Classmates.com 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

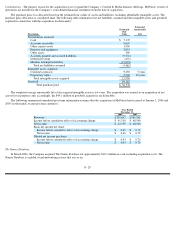

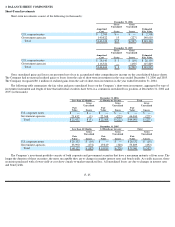

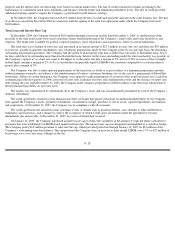

Combinations . The primary reason for the acquisition was to expand the Company’s Content & Media business offerings. MyPoints’ results of

operations are included in the Company’s consolidated financial statements from the date of acquisition.

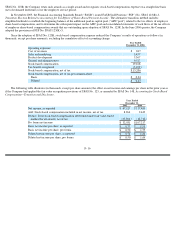

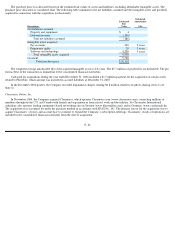

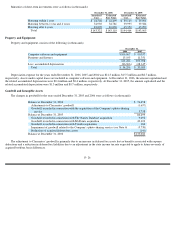

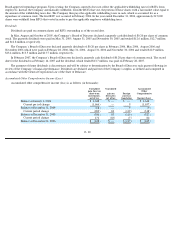

The purchase price was allocated based on the estimated fair values of assets and liabilities, including identifiable intangible assets. The

purchase price allocation is considered final. The following table summarizes the net liabilities assumed and the intangible assets and goodwill

acquired in connection with the acquisition (in thousands):

The weighted-average amortizable life of the acquired intangible assets is 6.4 years. The acquisition was treated as an acquisition of net

assets for tax purposes and, accordingly, the $49.1 million of goodwill acquired is tax deductible.

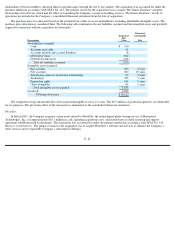

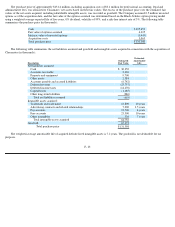

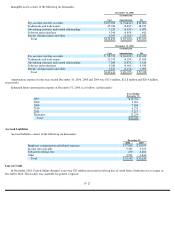

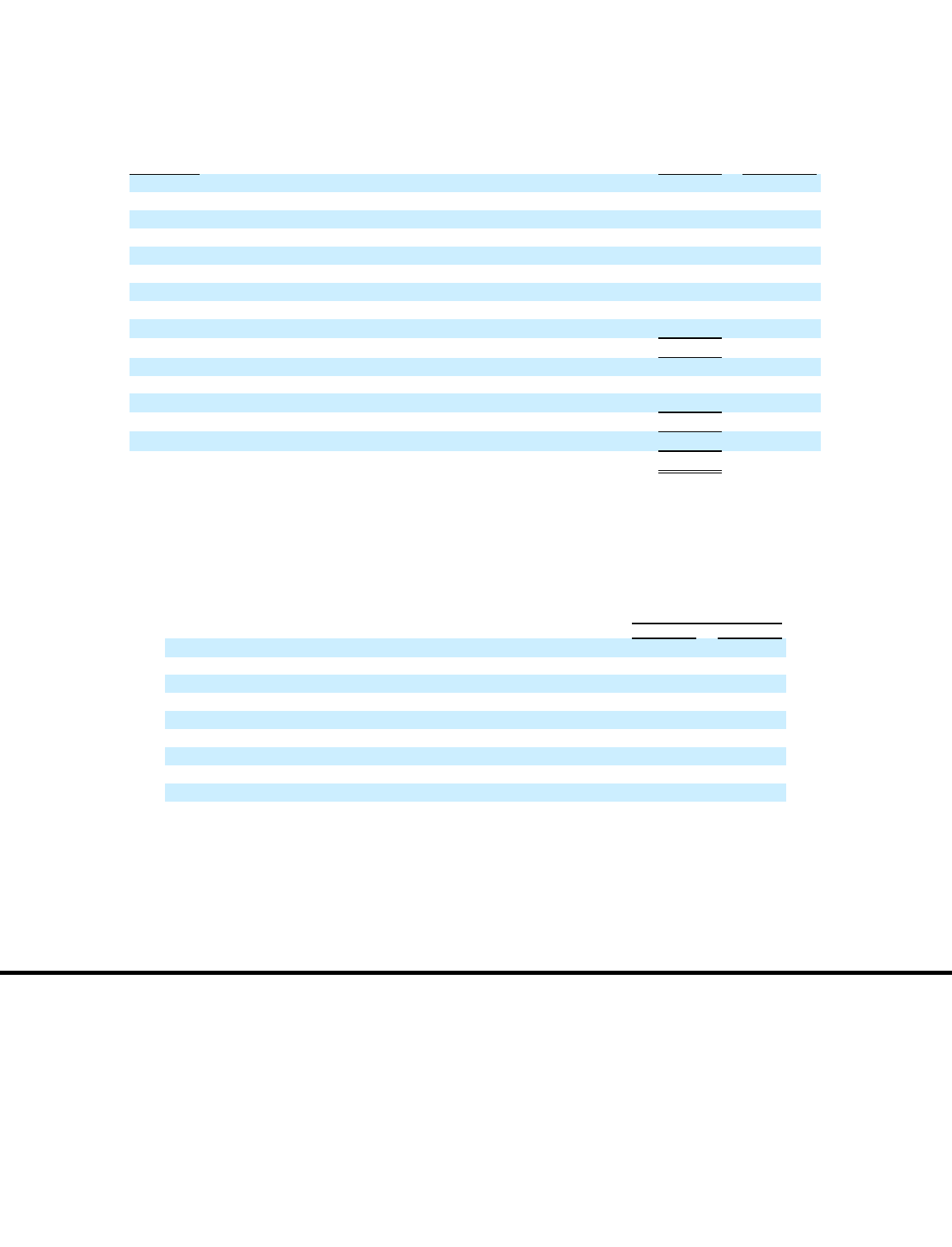

The following summarized unaudited pro forma information assumes that the acquisition of MyPoints had occurred at January 1, 2006 and

2005 (in thousands, except per share amounts):

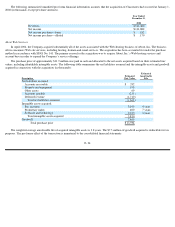

The Names Database

In March 2006, the Company acquired The Names Database for approximately $10.1 million in cash, including acquisition costs. The

Names Database is a global social

-networking service that acts as an

F- 20

Description

Estimated

Fair

Value

Estimated

Amortizable

Life

Net liabilities assumed:

Cash

$

7,137

Accounts receivable

9,667

Other current assets

1,905

Property and equipment

2,833

Other assets

496

Accounts payable and accrued liabilities

(9,376

)

Deferred revenue

(471

)

Member redemption liability

(17,673

)

Total net liabilities assumed

(5,482

)

Intangible assets acquired:

Customer contracts

9,230

5 years

Proprietary rights

3,700

10 years

Total intangible assets acquired

12,930

Goodwill

49,122

Total purchase price

$

56,570

Year Ended

December 31,

2006

2005

Revenues

$

535,647

$

563,343

Income before cumulative effect of accounting change

$

41,518

$

48,540

Net income

$

42,559

$

48,540

Basic net income per share:

Income before cumulative effect of accounting change

$

0.65

$

0.79

Net income

$

0.66

$

0.79

Diluted net income per share:

Income before cumulative effect of accounting change

$

0.63

$

0.76

Net income

$

0.64

$

0.76