Classmates.com 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

money market funds. Our primary objective is the preservation of principal and liquidity while maximizing yield. The minimum long-

term rating

is A, and if a long-term rating is not available, we require a short-term credit rating of A1 and P1. The value of these investments may fluctuate

with changes in interest rates. However, we believe this risk is immaterial due to the relatively short-term nature of the investments.

Foreign Currency Risk

We transact business in different foreign currencies and may be exposed to financial market risk resulting from fluctuations in foreign

currency exchange rates, particularly the Indian Rupee (INR) and the Euro, which may result in a gain or loss of earnings to us. The volatility of

the INR and the Euro (and all other applicable currencies) are monitored throughout the year. We face two risks related to foreign currency

exchange: translation risk and transaction risk. Amounts invested in our foreign operations are translated into U.S. dollars using period-end

exchange rates. The resulting translation adjustments are recorded as a component of accumulated other comprehensive income (loss) in

stockholders’ equity. Our foreign subsidiaries generally collect revenues and pay expenses in currencies other than the U.S. dollar. Since the

functional currencies of our foreign operations are denominated in the local currency of our subsidiaries, the foreign currency translation

adjustments are reflected as a component of stockholders’ equity and do not impact operating results. Revenues and expenses in foreign

currencies translate into higher or lower revenues and expenses in U.S. dollars as the U.S. dollar weakens or strengthens against other currencies.

Therefore, changes in exchange rates may negatively affect our consolidated revenues and expenses (as expressed in U.S. dollars) from foreign

operations. Currency transaction gains or losses arising from transactions in currencies other than the functional currency are included in

operating expenses. While we have not engaged in foreign currency hedging, we may in the future use hedging programs, currency forward

contracts, currency options and/or other derivative financial instruments commonly utilized to reduce financial market risks if it is determined

that such hedging activities are appropriate to reduce risk.

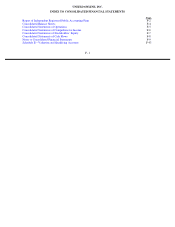

ITEM 8.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

For financial statements, see the Index to Consolidated Financial Statements on page F-1.

ITEM 9.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

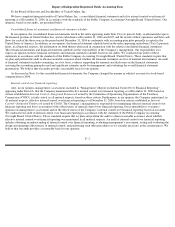

ITEM 9A.

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of the

Company’s disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of

1934, as amended (the “Exchange Act”)) as of the end of the period covered by this report. Based on such evaluation, our Chief Executive

Officer and Chief Financial Officer have concluded that, as of the end of such period, the Company’s disclosure controls and procedures are

effective in recording, processing, summarizing and reporting, on a timely basis, information required to be disclosed by the Company in the

reports that it files or submits under the Exchange Act and are effective in ensuring that information required to be disclosed by the Company in

the reports that it files or submits under the Exchange Act is accumulated and communicated to the Company’s management, including the

Company’s Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

54