Classmates.com 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

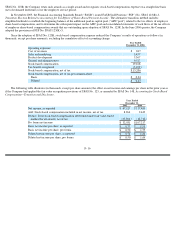

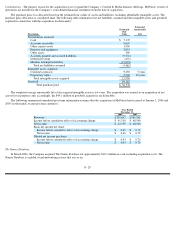

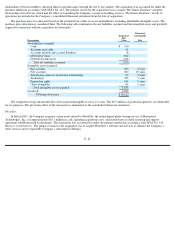

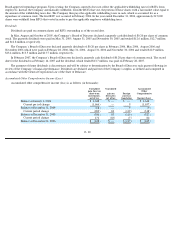

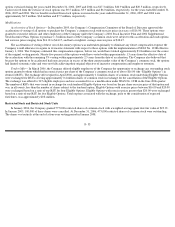

The purchase price of approximately $131.4 million, including acquisition costs of $3.1 million for professional, accounting, legal and

administrative fees, was allocated to Classmates’ net assets based on their fair values. The excess of the purchase price over the estimated fair

values of the net assets acquired, including identifiable intangible assets, was recorded as goodwill. The Company assumed 0.5 million unvested

options as of the acquisition date, and the fair value of the options assumed was determined based on the Black-Scholes option pricing model

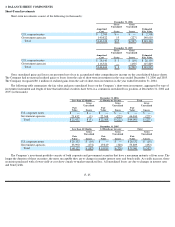

using a weighted-average expected life of five years, 0% dividend, volatility of 99%, and a risk-free interest rate of 3%. The following table

summarizes the purchase price (in thousands):

n

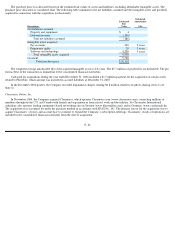

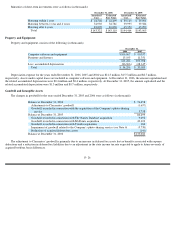

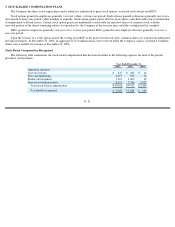

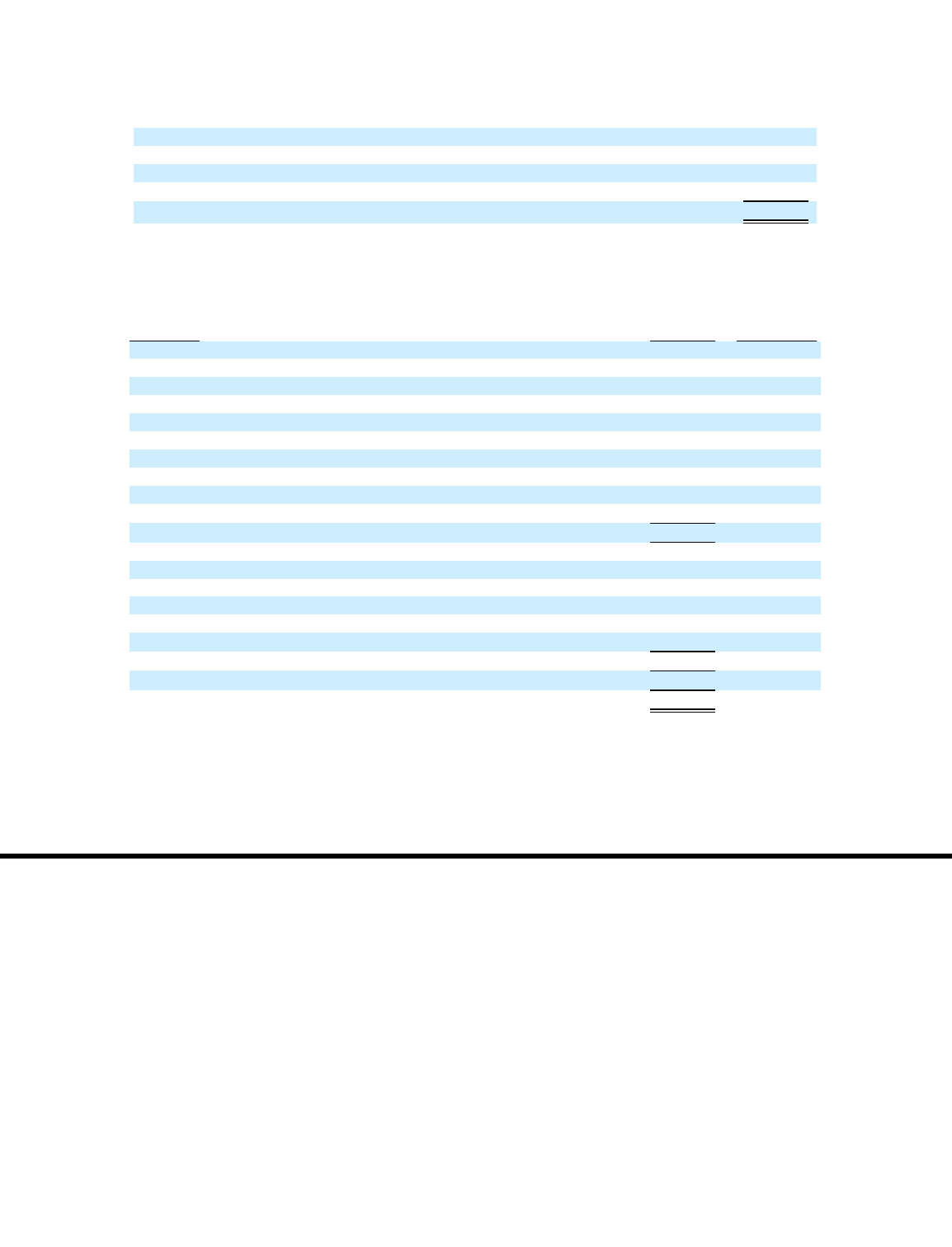

The following table summarizes the net liabilities assumed and goodwill and intangible assets acquired in connection with the acquisition of

Classmates (in thousands):

The weighted-average amortizable life of acquired definite-lived intangible assets is 7.2 years. The goodwill is not deductible for tax

purposes.

F- 23

Cash

$

125,453

Fair value of options assumed

4,325

Intrinsic value of unvested options

(1,445

)

Acquisition costs

3,065

Total purchase price

$

131,398

Estimated

Estimated

Amortizable

Description

Fair Value

Life

Net liabilities assumed:

Cash

$

30,350

Accounts receivable

3,396

Property and equipment

9,700

Other assets

2,384

Accounts payable and accrued liabilities

(6,742

)

Deferred revenue

(23,757

)

Deferred income taxes

(14,170

)

Capital leases

(1,485

)

Other long-term liabilities

(286

)

Total net liabilities assumed

(610

)

Intangible assets acquired:

Trademark and trade name

13,800

10 years

Advertising contracts and related relationships

7,200

3.5 years

Pay accounts

21,700

4 years

Free accounts

21,500

10 years

Other intangibles

536

7 years

Total intangible assets acquired

64,736

Goodwill

67,272

Total purchase price

$

131,398