Classmates.com 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

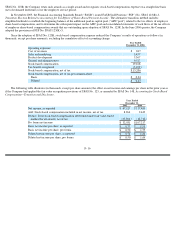

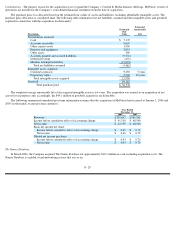

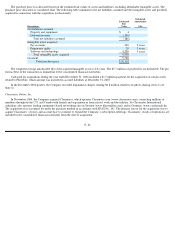

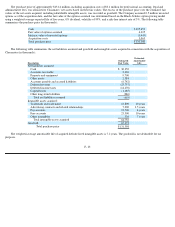

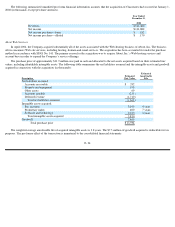

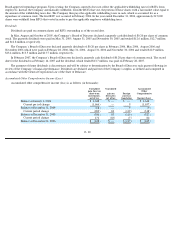

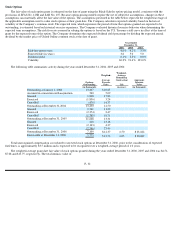

The purchase price was allocated based on the estimated fair values of assets and liabilities, including identifiable intangible assets. The

purchase price allocation is considered final. The following table summarizes the net liabilities assumed and the intangible assets and goodwill

acquired in connection with the acquisition (in thousands):

The weighted-average amortizable life of the acquired intangible assets is 4.8 years. The $5.7 million of goodwill is tax deductible. The pro

forma effect of the transaction is immaterial to the consolidated financial statements.

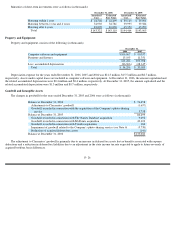

Cash paid for acquisitions during the year ended December 31, 2006 included a $1.5 million payment for the acquisition of certain assets

related to PhotoSite, which amount was included in accrued liabilities at December 31, 2005.

In the December 2006 quarter, the Company recorded impairment charges totaling $8.8 million related to its photo-sharing service (see

Note 6).

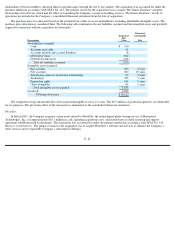

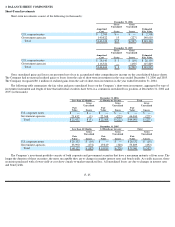

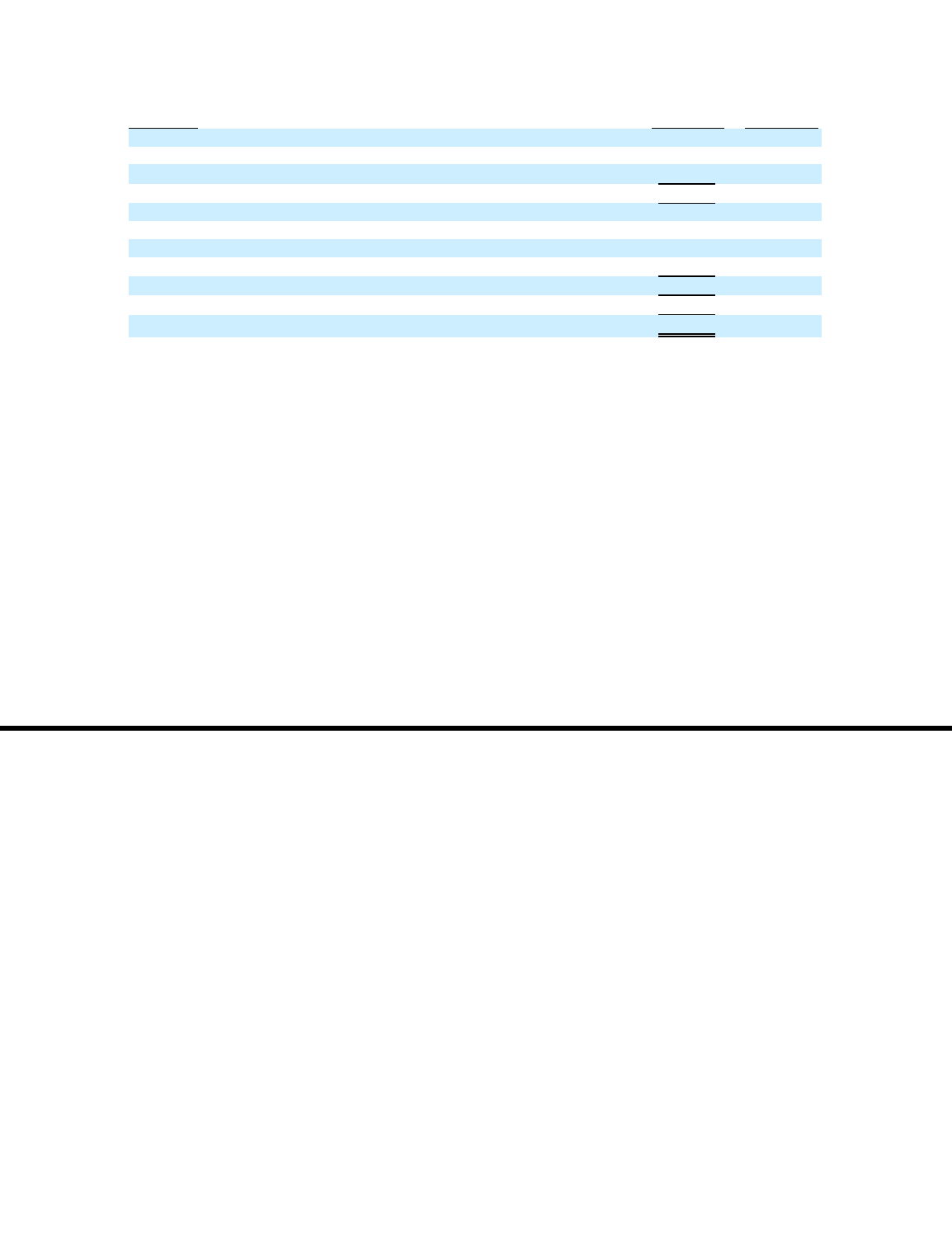

Classmates Online, Inc.

In November 2004, the Company acquired Classmates, which operates Classmates.com (www.classmates.com), connecting millions of

members throughout the U.S. and Canada with friends and acquaintances from school, work and the military. Its Classmates International

subsidiary also operates leading community-based networking sites in Sweden (www.klasstraffen.com), and in Germany (www.stayfriends.de).

The acquisition was accounted for under the purchase method in accordance with SFAS No. 141. The primary reason for the acquisition was to

acquire Classmates’ services and account base to continue to expand the Company’s subscription offerings. Classmates’

results of operations are

included in the consolidated financial statements from the date of acquisition.

F- 22

Description

Estimated

Fair

Value

Estimated

Amortizable

Life

Net liabilities assumed:

Property and equipment

$

4

Deferred revenue

(190

)

Total net liabilities assumed

(186

)

Intangible assets acquired:

Pay accounts

330

2 years

Proprietary rights

20

5 years

Software and technology

4,200

5 years

Total intangible assets acquired

4,550

Goodwill

5,738

Total purchase price

$

10,102