Cisco 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORWARD-LOOKING STATEMENTS

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements

regarding future events and our future results that are subject to the safe harbors created under the Securities Act of 1933 and the

Securities Exchange Act of 1934. These statements are based on current expectations, estimates, forecasts, and projections about the

industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,”

“goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “may,” variations of such words, and similar

expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future

financial performance, our anticipated growth and trends in our businesses (including the potential growth of Advanced Technologies),

and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned that these

forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict,

including those identified below, as well as on the inside back cover of this Annual Report to Shareholders and under “Risk Factors,”

and elsewhere in our Annual Report on Form 10-K. Therefore, actual results may differ materially and adversely from those expressed

in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

OVERVIEW

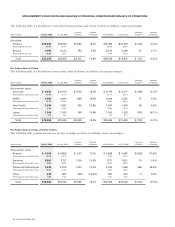

We sell scalable, standards-based networking products that address a wide range of customers’ business needs, including improving

productivity, reducing costs, and gaining a competitive advantage. Our corresponding technology focus is on delivering networking

products and systems that simplify customers’ infrastructures, offer integrated services, and are highly secure. Our products and services

help customers build their own network infrastructures while providing tools to allow them to communicate with key stakeholders,

including customers, prospects, business partners, suppliers, and employees. Our product offerings fall into several categories: our core

technologies, routing and switching; Advanced Technologies (home networking, IP telephony, optical networking, security, storage area

networking, and wireless technology); and other products, including our access products and network management software. Our

customer base spans virtually all types of public and private agencies and enterprises, comprising enterprise customers, service provider

customers, and commercial customers. We also have customers in the consumer market through our Linksys division.

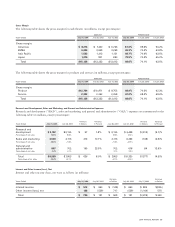

As we entered fiscal 2004, we articulated three long-term financial priorities:

• Seeking profitable growth opportunities while supporting our profitability targets;

• Continuing to improve productivity; and

•Maintaining our healthy balance sheet.

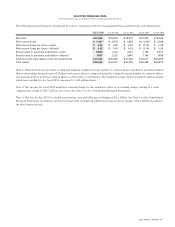

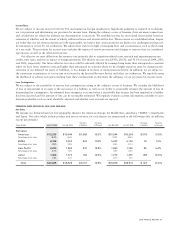

Our results for fiscal 2004 indicate that we made substantial progress toward these goals. Net sales were $22.0 billion, compared

with $18.9 billion in fiscal 2003. Net income was $4.4 billion, compared with $3.6 billion in fiscal 2003. Diluted earnings per share

was $0.62, compared with $0.50 in fiscal 2003. Cash flows from operations were $7.1 billion, compared with $5.2 billion for fiscal 2003.

All of our geographic segments contributed to our revenue growth in fiscal 2004 as general economic conditions around the world

began to improve from the recent economic downturn. We also improved our productivity, as operating expenses as a percentage of

sales improved by 4% from fiscal 2003. With regard to our balance sheet, at the end of fiscal 2004, cash and cash equivalents and

investments totaled $19.3 billion, days sales outstanding (DSO) were 28 days, and annualized inventory turns were 6.4. During the

fiscal year, we repurchased $9.1 billion or 408 million shares of our common stock at an average price of $22.30.

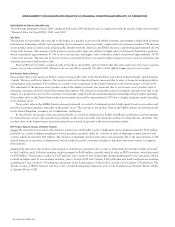

Our technology vision is based on an architectural evolution of networking from simple connectivity of products to intelligent

systems, or as we refer to it, the Intelligent Information Network. As such, many of our strategic initiatives and investments are aimed

at meeting the requirements of an Intelligent Information Network. If networking evolves the way we think it will, we believe we have

positioned ourselves well versus our key competitors, but if it does not, our initiatives and investments in this area may be of no or

limited value. In general, our markets are very competitive, and, in addition to positioning Cisco in relation to our traditional

competitors, we are also positioning ourselves to address new competitors, especially from Asia.

We rely on internal innovation along with strategic alliances and acquisitions to provide innovative products to enhance our

competitive position. Our ability to innovate internally requires us to attract and retain top talent in a very competitive industry. We have

made plans to hire up to 1,000 new employees in fiscal 2005, primarily for engineering and sales positions. In addition, we believe our

acquisitions have the potential to bring both talent and technology to Cisco, and we expect to continue to make strategic acquisitions.

As we evaluate our growth prospects and manage our operations for the future, we continue to believe that the leading indicator

of our growth will be the gross domestic product, or GDP, of the countries into which we sell our products. We regard the willingness

to take good business risk as part of our strategy, and we intend to be aggressive in this respect. For example, during fiscal 2004,

we steadily decreased product lead times for our customers. While these shortened lead times potentially increase our exposure to

changes in economic conditions, we believe this investment increases customer satisfaction.

18 CISCO SYSTEMS, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS