Classmates.com 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

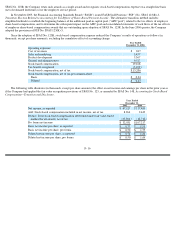

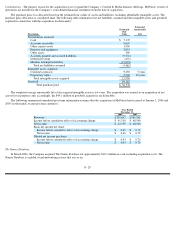

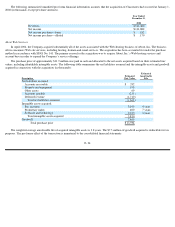

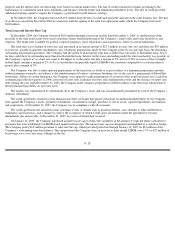

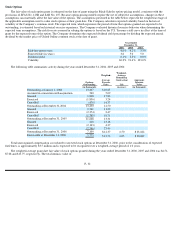

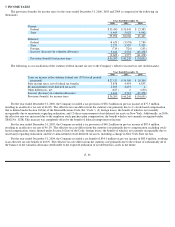

Maturities of short-term investments were as follows (in thousands):

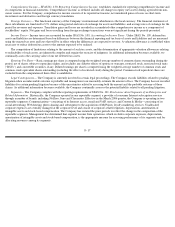

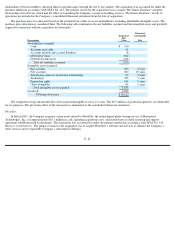

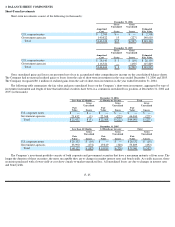

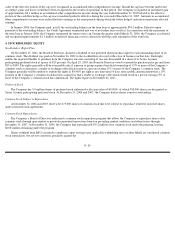

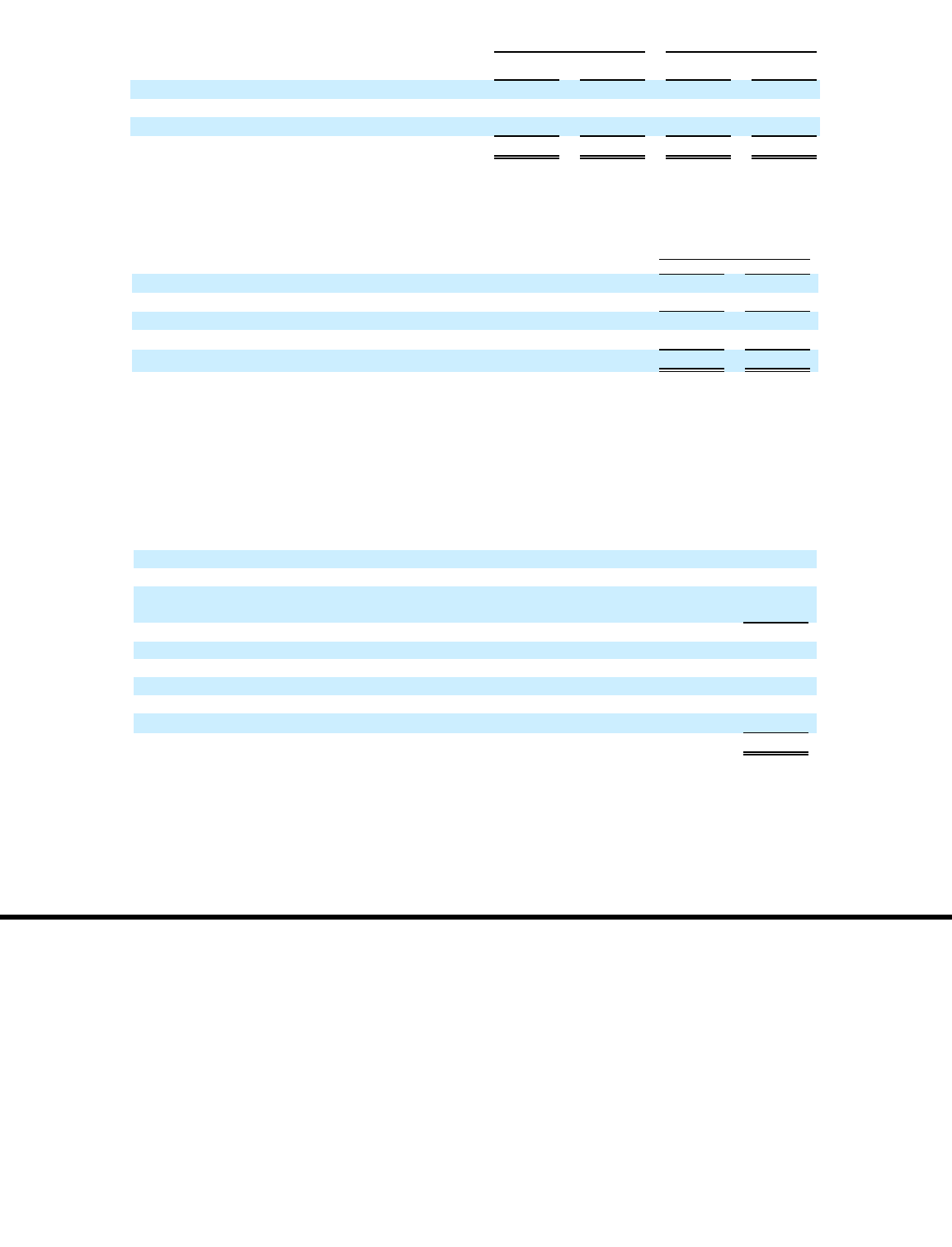

Property and Equipment

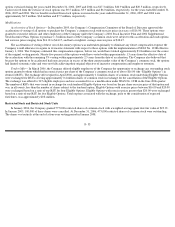

Property and equipment consists of the following (in thousands):

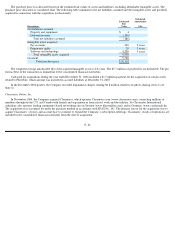

Depreciation expense for the years ended December 31, 2006, 2005 and 2004 was $21.3 million, $15.5 million and $8.7 million,

respectively. Assets under capital leases are included in computer software and equipment. At December 31, 2006, the amount capitalized and

the related accumulated depreciation were $0.4 million and $0.4 million, respectively. At December 31, 2005, the amount capitalized and the

related accumulated depreciation were $1.3 million and $0.7 million, respectively.

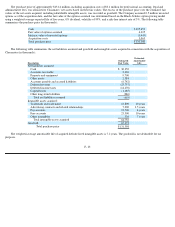

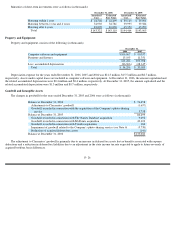

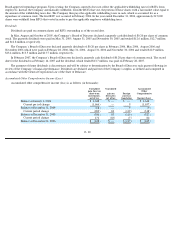

Goodwill and Intangible Assets

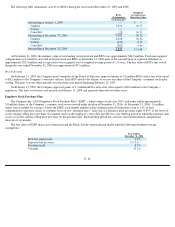

The changes in goodwill for the years ended December 31, 2005 and 2006 were as follows (in thousands):

The adjustment to Classmates’ goodwill is primarily due to an increase in deferred tax assets for tax benefits associated with expense

deductions and a reduction in deferred tax liabilities due to an adjustment in the state income tax rate expected to apply to future reversals of

acquired book/tax basis differences.

F- 26

December 31, 2006

December 31, 2005

Amortized

Cost

Estimated

Fair Value

Amortized

Cost

Estimated

Fair Value

Maturing within 1 year

$

24,502

$

24,499

$

39,119

$

39,091

Maturing between 1 year and 4 years

34,930

34,781

39,995

39,584

Maturing after 4 years

83,890

83,830

65,350

65,290

Total

$

143,322

$

143,110

$

144,464

$

143,965

December 31,

2006

2005

Computer software and equipment

$

106,067

$

90,357

Furniture and fixtures

15,195

11,351

121,262

101,708

Less: accumulated depreciation

(86,966

)

(68,615

)

Total

$

34,296

$

33,093

Balance at December 31, 2004

$

76,458

Adjustments to Classmates

’

goodwill

(1,697

)

Goodwill recorded in connection with the acquisition of the Company’s photo-sharing

service

5,738

Balance at December 31, 2005

80,499

Goodwill recorded in connection with The Names Database acquisition

9,092

Goodwill recorded in connection with MyPoints acquisition

49,122

Goodwill recorded in connection with Trombi acquisition

184

Impairment of goodwill related to the Company

’

s photo

-

sharing service (see Note 6)

(5,738

)

Reduction of acquired deferred tax assets

(141

)

Balance at December 31, 2006

$

133,018