Classmates.com 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Effects of Prior Year Misstatements

In September 2006, the SEC issued SAB No. 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in

Current Year Financial Statements , in order to address the observed diversity in quantification practices with respect to annual financial

statements. There have been two widely-recognized methods for quantifying the effects of financial statement errors: the “roll-over” method and

the “iron curtain” method. The roll-over method focuses primarily on the impact of a misstatement on the income statement, including the

reversing effect of prior year misstatements, but its use can lead to the accumulation of misstatements in the balance sheet. The iron-curtain

method, on the other hand, focuses primarily on the effect of correcting the period-end balance sheet with less emphasis on the reversing effects

of prior year errors on the income statement. In SAB No. 108, the SEC staff establishes an approach that requires quantification of financial

statement errors based on the effects of the error on each of the company’s financial statements and the related financial statement disclosures.

This model is commonly referred to as a “dual approach” because it essentially requires quantification of errors under both the iron-curtain and

the roll-over methods. From a transition perspective, SAB No. 108 permits existing public companies to record the cumulative effect of initially

applying the “dual approach” in the first year ending after November 15, 2006 by recording the necessary “correcting” adjustments to the

carrying values of assets and liabilities as of the beginning of that year with the offsetting adjustment recorded to the opening balance of retained

earnings. Additionally, the use of the “cumulative effect” transition method requires detailed disclosure of the nature and amount of each

individual error being corrected through the cumulative adjustment and how and when it arose. These disclosures are intended to make prior

years

’ materiality judgments easier for investors and others to assess. Assuming that a company has properly applied its previous approach to

evaluating financial statement misstatements, the SEC staff has indicated that it will not object if the company does not restate financial

statements for fiscal years ending on or before November 15, 2006. The implementation of SAB No. 108 did not have a material impact on the

Company’s financial position, results of operations or cash flows.

Fair Value Measurements

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements , which clarifies the definition of fair value, establishes

guidelines for measuring fair value, and expands disclosures regarding fair value measurements. SFAS No. 157 does not require any new fair

value measurements and eliminates inconsistencies in guidance found in various prior accounting pronouncements. SFAS No. 157 will be

effective for the Company on January 1, 2008. The Company is currently evaluating the impact of adopting SFAS No. 157 on its financial

position, cash flows, and results of operations.

Fair Value Option

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities , which permits

entities to choose to measure many financial instruments and certain other items at fair value that are not currently required to be measured at

fair value. SFAS No. 159 will be effective for the Company on January 1, 2008. The Company is currently evaluating the impact of adopting

SFAS No. 159 on its financial position, cash flows, and results of operations.

2.

ACQUISITIONS

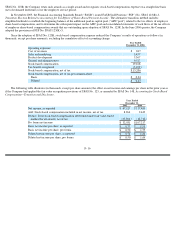

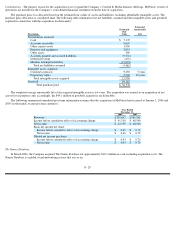

MyPoints.com, Inc.

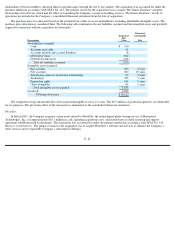

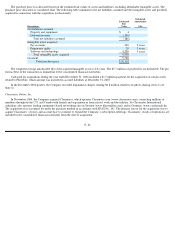

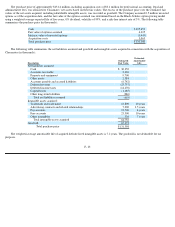

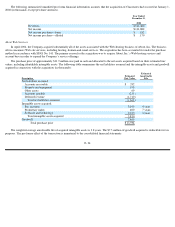

On April 10, 2006, the Company acquired MyPoints.com, Inc. for approximately $56.6 million in cash, including acquisition costs.

MyPoints is a leading provider of member-driven Internet direct marketing services and provides advertisers with an integrated suite of

incentive-based media products. The acquisition was accounted for under the purchase method in accordance with SFAS No. 141, Business

F- 19