Classmates.com 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

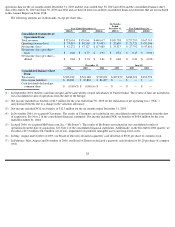

services due to increased use of free months of service and promotional pricing to obtain or retain pay access accounts. We anticipate that the

average number of Communications pay accounts will continue to decline due to decreases in pay access accounts. We also may experience

further declines in ARPU primarily as a result of discounted prices for extended service commitments on our access services, including

providing our $14.95 accelerated access services at $9.95 for a one-year commitment. As a result of these factors, the rate of decline in

Communications billable services revenues has been increasing and may continue to increase, at least in the near term.

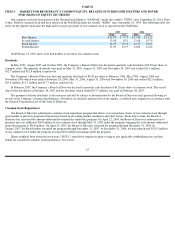

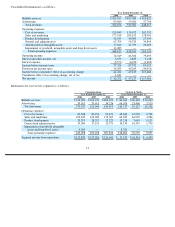

Content & Media Billable Services Revenues. Content & Media billable services revenues consist of fees charged to pay accounts for

social-networking, Web-hosting and other services, with substantially all generated from social-networking. Content & Media billable services

revenues increased by $17.0 million, or 24%, to $86.6 million for the year ended December 31, 2006, compared to $69.6 million for the year

ended December 31, 2005. The increase in Content & Media billable services revenues was due to a 22% increase in our average number of pay

accounts from 1,681,000 for the year ended December 31, 2005 to 2,048,000 for the year ended December 31, 2006. Substantially all of this

increase was associated with growth in our social-networking pay accounts primarily as a result of organic growth and, to a lesser extent, the

acquisition of pay accounts associated with The Names Database business in March 2006, which had approximately 58,000 pay accounts at the

time of the acquisition. Additionally, Content & Media billable services revenues increased due to a 2% increase in ARPU from $3.45 for the

year ended December 31, 2005 to $3.53 for the year ended December 31, 2006. The increase in ARPU is attributable to an increase in ARPU for

our social-networking services due to a greater percentage of those pay accounts represented by higher-priced, shorter-term pay service plans,

partially offset by decreases in ARPU for our Web-hosting and online photo-sharing services. We expect Content & Media billable services

revenues to grow sequentially at a faster rate in the March 2007 quarter versus the growth rate we experienced in the December 2006 quarter.

Advertising Revenues

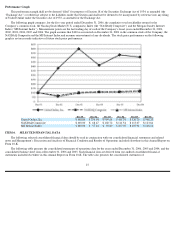

We connect advertisers to consumers through a variety of online marketing initiatives integrated throughout our services and Web

properties, including advertising and search placements, email campaigns and user registration placements. In addition, we offer advertisers

sophisticated market research capabilities and online direct marketing solutions. Factors impacting our advertising revenues generally include

changes in orders from significant customers, the performance of our online marketing initiatives, the state of the online search and advertising

markets, seasonality, increases or decreases in our active accounts, and increases or decreases in advertising inventory available for sale.

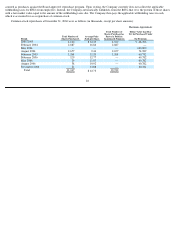

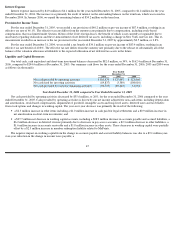

Consolidated Advertising Revenues. Consolidated advertising revenues increased by $40.0 million, or 68%, to $99.1 million for the year

ended December 31, 2006, compared to $59.1 million for the year ended December 31, 2005. The increase was primarily attributable to

increases in advertising revenues in our Content & Media segment and, to a lesser extent, our Communications segment. Advertising revenues

from our Communications segment and from our Content & Media segment constituted 39.4% and 60.6%, respectively, of our consolidated

advertising revenues for the year ended December 31, 2006, compared to 60.3% and 39.7%, respectively, for the year ended December 31, 2005.

We anticipate that our consolidated advertising revenues may decrease in the March 2007 quarter when compared to the December 2006 quarter

due to seasonality.

Communications Advertising Revenues. Communications advertising revenues increased by $3.4 million, or 10%, to $39.0 million for the

year ended December 31, 2006, from $35.6 million for the year ended December 31, 2005. The increase was primarily attributable to increases

in advertising sales and data revenue, partially offset by decreases in search revenues due to a decline in our active access accounts.

35