Classmates.com 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The year-over-

year increase was primarily the result of a $15.0 million net increase in working capital accounts due to increases in revenues

and operating expenses and the timing of related cash receipts and payments, including an $8.7 million increase in income taxes payable.

Net cash used for investing activities decreased by $104.6 million, or 97%, for the year ended December 31, 2005 compared to the year

ended December 31, 2004. The decrease was primarily the result of the following:

•

a $101.5 million decrease in cash paid for acquisitions in the year ended December 31, 2005, compared to the year ended December 31,

2004, primarily the result of the Classmates acquisition for $98.2 million in cash, net of cash acquired, in November 2004; and

•

a $17.0 million net increase in proceeds from maturities and sales of short-term investments in the year ended December 31, 2005

compared to the year ended December 31, 2004.

These decreases were partially offset by:

•

a $9.1 million increase in capital equipment purchases and capitalized software costs in connection with the development of new

products and the ongoing operations of our business; and

•

a $4.6 million increase in purchases of rights, patents and trademarks, primarily related to the purchase of proprietary rights associated

with the NetZero trademark for $6.0 million, $5.5 million of which was paid in the March 2005 quarter. The remaining $0.5 million was

paid in January 2006.

Net cash used for financing activities increased by $121.3 million for the year ended December 31, 2005 to $89.6 million compared to

$31.7 million net cash provided by financing activities in the year ended December 31, 2004. The increase was primarily the result of the

following:

•

the borrowing of $100 million in December 2004 through a four-year term loan facility;

•

payments of $45.8 million on the term loan in the year ended December 31, 2005, including voluntary prepayments of $28.8 million. In

January 2006, we paid, in full, the outstanding balance of the term loan of approximately $54.2 million; and

•

payments of $38.1 million for dividends in the year ended December 31, 2005.

The increases were offset by:

•

a $60.3 million decrease in repurchases of common stock in the year ended December 31, 2005 compared to the year ended

December 31, 2004.

In May, August and October of 2005, our Board of Directors declared a quarterly cash dividend of $0.20 per share of common stock. The

quarterly dividends were paid on May 31, 2005, August 31, 2005 and November 30, 2005 and totaled $12.6 million, $12.7 million and $12.8

million, respectively.

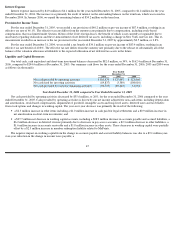

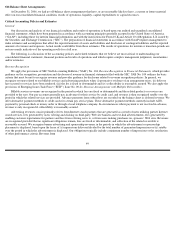

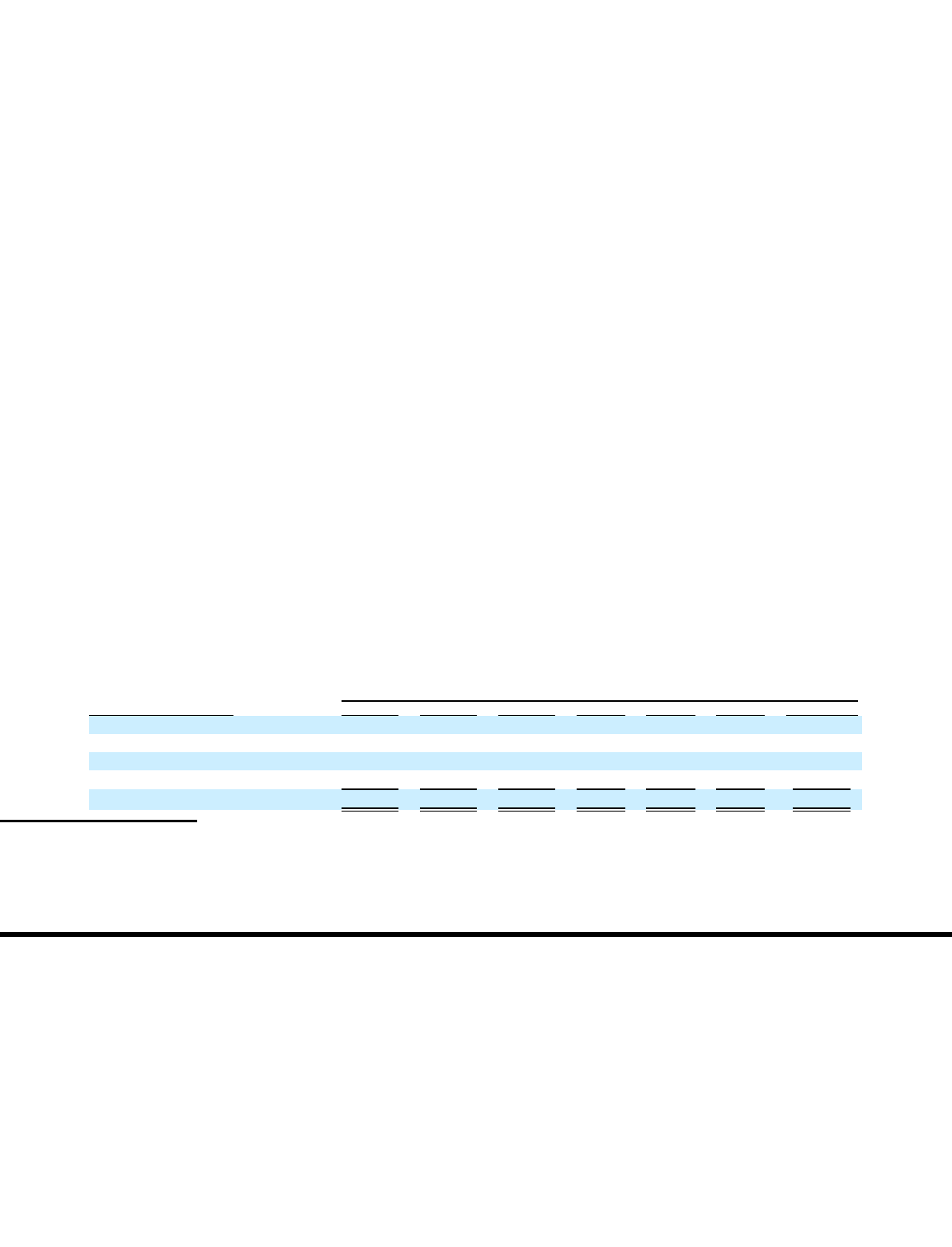

Financial Commitments

Our financial commitments were as follows at December 31, 2006 (in thousands):

(1)

Includes $2 of imputed interest.

48

Year Ending December 31,

Contractual Obligations:

Total

2007

2008

2009

2010

2011

Thereafter

Capital leases(1)

$

32

$

18

$

14

$

—

$

—

$

—

$

—

Operating leases

40,181

7,331

7,094

6,076

4,685

4,010

10,985

Telecommunications purchases

12,050

7,550

4,500

—

—

—

—

Media purchases

2,311

2,311

—

—

—

—

—

Total

$

54,574

$

17,210

$

11,608

$

6,076

$

4,685

$

4,010

$

10,985