Classmates.com 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

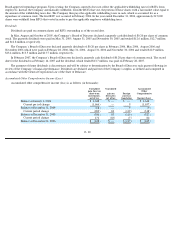

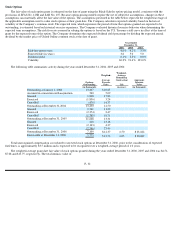

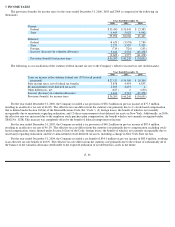

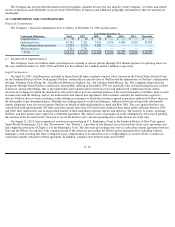

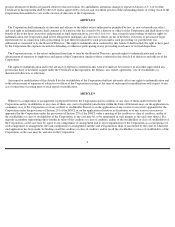

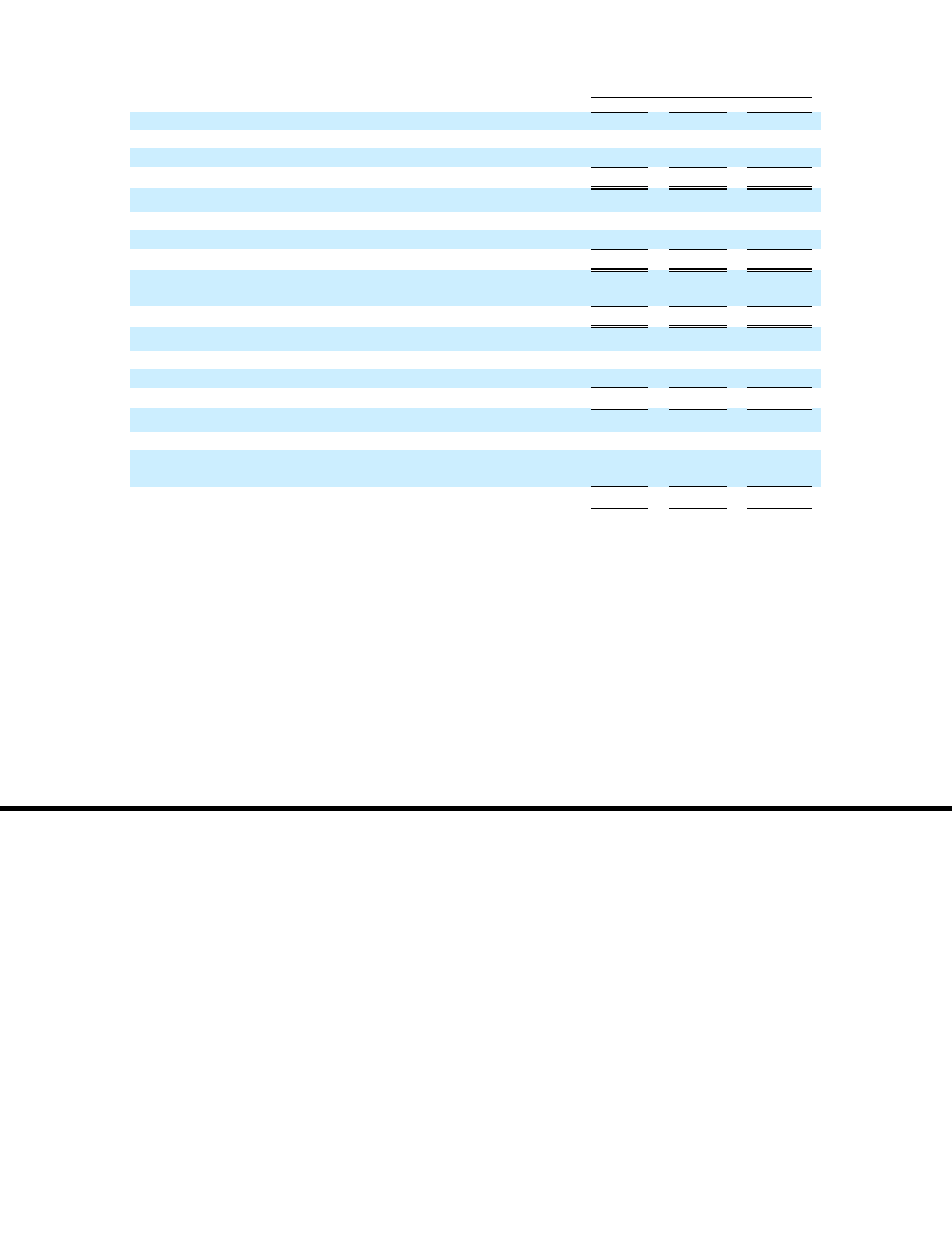

8. NET INCOME PER SHARE

The following table sets forth the computation of basic and diluted net income per share for the years ended December 31, 2006, 2005 and

2004 (in thousands, except per share amounts):

The diluted per share computations exclude stock options, unvested common stock and RSUs, which are antidilutive. The number of

antidilutive shares at December 31, 2006, 2005 and 2004 was 3.0 million, 6.8 million and 6.4 million, respectively.

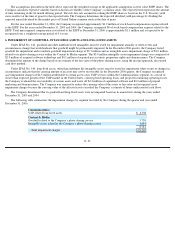

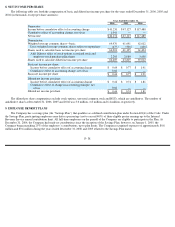

9. EMPLOYEE BENEFIT PLANS

The Company has a savings plan (the “Savings Plan”) that qualifies as a defined contribution plan under Section 401(k) of the Code. Under

the Savings Plan, participating employees may defer a percentage (not to exceed 40%) of their eligible pretax earnings up to the Internal

Revenue Service annual contribution limit. All full-time employees on the payroll of the Company are eligible to participate in the Plan. At

December 31, 2004, the Company had made no contributions since the inception of the Savings Plan; however, on January 1, 2005, the

Company began matching 25% of the employee’s contributions, up to plan limits. The Company recognized expenses of approximately $0.8

million and $0.6 million during the years ended December 31, 2006 and 2005 related to the Savings Plan match.

F- 38

Year Ended December 31,

2006

2005

2004

Numerator:

Income before cumulative effect of accounting change

$

41,231

$

47,127

$

117,480

Cumulative effect of accounting change, net of tax

1,041

—

—

Net income

$

42,272

$

47,127

$

117,480

Denominator:

Weighted

-

average common shares

—

basic

64,476

61,641

62,012

Less: weighted

-

average common shares subject to repurchase

(475

)

(506

)

(608

)

Shares used to calculate basic net income per share

64,001

61,135

61,404

Add: Dilutive effect of stock options, restricted stock and

employee stock purchase plan shares

2,268

2,680

3,608

Shares used to calculate diluted net income per share

66,269

63,815

65,012

Basic net income per share:

Income before cumulative effect of accounting change

$

0.64

$

0.77

$

1.91

Cumulative effect of accounting change, net of tax

0.02

—

—

Basic net income per share

$

0.66

$

0.77

$

1.91

Diluted net income per share:

Income before cumulative effect of accounting change

$

0.62

$

0.74

$

1.81

Cumulative effect of change in accounting principle, net

of tax

0.02

—

—

Diluted net income per share

$

0.64

$

0.74

$

1.81