Classmates.com 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

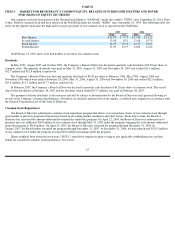

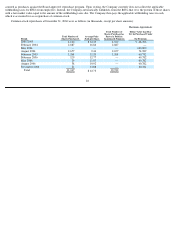

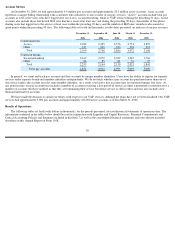

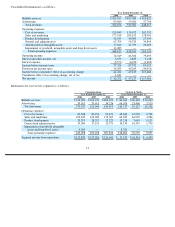

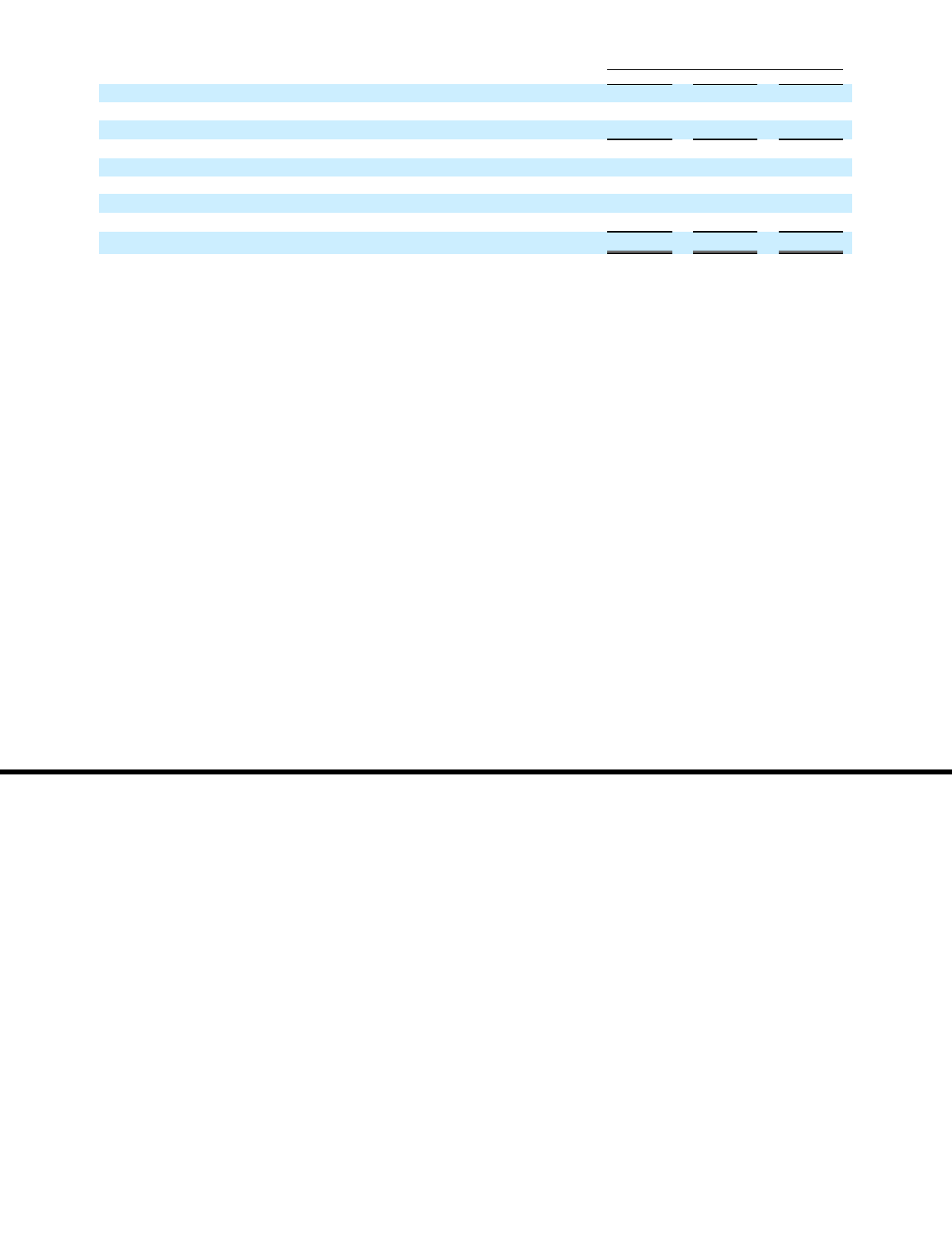

A reconciliation of segment income from operations (which excludes corporate expenses, depreciation, amortization of intangible assets

and stock-based compensation) to consolidated operating income, is as follows for each period presented (in thousands):

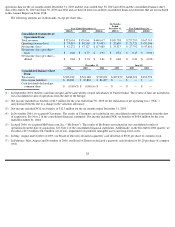

Communications segment income from operations for the year ended December 31, 2006 included restructuring charges of $0.6 million and

impairment charges of $4.5 million. Content & Media segment income from operations for the year ended December 31, 2006 included

impairment charges of $8.8 million. All of these charges are included in our operating expenses.

Year Ended December 31, 2006 compared to

Year Ended December 31, 2005

Comparability

On January 1, 2006, we adopted Statement of Financial Accounting Standards (“SFAS”) No. 123 (revised 2004), Share-Based Payment ,

which requires the measurement and recognition of compensation expense for all share-based payment awards made to employees and directors

including employee stock options, restricted stock awards and employee stock purchases related to the Employee Stock Purchase Plan

(“employee stock purchases”) based on the grant date fair values of the awards. SFAS No. 123R supersedes our previous accounting under

Accounting Principles Board (“APB”) Opinion No. 25, Accounting for Stock Issued to Employees . In March 2005, the SEC issued Staff

Accounting Bulletin (“SAB”)

No. 107 relating to SFAS No. 123R. We have applied the provisions of SAB No. 107 in our adoption of SFAS No.

123R.

We adopted SFAS No. 123R using the modified prospective transition method, and the Company’

s consolidated financial statements at and

for the year ended December 31, 2006 reflect the impact of SFAS No. 123R. In accordance with the modified prospective transition method, our

consolidated financial statements for prior periods have not been restated to reflect, and do not include, the impact of SFAS No. 123R. Stock-

based compensation expense recognized under SFAS No. 123R for the year ended December 31, 2006 was $19.2 million, which was primarily

related to stock options, restricted stock and the discount on employee stock purchases. Stock-based compensation expense, recorded in

accordance with APB Opinion No. 25, for the years ended December 31, 2005 and 2004 was $10.0 million and $2.4 million, respectively, which

was primarily related to restricted stock.

32

Year Ended December 31,

2006

2005

2004

Segment income from operations:

Communications

$

132,839

$

135,286

$

126,641

Content & Media

17,913

16,541

4,447

Total segment income from operations

150,752

151,827

131,088

Corporate expenses

(18,635

)

(18,035

)

(20,740

)

Depreciation

(21,290

)

(15,481

)

(8,003

)

Amortization of intangible assets

(17,640

)

(21,799

)

(20,403

)

Stock

-

based compensation

(19,168

)

(9,952

)

(2,449

)

Consolidated operating income

$

74,019

$

86,560

$

79,493