Classmates.com 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

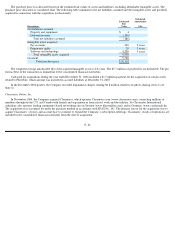

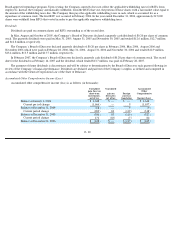

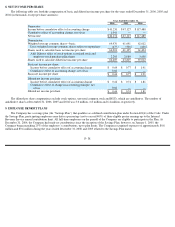

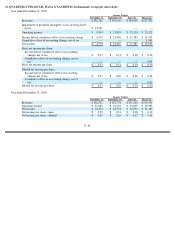

Stock Options

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option-pricing model, consistent with the

provisions of SFAS No. 123R and SAB No. 107. Because option-pricing models require the use of subjective assumptions, changes in these

assumptions can materially affect the fair value of the options. The assumptions presented in the table below represent the weighted average of

the applicable assumption used to value stock options at their grant date. The Company calculates expected volatility based on historical

volatility of the Company’s common stock. The expected term, which represents the period of time that options granted are expected to be

outstanding, is estimated based on historical exercise experience. The Company evaluated historical exercise behavior when determining the

expected term assumptions. The risk-free rate assumed in valuing the options is based on the U.S. Treasury yield curve in effect at the time of

grant for the expected term of the option. The Company determines the expected dividend yield percentage by dividing the expected annual

dividend by the market price of United Online common stock at the date of grant.

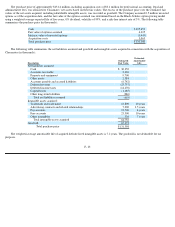

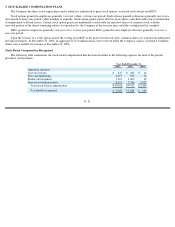

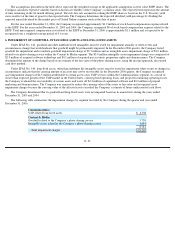

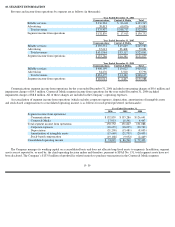

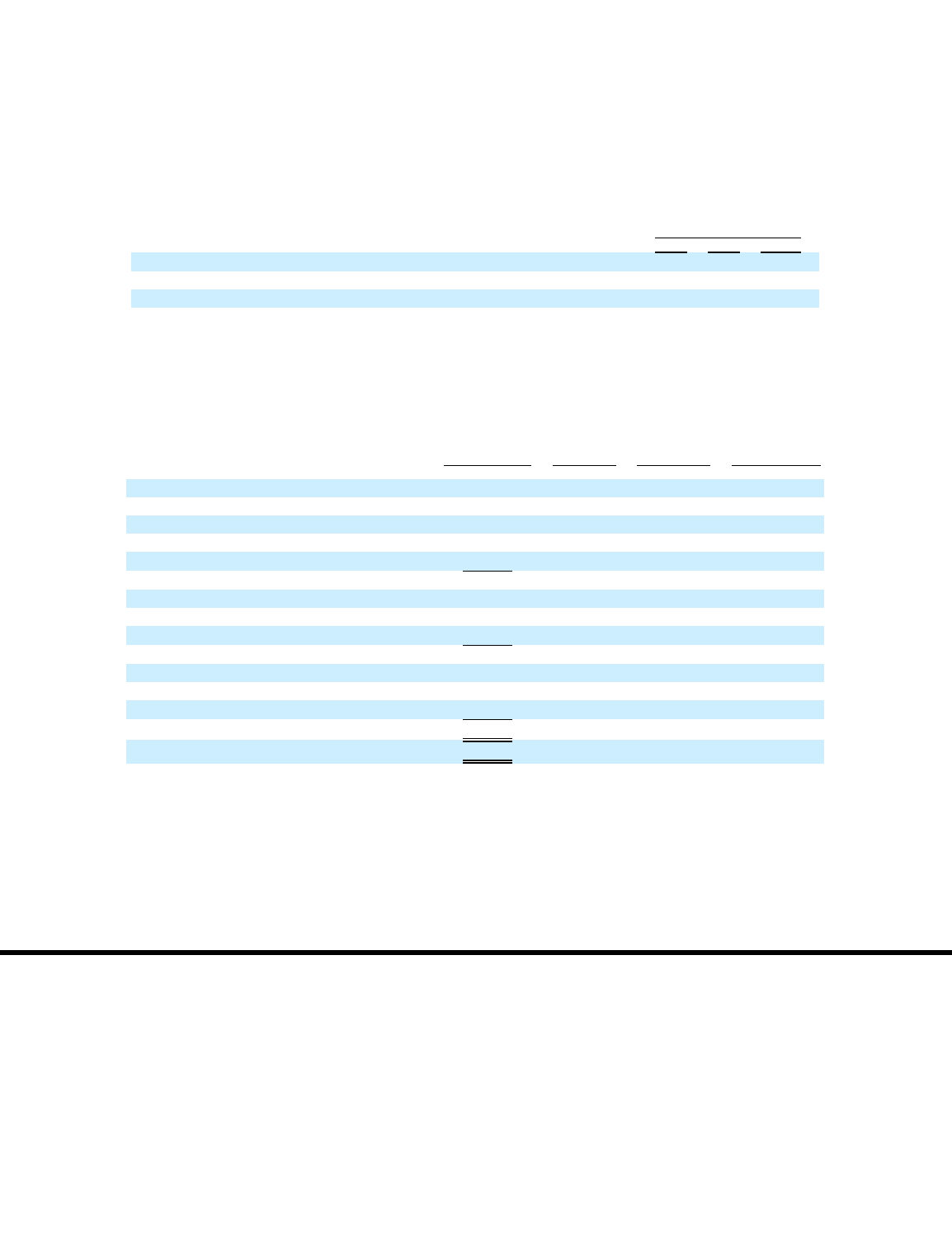

The following table summarizes activity during the years ended December 31, 2004, 2005 and 2006:

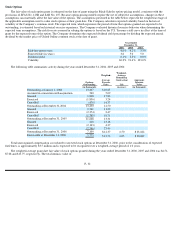

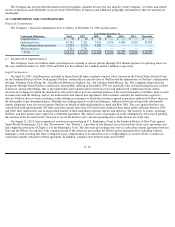

Total unrecognized compensation cost related to unvested stock options at December 31, 2006, prior to the consideration of expected

forfeitures, is approximately $3.5 million and is expected to be recognized over a weighted-average period of 1.0 years.

The weighted-average grant date fair value of stock options granted during the years ended December 31, 2006, 2005 and 2004 was $4.51,

$7.08 and $13.75, respectively. The total intrinsic value of

F- 32

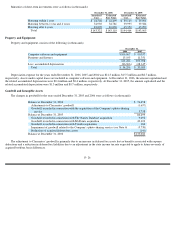

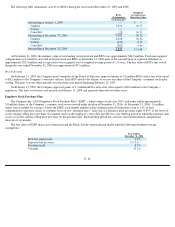

Year Ended

December 31,

2006

2005

2004

Risk

-

free interest rate

4.6

%

4.2

%

3.3

%

Expected life (in years)

3.8

5.0

5.0

Dividend yield

6.1

%

2.3

%

0.0

%

Volatility

60.0

%

91.6

%

103.0

%

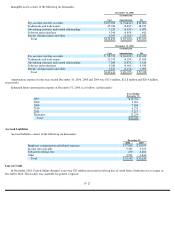

Options

Outstanding

Weighted

-

Average

Exercise

Price

Weighted

-

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(in thousands)

(in years)

(in thousands)

Outstanding at January 1, 2004

13,207

$

10.83

Assumed in connection with acquisition

540

5.09

Granted

1,818

17.83

Exercised

(1,856

)

3.24

Cancelled

(479

)

14.37

Outstanding at December 31,2004

13,230

12.50

Granted

2,541

11.20

Exercised

(2,374

)

2.47

Cancelled

(1,769

)

18.71

Outstanding at December 31, 2005

11,628

13.31

Granted

210

13.18

Exercised

(2,163

)

4.37

Cancelled

(2,566

)

23.46

Outstanding at December 31, 2006

7,109

$

12.37

6.50

$

23,182

Exercisable at December 31, 2006

5,775

$

12.56

6.05

$

20,689