Cisco 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

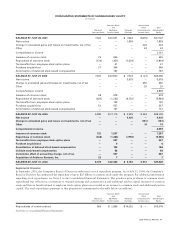

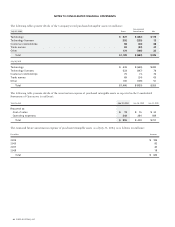

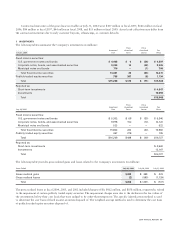

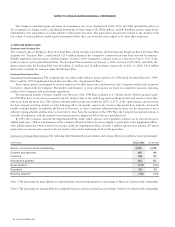

4. RESTRUCTURING COSTS AND OTHER SPECIAL CHARGES

On April 16, 2001, the Company announced a restructuring program, which included a worldwide workforce reduction, consolidation

of excess facilities, and restructuring of certain business functions. The liability for restructuring costs is recorded in other accrued

liabilities in the Consolidated Balance Sheets. The following table summarizes the activity related to the liability for restructuring costs

and other special charges as of July 31, 2004 (in millions):

Consolidation Impairment of

of Excess Goodwill

Workforce Facilities and and Purchased

Reduction Other Charges Intangible Assets Total

Initial charge in the third quarter of fiscal 2001 $ 397 $ 484 $ 289 $1,170

Noncash charges (71) (141) (289) (501)

Cash payments (265) (18) — (283)

Balance at July 28, 2001 61 325 — 386

Adjustments(1) (35) 128 — 93

Cash payments (26) (131) — (157)

Balance at July 27, 2002 — 322 — 322

Adjustments(2) — 45 — 45

Cash payments — (72) — (72)

Balance at July 26, 2003 — 295 — 295

Cash payments(3) — (230) — (230)

Balance at July 31, 2004 $ — $ 65 $ — $ 65

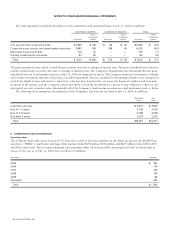

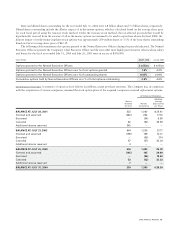

Note 1: Due to changes in previous estimates, in fiscal 2002, the Company reclassified $35 million of restructuring liabilities related

to the workforce reduction charges to consolidation of excess facilities and other charges. The initial estimated workforce reduction

was approximately 6,000 regular employees. Approximately 5,400 regular employees were terminated, and the liability was paid. In

addition, during fiscal 2002, the Company increased the restructuring liabilities related to the consolidation of excess facilities and other

charges by $93 million, which was recorded during the third quarter of fiscal 2002, due to changes in real estate market conditions.

The increase in restructuring liabilities was recorded as expenses related to research and development ($39 million), sales and marketing

($42 million), general and administrative ($8 million), and cost of sales ($4 million) in the Consolidated Statements of Operations.

Note 2: During fiscal 2003, the Company increased the restructuring liabilities related to the consolidation of excess facilities and

other charges by a total of $45 million, which was recorded during the first quarter and fourth quarter of fiscal 2003, due to changes

in real estate market conditions. The increase in restructuring liabilities was recorded as expenses related to research and development

($18 million), sales and marketing ($18 million), general and administrative ($4 million), and cost of sales ($5 million) in the Consolidated

Statements of Operations.

Note 3: Cash payments include payments of approximately $204 million on lease obligations that were terminated.

2004 ANNUAL REPORT 51