Classmates.com 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

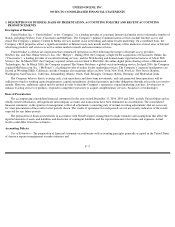

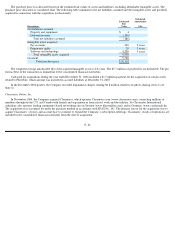

provides guidance on the recognition, presentation and disclosure of revenue in financial statements filed with the SEC. SAB No. 104 outlines

the basic criteria that must be met to recognize revenue and provides guidance for disclosure related to revenue recognition policies. In general,

the Company recognizes revenue related to its billable services and advertising products when (i) persuasive evidence of an arrangement exists,

(ii) delivery has occurred or services have been rendered, (iii) the fee is fixed or determinable and (iv) collectibility is reasonably assured. The

Company also applies the provisions of Emerging Issues Task Force (“EITF”) Issue No. 00-21, Revenue Arrangements with Multiple

Deliverables

.

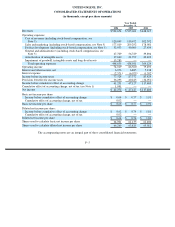

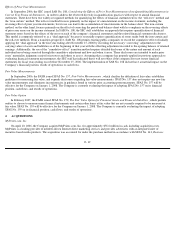

Billable services revenues are recognized in the period in which fees are fixed or determinable and the related products or services are

provided to the user. The Company’s pay accounts generally pay in advance for their service by credit card, and revenue is then recognized

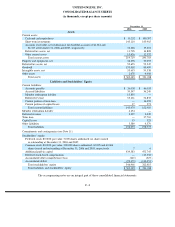

ratably over the period in which the related services are provided. Advance payments from subscribers are recorded on the balance sheet as

deferred revenue. The Company offers alternative payment methods to credit cards for certain pay service plans. These alternative payment

methods currently include ACH, payment by personal check or money order or through a local telephone company. In circumstances where

payment is not received in advance, revenue is only recognized if collectibility is reasonably assured.

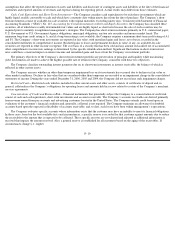

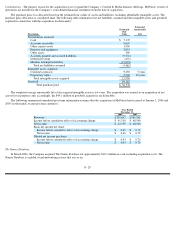

Advertising revenues consist primarily of fees which result from users utilizing partner Internet search services, fees generated by users

viewing and clicking on third-party Web site banners and text-

link advertisements, fees generated by enabling customer registrations for partners

and fees from referring users to, or from users making purchases on, sponsors’ Web sites. Revenues are recognized provided that no significant

obligations remain, fees are fixed or determinable, and collection of the related receivable is reasonably assured. The Company recognizes

banner advertising and sponsorship revenues in the periods in which the advertisement or sponsorship placement is displayed, based upon the

lesser of (i) impressions delivered divided by the total number of guaranteed impressions or (ii) ratably over the period in which the

advertisement is displayed. The Company’s obligations typically include a minimum number of impressions or the satisfaction of other

performance criteria. Revenue from performance-based arrangements, including referral revenues, is recognized as the related performance

criteria are met. In determining whether an arrangement exists, the Company ensures that a binding contract is in place, such as a standard

insertion order or a fully executed customer-

specific agreement. The Company assesses whether performance criteria have been met and whether

the fees are fixed or determinable based on a reconciliation of the performance criteria and the payment terms associated with the transaction.

The reconciliation of the performance criteria generally includes a comparison of internally tracked performance data to the contractual

performance obligation and to third-

party or customer performance data in circumstances where that data is available. Probability of collection is

assessed based on a number of factors, including past transaction history with the customer and the creditworthiness of the customer. If it is

determined that collection is not reasonably assured, revenue is not recognized until collection becomes reasonably assured, which is generally

upon receipt of cash.

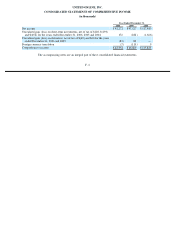

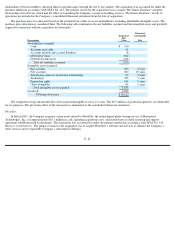

The Company’s MyPoints subsidiary earns revenue primarily from corporate advertising customers by charging fees for sending emails to

the MyPoints’ members and placing advertising on the MyPoints Web site. Under the terms of advertising contracts, MyPoints earns revenue

primarily based on three components: (1) transmission of email advertisements to enrolled members, (2) unique clicks on transmitted emails and

(3) actual transactions by members over the Internet. Revenue is recognized when email is transmitted to members, when responses are received

and when members complete online transactions. Each of these activities is a discrete, independent activity, which generally is specified in the

advertising sales agreement entered into with the customer. As the earning activities take place, activity measurement data (e.g., number of

emails delivered and number of responses received) is accumulated and the related revenue is recorded. Revenue from the sale of points to

MyPoints’ advertisers is deferred over a fifteen-month period, which is the expected time that either the points are redeemed and MyPoints

provides a reward, or the points expire prior to redemption. Revenue is also deferred if MyPoints has

F- 13