Classmates.com 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

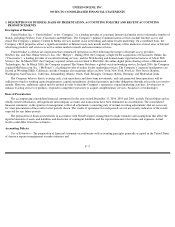

SFAS No. 123R, the Company treats such awards as a single award and recognizes stock-based compensation expense on a straight-line basis

(net of estimated forfeitures) over the employee service period.

In November 2005, the Financial Accounting Standards Board (“FASB”) issued FASB Staff Position (“FSP”) No. SFAS 123(R)-3,

Transition Election Related to Accounting for Tax Effects of Share-Based Payment Awards . The alternative transition method includes

simplified methods to establish the beginning balance of the additional paid-in capital pool (“APIC pool”) related to the tax effects of employee

share-

based compensation, and to determine the subsequent impact on the APIC pool and consolidated statements of cash flows of the tax effects

of employee share-based compensation awards that are outstanding upon adoption of SFAS No. 123R. In the June 2006 quarter, the Company

adopted the provisions of FSP No. SFAS 123(R)-3.

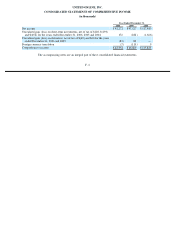

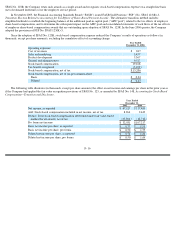

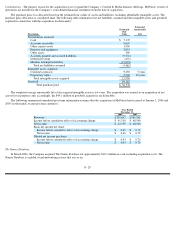

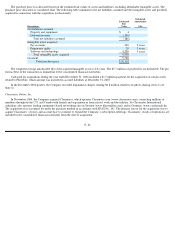

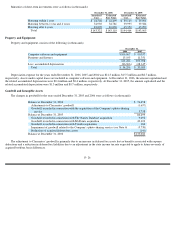

Since the adoption of SFAS No. 123R, stock-based compensation expense reduced the Company’s results of operations as follows (in

thousands, except per share amounts), excluding the cumulative effect of accounting change:

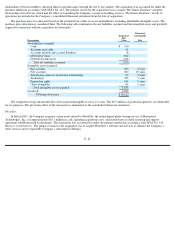

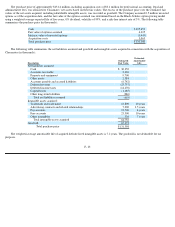

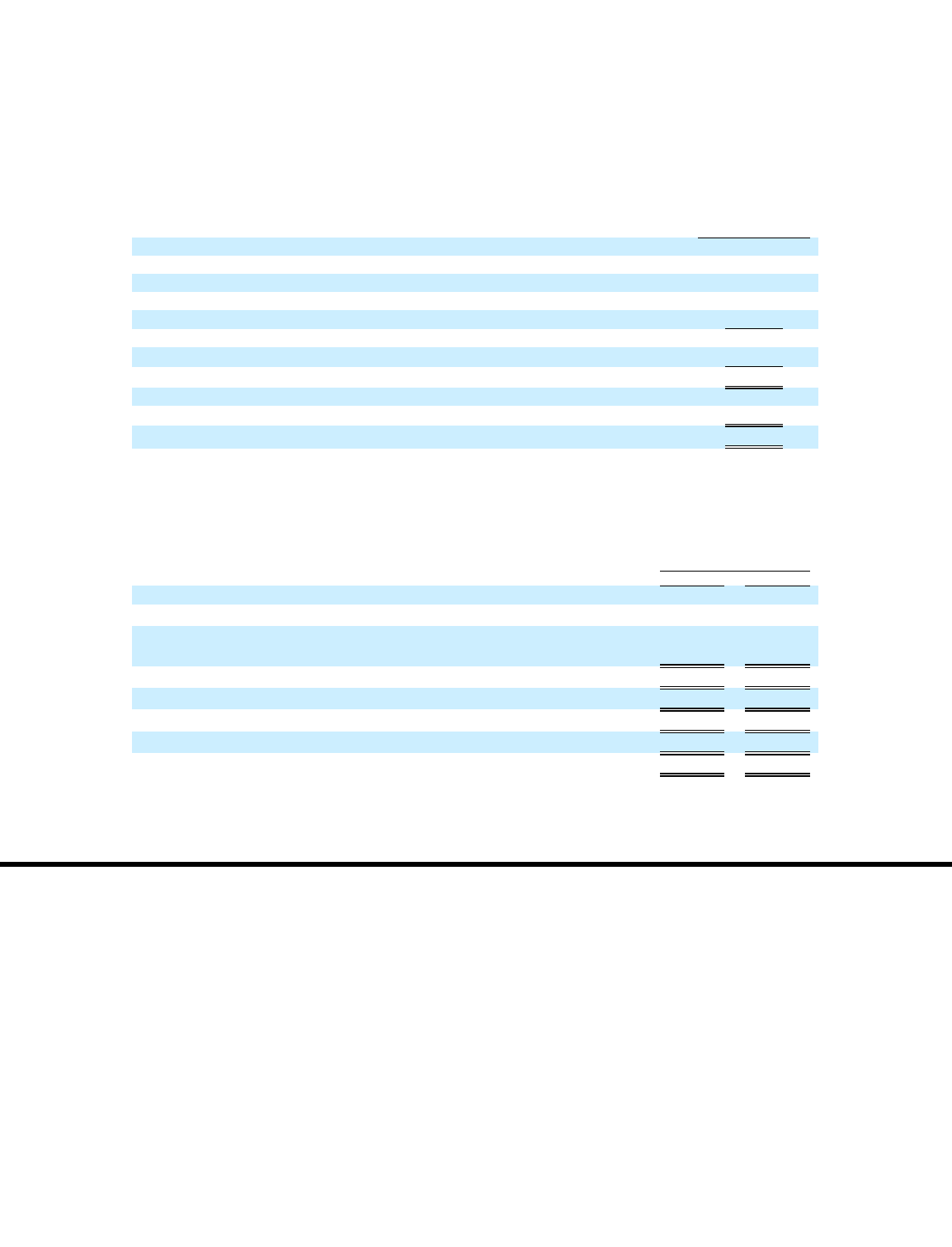

The following table illustrates (in thousands, except per share amounts) the effect on net income and earnings per share in the prior year as

if the Company had applied the fair value recognition provisions of SFAS No. 123, as amended by SFAS No. 148, Accounting for Stock-Based

Compensation—Transition and Disclosure .

F- 16

Year Ended

December 31, 2006

Operating expenses:

Cost of revenues

$

817

Sales and marketing

3,457

Product development

5,367

General and administrative

9,527

Stock-based compensation

19,168

Tax benefit recognized

(3,962

)

Stock-based compensation, net of tax

$

15,206

Stock

-

based compensation, net of tax per common share:

Basic

$

0.24

Diluted

$

0.23

Year Ended

December 31,

2005

2004

Net income, as reported

$

47,127

$

117,480

Add: Stock

-

based compensation included in net income, net of tax

8,264

2,449

Deduct: Total stock-based compensation determined under fair value-based

method for all awards, net of tax

(23,360

)

(12,712

)

Pro forma net income

$

32,031

$

107,217

Basic net income per share, as reported

$

0.77

$

1.91

Basic net income per share, pro forma

$

0.52

$

1.75

Diluted net income per share, as reported

$

0.74

$

1.81

Diluted net income per share, pro forma

$

0.50

$

1.64