Classmates.com 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

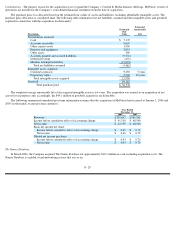

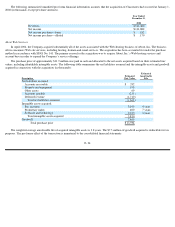

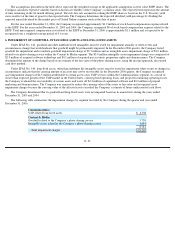

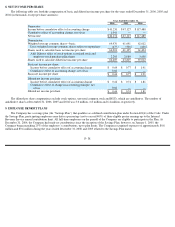

Board-approved repurchase program. Upon vesting, the Company currently does not collect the applicable withholding taxes for RSUs from

employees. Instead, the Company automatically withholds, from the RSUs that vest, the portion of those shares with a fair market value equal to

the amount of the withholding taxes due. The Company then pays the applicable withholding taxes in cash, which is accounted for as a

repurchase of common stock. The first RSU vest occurred in February 2006. In the year ended December 31, 2006, approximately 215,000

shares were withheld from RSUs that vested in order to pay the applicable employee withholding taxes.

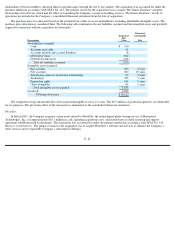

Dividends

Dividends are paid on common shares and RSUs outstanding as of the record date.

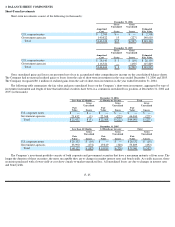

In May, August and October of 2005, the Company’s Board of Directors declared a quarterly cash dividend of $0.20 per share of common

stock. The quarterly dividends were paid on May 31, 2005, August 31, 2005 and November 30, 2005 and totaled $12.6 million, $12.7 million

and $12.8 million, respectively.

The Company’s Board of Directors declared quarterly dividends of $0.20 per share in February 2006, May 2006, August 2006 and

November 2006 which were paid on February 28, 2006, May 31, 2006, August 31, 2006 and November 30, 2006 and totaled $12.9 million,

$13.4 million, $13.5 million and $13.7 million, respectively.

In February 2007, the Company’s Board of Directors declared a quarterly cash dividend of $0.20 per share of common stock. The record

date for the dividend was February 14, 2007 and the dividend, which totaled $13.7 million, was paid on February 28, 2007.

The payment of future dividends is discretionary and will be subject to determination by the Board of Directors each quarter following its

review of the Company’s financial performance. Dividends are declared and paid out of the Company’s surplus, as defined and computed in

accordance with the General Corporation Law of the State of Delaware.

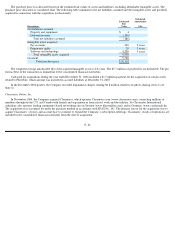

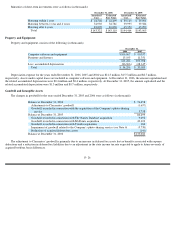

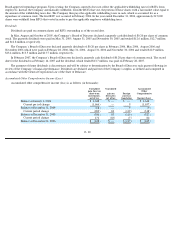

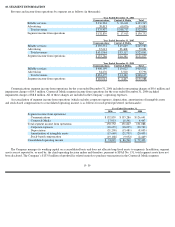

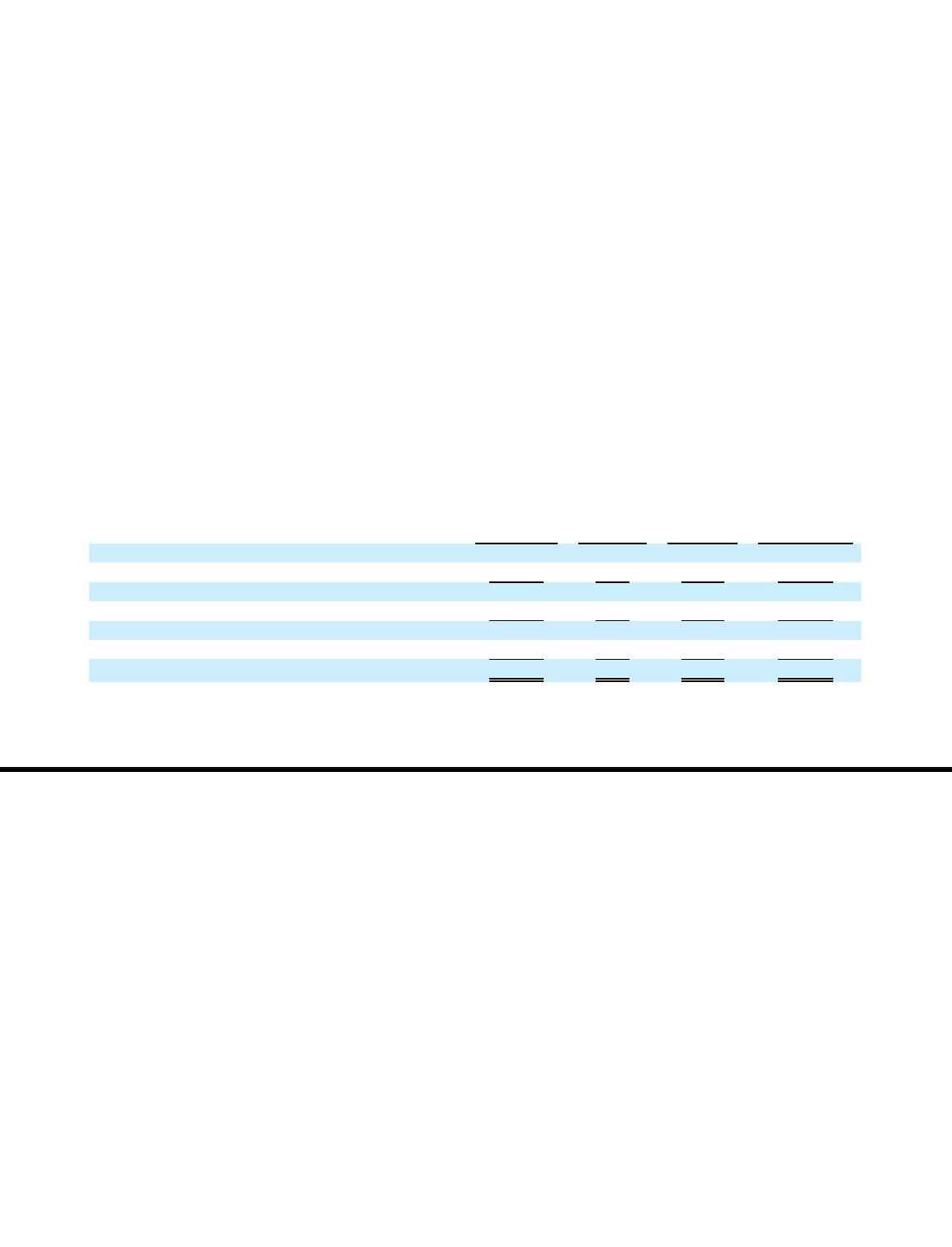

Accumulated Other Comprehensive Income (Loss)

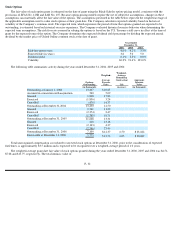

Accumulated other comprehensive income (loss) is as follows (in thousands):

F- 30

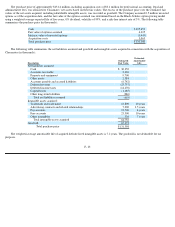

Unrealized

gain (loss) on

short-term

investments,

net of tax

Unrealized

gain on

derivative,

net of tax

Foreign

currency

translation

Accumulated

Other

Comprehensive

Income (Loss)

Balance at January 1, 2004

$

1,648

$

—

$

—

$

1,648

Current per iod change

(1,666

)

—

9

(1,657

)

Balance at December 31, 2004

(18

)

—

9

(9

)

Current period change

(282

)

83

(119

)

(318

)

Balance at December 31, 2005

(300

)

83

(110

)

(327

)

Current period change

172

(83

)

(7

)

82

Balance at December 31, 2006

$

(128

)

$

—

$

(

117

)

$

(245

)