Classmates.com 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

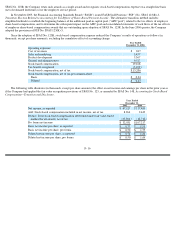

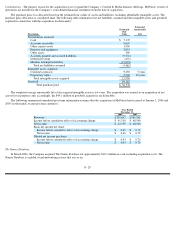

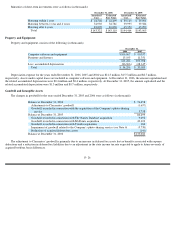

Operating Leases— The Company leases office space, data centers and certain office equipment under operating lease agreements with

original lease periods of up to 10 years. Certain of the lease agreements contain rent holidays and rent escalation provisions. Rent holidays and

rent escalation provisions are considered in determining straight-line rent expense to be recorded over the lease term. The lease term begins on

the date of initial possession of the lease property for purposes of recognizing lease expense on a straight-line basis over the term of the lease.

Lease renewal periods are considered on a lease-by-lease basis and are generally not included in the initial lease term.

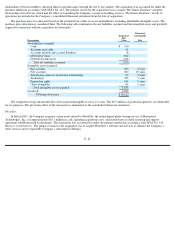

Reclassifications— Certain prior year amounts have been reclassified to conform to current year presentation. These changes had no impact

on previously reported results of operations or stockholders’ equity.

Recent Accounting Pronouncements

Accounting Changes and Error Corrections

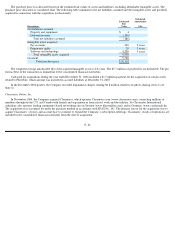

In June 2005, the FASB issued SFAS No. 154, Accounting Changes and Error Corrections—a replacement of APB Opinion No. 20 and

FASB Statement No. 3

. SFAS No. 154 changes the requirements for the accounting for and reporting of a change in accounting principle and

applies to all voluntary changes in accounting principle. APB Opinion No. 20 previously required that most voluntary changes in accounting

principle be recognized by including in net income of the period of change the cumulative effect of changing to the new accounting principle.

SFAS No. 154 requires retrospective application to prior periods’ financial statements of changes in accounting principle, unless it is

impracticable to determine either the period-specific effects or the cumulative effect of the change. When it is impracticable to determine the

period-specific effects of an accounting change on one or more individual prior periods presented, SFAS No. 154 requires that the new

accounting principle be applied to the balances of assets and liabilities as of the beginning of the earliest period for which retrospective

application is practicable and that a corresponding adjustment be made to the opening balance of retained earnings for that period rather than

being reported in an income statement. When it is impracticable to determine the cumulative effect of applying a change in accounting principle

to all prior periods, SFAS No. 154 requires that the new accounting principle be applied as if it were adopted prospectively from the earliest date

practicable. In addition, SFAS No. 154 makes a distinction between retrospective application of an accounting principle and the restatement of

financial statements to reflect the correction of an error. SFAS No. 154 is effective for accounting changes and corrections of errors made

beginning in the March 2006 quarter. The implementation of SFAS No. 154 did not have a material impact on the Company’s financial position,

results of operations or cash flows.

Accounting for Uncertainty in Income Taxes

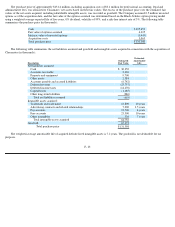

In July 2006, the FASB issued FASB Interpretation No. (“FIN”) 48, Accounting for Uncertainty in Income Taxes—an interpretation of

FASB Statement No. 109

, which clarifies the accounting for uncertainty in income tax positions. This Interpretation requires that the Company

recognize in the consolidated financial statements the impact of a tax position that is more likely than not to be sustained upon examination

based on the technical merits of the position. The provisions of FIN 48 will be effective for the Company beginning in the March 2007 quarter,

with the cumulative effect of the change in accounting principle recorded as an adjustment to opening retained earnings. While the Company’s

analysis of the impact of this Interpretation is not yet complete, the Company does not anticipate it will have a material impact on its retained

earnings at the time of adoption.

F- 18