Cisco 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

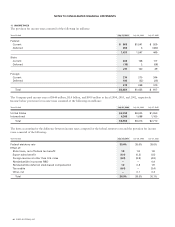

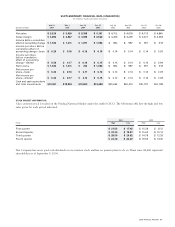

The majority of the Company’s assets as of July 31, 2004 and July 26, 2003 were attributable to its U.S. operations. In fiscal 2004,

2003, and 2002, no single customer accounted for 10% or more of the Company’s net sales.

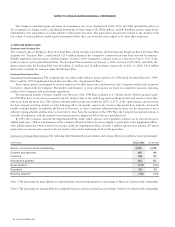

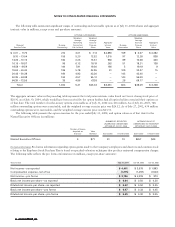

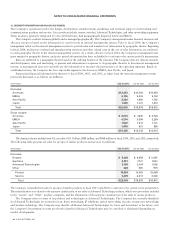

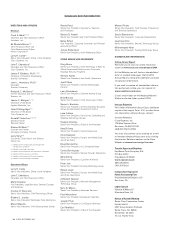

Property and equipment information is based on the physical location of the assets. The following table presents property and

equipment information for geographic areas (in millions):

July 31, 2004 July 26, 2003 July 27, 2002

Property and equipment, net:

United States $ 2,919 $ 3,186 $ 3,555

International 371 457 547

Total $ 3,290 $ 3,643 $ 4,102

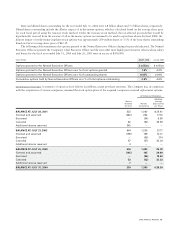

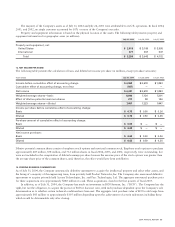

13. NET INCOME PER SHARE

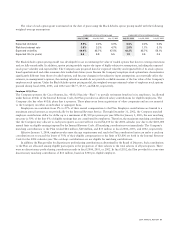

The following table presents the calculation of basic and diluted net income per share (in millions, except per-share amounts):

Years Ended July 31, 2004 July 26, 2003 July 27, 2002

Income before cumulative effect of accounting change $ 4,968 $ 3,578 $ 1,893

Cumulative effect of accounting change, net of tax (567) ——

Net income $ 4,401 $ 3,578 $ 1,893

Weighted-average shares—basic 6,840 7,124 7,301

Effect of dilutive potential common shares 217 99 146

Weighted-average shares—diluted 7,057 7,223 7,447

Income per share before cumulative effect of accounting change:

Basic $0.73 $0.50 $0.26

Diluted $ 0.70 $ 0.50 $ 0.25

Per-share amount of cumulative effect of accounting change:

Basic $ 0.09 $— $—

Diluted $0.08 $ — $ —

Net income per share:

Basic $ 0.64 $ 0.50 $ 0.26

Diluted $0.62 $0.50 $0.25

Dilutive potential common shares consist of employee stock options and restricted common stock. Employee stock options to purchase

approximately 469 million, 838 million, and 712 million shares in fiscal 2004, 2003, and 2002, respectively, were outstanding, but

were not included in the computation of diluted earnings per share because the exercise price of the stock options was greater than

the average share price of the common shares, and, therefore, the effect would have been antidilutive.

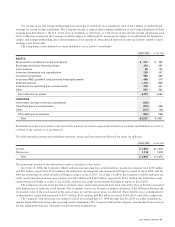

14. PENDING BUSINESS COMBINATIONS

As of July 31, 2004, the Company announced a definitive agreement to acquire the intellectual property and select other assets, and

the hiring of a majority of the engineering team, from privately held Procket Networks, Inc. The Company also announced definitive

agreements to acquire privately held Actona Technologies, Inc. and Parc Technologies, Ltd. The aggregate announced purchase price

for these acquisitions was approximately $180 million in cash. These acquisitions closed in the first quarter of fiscal 2005.

In addition, as of July 31, 2004, the Company has made an investment in BCN Systems, Inc. (“BCN”). The Company has the

right, but not the obligation, to acquire the portion of BCN it does not own, with such purchase dependent upon the Company’s sole

determination as to whether certain technical conditions have been met. The aggregate total purchase value of BCN could range from

approximately $45 million to approximately $195 million depending upon the achievement of certain milestones including those

which would be determinable only after closing.

2004 ANNUAL REPORT 65