Classmates.com 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

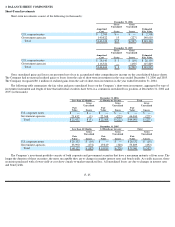

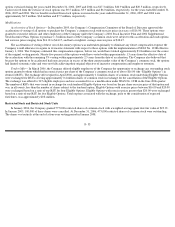

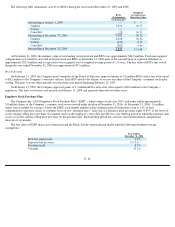

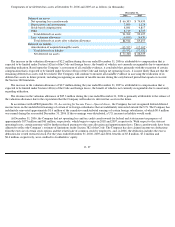

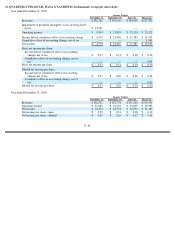

The assumptions presented in the table above represent the weighted average of the applicable assumptions used to value ESPP shares. The

Company calculates expected volatility based on historical volatility of the Company’s common stock. The expected term represents the amount

of time remaining in the 24-month offering period. The risk-free rate assumed in valuing the ESPP shares is based on the U.S. Treasury yield

curve in effect at the time of grant for the expected term. The Company determines the expected dividend yield percentage by dividing the

expected annual dividend by the market price of United Online common stock at the date of grant.

For the year ended December 31, 2006, the Company recognized approximately $1.9 million of stock-based compensation expense related

to the ESPP. For the years ended December 31, 2005 and 2004, the Company recognized $0 of stock-based compensation expense related to the

ESPP. Total unrecognized compensation cost related to the ESPP at December 31, 2006 is approximately $1.1 million and is expected to be

recognized over a weighted-average period of 0.6 years.

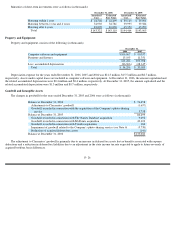

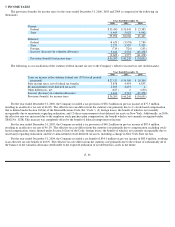

6. IMPAIRMENT OF GOODWILL, INTANGIBLE ASSETS AND LONG-LIVED ASSETS

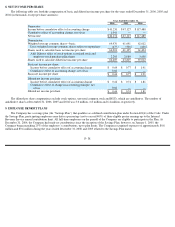

Under SFAS No. 142, goodwill and other indefinite-lived intangibles must be tested for impairment annually or when events and

circumstances change that would indicate that goodwill might be permanently impaired. In the December 2006 quarter, the Company tested

goodwill for impairment and recorded a goodwill impairment charge of $5.7 million and an intangible assets impairment charge of $3.0 million

related to its photo-

sharing service within the Content & Media segment. The $3.0 million intangible assets impairment charge was comprised of

$2.9 million of acquired software technology and $0.1 million of acquired pay accounts, proprietary rights and domain names. The Company

determined the amount of the charge based on an estimate of the fair value of the photo-sharing assets, using the income approach, discounted

cash flow method.

Under SFAS No. 144, long-

lived assets, other than indefinite life intangible assets, must be tested for impairment when events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. In the December 2006 quarter, the Company recognized

asset impairment charges of $4.5 million attributable to certain assets of its VoIP services within the Communications segment. As a result of

slower than expected growth of the VoIP market in the United States, current period operating losses and projected continuing operating losses,

the Company evaluated the recoverability of certain assets and wrote off $4.3 million of capitalized software and $0.2 million of prepaid

marketing and domain names. The Company was required to reduce the carrying value of the assets to fair value and recognized asset

impairment charges because the carrying value of the affected assets exceeded the Company’s estimate of future undiscounted cash flows.

The Company determined that its goodwill and long-lived assets were not impaired based on its annual tests during the years ended

December 31, 2005 and 2004.

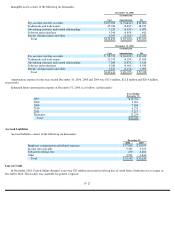

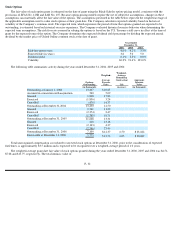

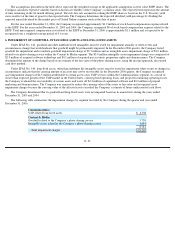

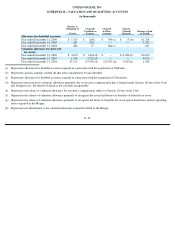

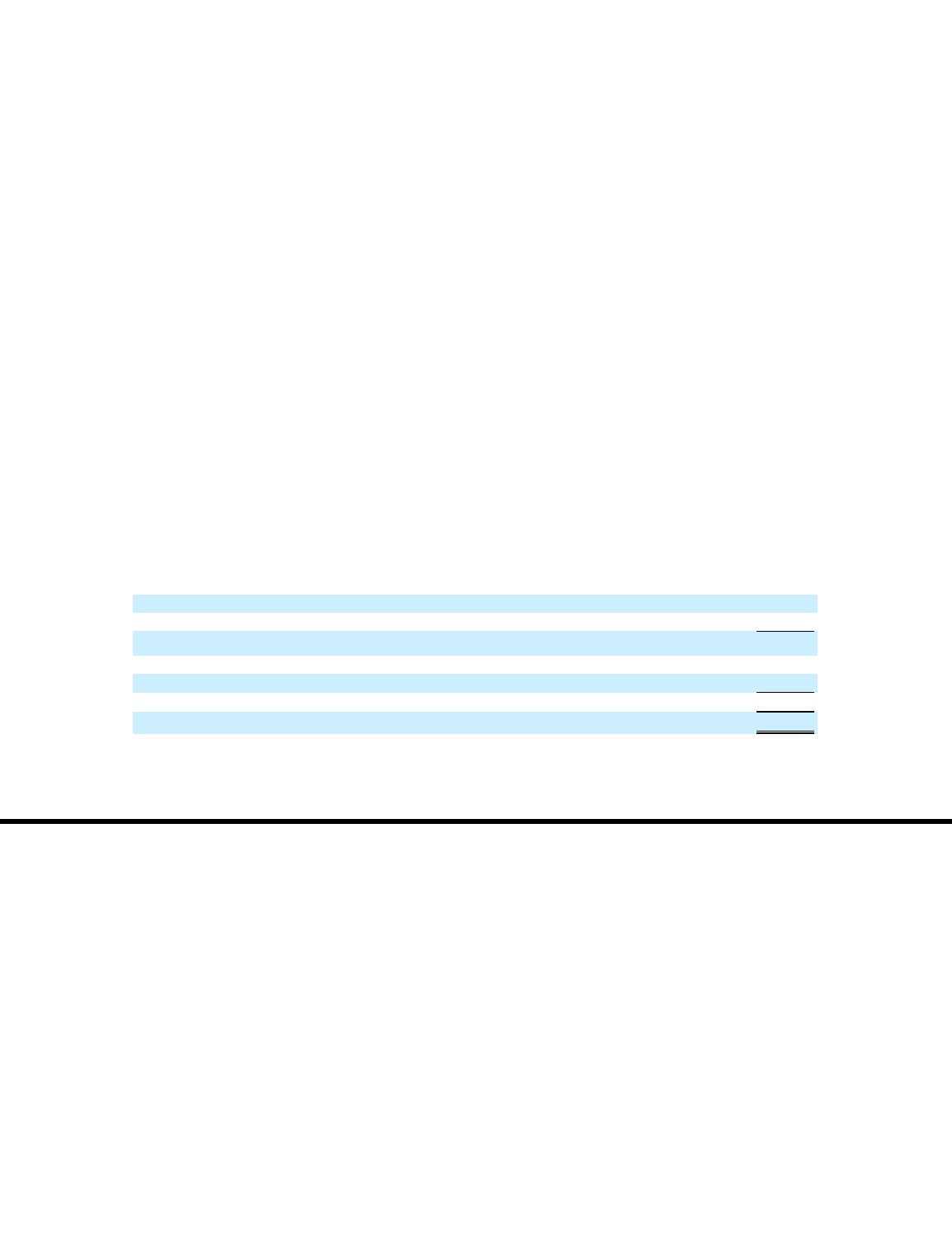

The following table summarizes the impairment charges by segment recorded by the Company during the quarter and year ended

December 31, 2006:

F- 35

Communications:

VoIP

-

related long

-

lived assets

$

4,504

Content & Media:

Goodwill related to the Company

’

s photo

-

sharing service

5,738

Intangible assets related to the Company’s photo-sharing service

3,043

8,781

Total impairment charges

$

13,285