Classmates.com 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

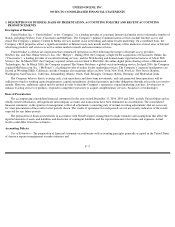

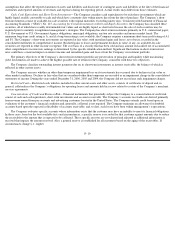

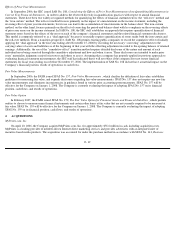

Comprehensive Income— SFAS No. 130, Reporting Comprehensive Income,

establishes standards for reporting comprehensive income and

its components in financial statements. Comprehensive income, as defined, includes all changes in equity (net assets) during a period from non-

owner sources. For the Company, comprehensive income consists of its reported net income, net unrealized gains or losses on short-term

investments and derivatives and foreign currency translation.

Foreign Currency— The functional currency of the Company’s international subsidiaries is the local currency. The financial statements of

these subsidiaries are translated to U.S. dollars using period-

end rates of exchange for assets and liabilities, and average rates of exchange for the

period for revenues and expenses. Translation gains and losses are recorded in accumulated other comprehensive income as a component of

stockholders’ equity. Net gains and losses resulting from foreign exchange transactions were not significant during the periods presented.

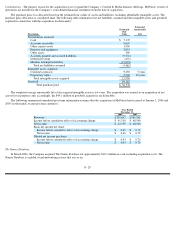

Income Taxes— Income taxes are accounted for under SFAS No. 109, Accounting for Income Taxes . Under SFAS No. 109, deferred tax

assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured

using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is established when

necessary to reduce deferred tax assets to the amount expected to be realized.

The computation of limitations relating to the amount of such tax assets, and the determination of appropriate valuation allowances relating

to realizability of such assets, are inherently complex and require the exercise of judgment. As additional information becomes available, we

continually assess the carrying value of our net deferred tax assets.

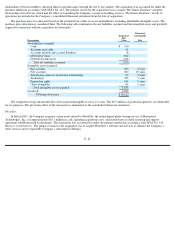

Earnings Per Share— Basic earnings per share is computed using the weighted-average number of common shares outstanding during the

period, net of shares subject to repurchase rights, and excludes any dilutive effects of options or warrants, restricted stock, restricted stock units

(“RSUs”) and convertible securities, if any. Diluted earnings per share is computed using the weighted-average number of common stock and

common stock equivalent shares outstanding (including the effect of restricted stock) during the period. Common stock equivalent shares are

excluded from the computation if their effect is antidilutive.

Legal Contingencies— The Company is currently involved in certain legal proceedings. The Company records liabilities related to pending

litigation when an unfavorable outcome is probable and management can reasonably estimate the amount of loss. The Company has not recorded

liabilities for certain pending litigation because of the uncertainties related to assessing both the amount and the probable outcome of those

claims. As additional information becomes available, the Company continually assesses the potential liability related to all pending litigation.

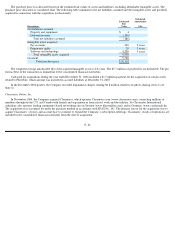

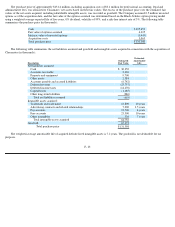

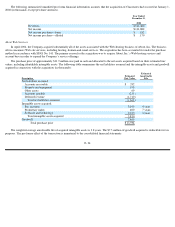

Segments— The Company complies with the reporting requirements of SFAS No. 131, Disclosures about Segments of an Enterprise and

Related Information

. Historically, the Company operated in one reportable segment, a provider of consumer Internet subscription services

through a number of brands, including NetZero, Juno and Classmates. Effective in the March 2006 quarter, the Company is operating in two

reportable segments: Communications—consisting of its Internet access, email and VoIP services; and Content & Media—consisting of its

social-networking, Web-hosting, photo-sharing and, subsequent to the acquisition of MyPoints, loyalty marketing services. Unallocated

corporate expenses are centrally managed at the corporate level and consist of corporate-related expenses, depreciation, amortization of

intangible assets and stock-based compensation. The Company has restated the prior periods to reflect the change in the composition of the

reportable segments. Management has determined that segment income from operations, which excludes corporate expenses, depreciation,

amortization of intangible assets and stock-based compensation, is the appropriate measure for assessing performance of its segments and for

allocating resources among its segments.

F- 17