Classmates.com 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

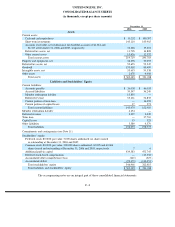

than expected defaults or an unexpected material adverse change in a major customer’s ability to meet its financial obligations), the estimates of

the recoverability of amounts due to the Company are adjusted.

At December 31, 2006, one customer comprised approximately 13% of the consolidated accounts receivable balance. At December 31,

2005, two customers comprised approximately 21% and 12% of the consolidated accounts receivable balance. For the years ended December 31,

2006, 2005 and 2004, the Company did not have any individual customers that comprised more than 10% of total revenues.

At December 31, 2006 and 2005, the Company’s cash and cash equivalents were maintained primarily with three major financial

institutions in the United States. Deposits with these institutions generally exceed the amount of insurance provided on such deposits.

Long-Lived Assets— The Company accounts for long-lived assets in accordance with SFAS No. 144, Accounting for the Impairment or

Disposal of Long

-Lived Assets , which addresses financial accounting and reporting for the impairment and disposition of long-lived assets. The

Company evaluates the recoverability of long-lived assets, other than indefinite life intangible assets, for impairment when events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. Events and circumstances that may indicate that an asset is

impaired include significant decreases in the market value of an asset, significant underperformance relative to expected historical or projected

future results of operations, a change in the extent or manner in which an asset is used, significant declines in the Company’s stock price for a

sustained period, shifts in technology, loss of key management or personnel, changes in the Company’s operating model or strategy and

competitive forces.

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation is computed using the straight-line method

over the estimated useful lives of the assets, which is generally two to three years for computer software and equipment and three to seven years

for furniture, fixtures and office equipment. Leasehold improvements are amortized over the shorter of the lease term or the estimated useful

lives. Upon the sale or retirement of property or equipment, the cost and related accumulated depreciation or amortization is removed from the

Company’s financial statements with the resulting gain or loss reflected in the Company’s results of operations. Repairs and maintenance costs

are expensed as incurred.

Definite-lived identifiable intangible assets are amortized over their estimated useful lives, ranging from two to ten years. The Company’s

intangible assets were acquired primarily in connection with business combinations.

Goodwill— Goodwill represents the excess of the cost of an acquired entity over the fair value of the acquired net assets. The Company

accounts for goodwill in accordance with SFAS No. 142, Goodwill and Other Intangible Assets , which among other things, addresses financial

accounting and reporting requirements for acquired goodwill and other intangible assets. SFAS No. 142 requires goodwill to be carried at cost,

prohibits the amortization of goodwill and requires the Company to test goodwill for impairment at least annually. The Company performs an

impairment test of its goodwill annually during the fourth quarter of its fiscal year or when events and circumstances change that would indicate

that goodwill might be permanently impaired. Events or circumstances which could trigger an impairment review include a significant adverse

change in legal factors or in the business climate, an adverse action or assessment by a regulator, unanticipated competition, a loss of key

personnel, significant changes in the manner of the Company’s use of the acquired assets or the strategy for the Company’s overall business,

significant negative industry or economic trends, significant declines in the Company’s stock price for a sustained period or significant

underperformance relative to expected historical or projected future results of operations.

The testing for a potential impairment of goodwill involves a two-step process. The first step of the impairment test involves comparing the

estimated fair values of the Company’s reporting units with their respective book values, including goodwill. If the estimated fair value exceeds

book value, goodwill is

F- 11