Classmates.com 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

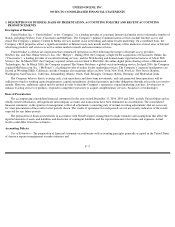

considered not to be impaired and no additional steps are necessary. If, however, the fair value of the reporting unit is less than book value, then

the carrying amount of the goodwill is compared with its implied fair value. The estimate of implied fair value of goodwill may require

independent valuations of certain internally generated and unrecognized intangible assets such as the Company’s pay account base, software and

technology and patents and trademarks. If the carrying amount of goodwill exceeds the implied fair value of that goodwill, an impairment loss is

recognized in an amount equal to the excess.

Business Combinations— All of the Company’s acquisitions have been accounted for as purchase business combinations. Under the

purchase method of accounting, the cost, including transaction costs, is allocated to the underlying net assets, based on their respective estimated

fair values. The excess of the purchase price over the estimated fair values of the net assets acquired is recorded as goodwill.

The judgments made in determining the estimated fair value and expected useful lives assigned to each class of assets and liabilities

acquired can significantly impact net income. Consequently, to the extent an indefinite-lived or a longer-lived asset is ascribed greater value

under the purchase method than a shorter-lived asset, there may be less amortization recorded in a given period. Definite-lived identifiable

intangible assets are amortized on either a straight-line basis or an accelerated basis. The Company determines the appropriate amortization

method by performing an analysis of expected cash flows over the estimated useful life of the asset and matches the amortization expense to the

expected cash flows from those assets.

Determining the fair value of certain assets and liabilities acquired is subjective in nature and often involves the use of significant estimates

and assumptions. Two areas, in particular, that require significant judgment are estimating the fair value and related useful lives of identifiable

intangible assets. To assist in this process, the Company may obtain appraisals from valuation specialists for certain intangible assets. While

there are a number of different methods used in estimating the value of acquired intangibles, there are two approaches primarily used: the

discounted cash flow and market comparison approaches. Some of the more significant estimates and assumptions inherent in the two

approaches include: projected future cash flows (including timing); discount rate reflecting the risk inherent in the future cash flows; perpetual

growth rate; subscriber churn and terminal value; determination of appropriate market comparables; and the determination of whether a premium

or a discount should be applied to comparables. Most of the above assumptions are made based on available historical information.

Member Redemption Liability— The member redemption liability represents the estimated costs associated with the Company’s obligation

to redeem outstanding member balances (in points), less an allowance for points expected to expire prior to redemption. Such members’ points

may be converted by enrolled members into various third-party gift certificates, frequent travel programs, coupons or other rewards. Points are

granted to members when they respond to direct marketing offers delivered by the Company, purchase goods from advertisers or engage in other

specified activities. The Company is liable for providing the rewards to members if and when such members seek to redeem accumulated points

upon reaching required redemption thresholds. The member redemption liability is estimated based upon a weighted-average cost of points that

may be redeemed in the future. The liability is based upon historical redemption costs and management’s estimate of future trends. Under the

current policy, the Company reserves the right to cancel or disable accounts and expire unredeemed points in those accounts that are inactive for

a period of twelve consecutive months. “Inactive” shall be defined as a lack of one of the following: Web site visit (click through); email

response; survey completion; profile update; or any point-earning or point-spending transaction. The Company bases its estimate of points that

will not be redeemed on an analysis of historical point earning trends, redemption activity and individual member accounts. This analysis is

updated quarterly.

Revenue Recognition— The Company applies the provisions of Securities and Exchange Commission (“SEC”) Staff Accounting Bulletin

(“SAB”) No. 104, Revenue Recognition in Financial Statements, which

F- 12