Classmates.com 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

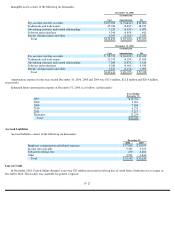

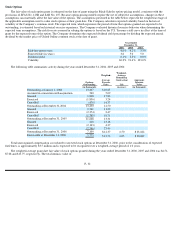

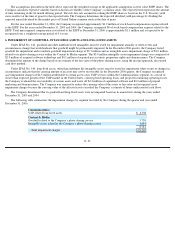

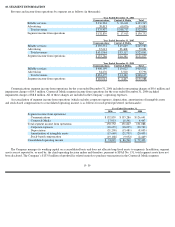

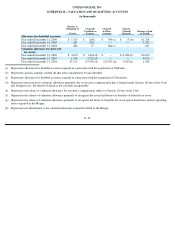

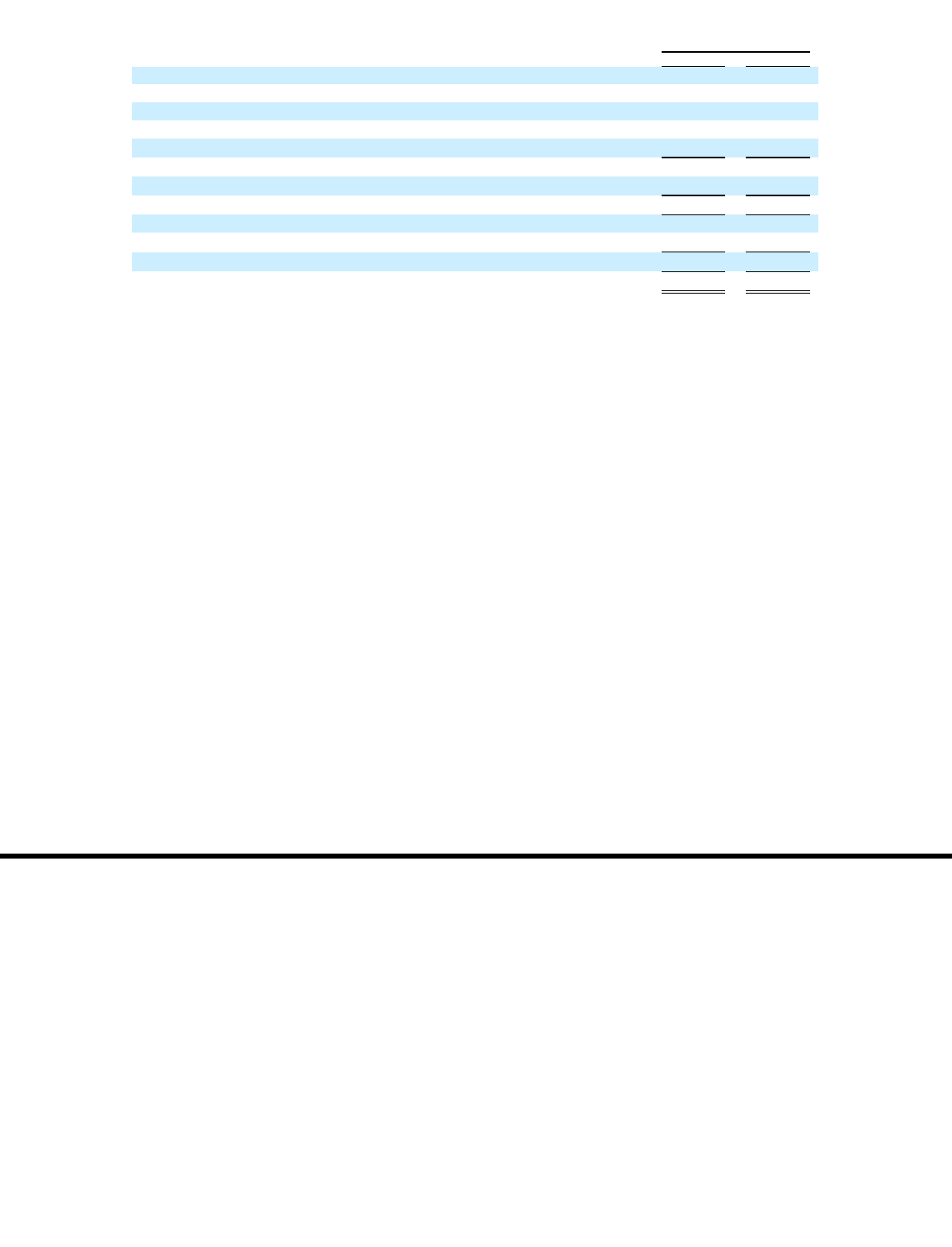

Components of net deferred tax assets at December 31, 2006 and 2005 are as follows (in thousands):

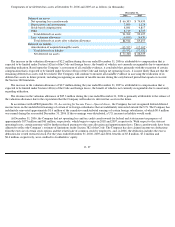

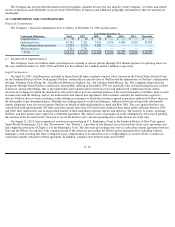

The increase in the valuation allowance of $2.2 million during the year ended December 31, 2006 is attributable to compensation that is

expected to be limited under Section 162(m) of the Code and foreign losses, the benefit of which is not currently recognizable due to uncertainty

regarding utilization. Based upon the Company’s assessment of all available evidence, it concluded that, primarily with the exception of certain

compensation that is expected to be limited under Section 162(m) of the Code and foreign net operating losses, it is more likely than not that the

remaining deferred tax assets will be realized. The Company will continue to monitor all available evidence in assessing the realization of its

deferred tax assets in future periods, including recognizing an amount of taxable income during the carryforward period that equals or exceeds

the Section 382 limitation.

The increase in the valuation allowance of $2.7 million during the year ended December 31, 2005 is attributable to compensation that is

expected to be limited under Section 162(m) of the Code and foreign losses, the benefit of which is not currently recognizable due to uncertainty

regarding utilization.

The decrease in the valuation allowance of $85.3 million during the year ended December 31, 2004 is primarily attributable to the release of

the valuation allowance due to the expectation that the Company will realize its deferred tax assets in the future.

In accordance with APB Opinion No. 23, Accounting for Income Taxes—Special Areas , the Company has not recognized federal deferred

income taxes on the undistributed earnings of certain of its foreign subsidiaries that are indefinitely reinvested outside the U.S. The Company has

indefinitely reinvested approximately $1.6 million of the cumulative undistributed earnings of certain foreign subsidiaries, of which $0.4 million

was earned during the year ended December 31, 2006. If these earnings were distributed, a U.S. income tax liability would result.

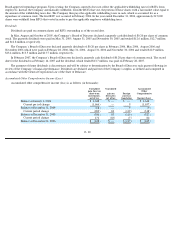

At December 31, 2006, the Company had net operating loss and tax credit carryforwards for federal and state income tax purposes of

approximately $175 million and $61 million, respectively, which begin to expire in 2018 and 2007, respectively. With respect to the state net

operating losses, certain amounts will be further reduced pursuant to the state allocation and apportionment laws. These carryforwards have been

adjusted to reflect the Company’s estimate of limitations under Section 382 of the Code. The Company has also claimed income tax deductions

from the exercise of certain stock options and the related sale of common stock by employees, and, in 2006, the deduction includes the excess

deduction for vested restricted stock. For the years ended December 31, 2006, 2005 and 2004, benefits of $5.8 million, $7.2 million and

$8.6 million, respectively, were credited to stockholders’ equity.

F- 37

December 31,

2006

2005

Deferred tax assets:

Net operating loss carryforwards

$

66,303

$

74,459

Depreciation and amortization

7,899

2,126

Stock

-

based compensation

8,841

4,817

Other

8,719

8,725

Total deferred tax assets

91,762

90,127

Less: valuation allowance

(6,850

)

(4,670

)

Total deferred tax assets after valuation allowance

84,912

85,457

Deferred tax liability:

Amortization of acquired intangible assets

(13,552

)

(17,102

)

Total deferred tax liability

(13,552

)

(17,102

)

Net deferred tax assets

$

71,360

$

68,355