Classmates.com 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5. STOCK

-

BASED COMPENSATION PLANS

The Company has three active equity plans under which it is authorized to grant stock options, restricted stock awards and RSUs.

Stock options granted to employees generally vest over a three- or four-year period. Stock options granted to directors generally vest over a

nine-month to three-

year period, either monthly or annually. Stock option grants expire after ten years unless cancelled earlier due to termination

of employment or Board service. Certain stock option grants are immediately exercisable for unvested shares of common stock, with the

unvested portion of the shares remaining subject to repurchase by the Company at the exercise price until the vesting period is complete.

RSUs granted to employees generally vest over a two- to four-year period. RSUs granted to non-employee directors generally vest over a

one-year period.

Upon the exercise of a stock option award, the vesting of an RSU or the grant of restricted stock, common shares are issued from authorized

but unissued shares. At December 31, 2006, an aggregate of 27.6 million shares were reserved under the Company’s plans, of which 4.0 million

shares were available for issuance at December 31, 2006.

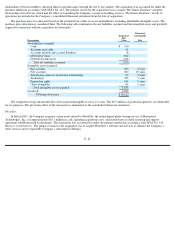

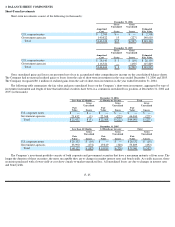

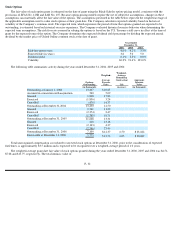

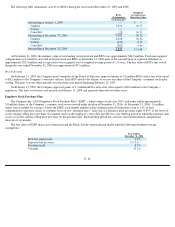

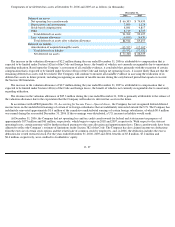

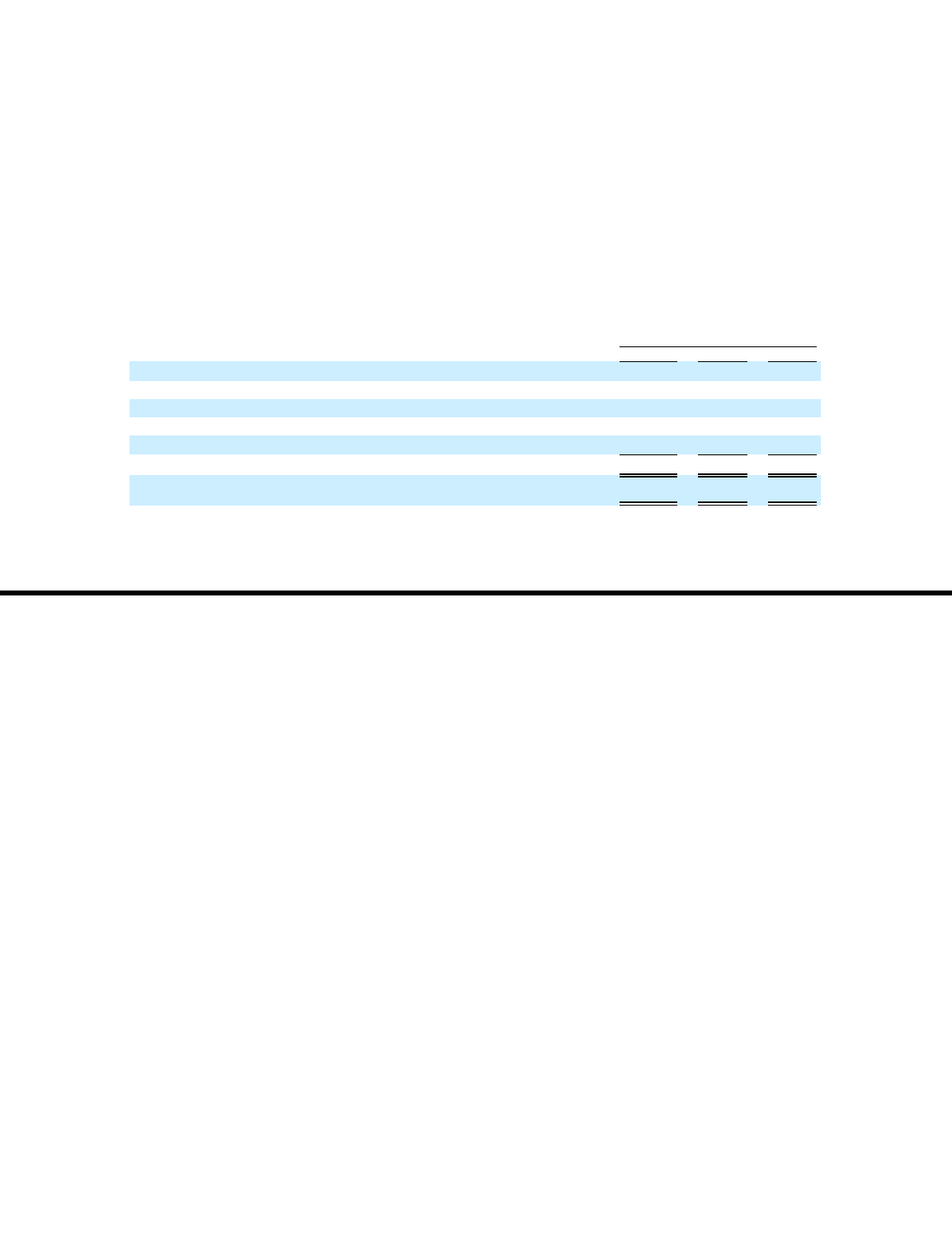

Stock-Based Compensation Recognized

The following table summarizes the stock-based compensation that has been included in the following captions for each of the periods

presented (in thousands):

F- 31

Year Ended December 31,

2006

2005

2004

Operating expenses:

Cost of revenues

$

817

$

183

$

16

Sales and marketing

3,457

954

76

Product development

5,367

1,069

32

General and administrative

9,527

7,746

2,325

Total stock-based compensation

$

19,168

$

9,952

$

2,449

Tax benefit recognized

$

3,962

$

1,688

$

116