zero) equal to the excess of 120% of the fully distributed

public market trading value over $28.4 billion. Subject to

various limitations, we are committed to fund up to $2.875

billion in cash or our common stock for each of the two

redemptions (up to an aggregate of $5.75 billion, with

amounts not used in the first redemption to be available for

the second redemption) to the extent NBCUniversal Holdings

cannot fund the redemptions.

Until July 28, 2014, GE may not directly or indirectly transfer

its interest in NBCUniversal Holdings. Thereafter, GE may

transfer its interest to a third party, subject to our right of first

offer. The right of first offer would permit us to purchase all,

but not less than all, of the interests proposed to be

transferred. In the event that GE makes a registration request

in accordance with certain registration rights that are granted

to it under the agreement, we will have the right to purchase,

for cash at the market value (determined pursuant to an

appraisal process if NBCUniversal Holdings is not then

publicly traded), all of GE’s interest in NBCUniversal Holdings

that GE is seeking to register.

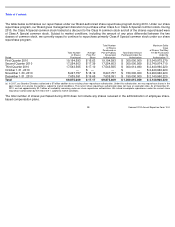

Year ended December 31, 2010 (in millions)

Operating, selling, general and administrative

expenses

$

80

Other expense

$

129

Interest expense

$

7