Cisco 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

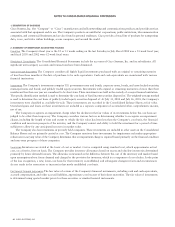

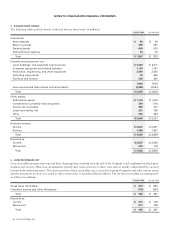

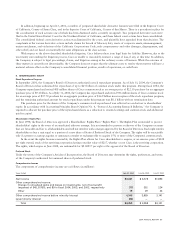

Goodwill

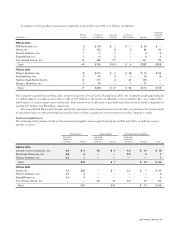

The following tables present the changes in goodwill allocated to the Company’s reportable segments during fiscal 2004 and 2003

(in millions):

Balance at Balance at

July 26, 2003 Acquired July 31, 2004

Americas $2,642 $ 74 $2,716

EMEA 668 10 678

Asia Pacific 167 4 171

Japan 566 67 633

Total $4,043 $155 $4,198

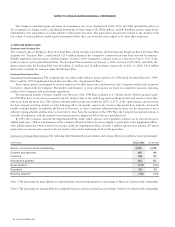

Balance at Balance at

July 27, 2002 Acquired July 26, 2003

Americas $2,335 $307 $2,642

EMEA 593 75 668

Asia Pacific 140 27 167

Japan 497 69 566

Total $3,565 $478 $4,043

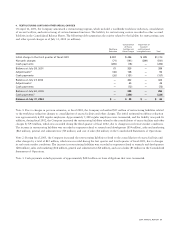

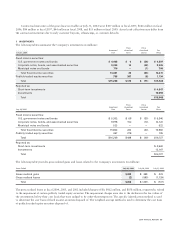

In fiscal 2004, the Company purchased a portion of the minority interest of Cisco Systems, K.K. (Japan). As a result, the Company

increased its ownership from 94.8% to 97.6% of the voting rights of Cisco Systems, K.K. (Japan) and recorded goodwill of $65 million,

which was included in the preceding table.

Acquisition of Andiamo Systems, Inc.

In April 2001, the Company entered into a commitment to provide convertible debt funding of approximately $84 million to Andiamo,

a privately held storage switch developer. This debt was convertible into approximately 44% of the equity of Andiamo. In connection

with this investment, the Company obtained a call option that provided the Company the right to purchase Andiamo. The purchase

price under the call option was based on a valuation of Andiamo using a negotiated formula. On August 19, 2002, the Company entered

into a definitive agreement to acquire Andiamo, which represented the exercise of its rights under the call option. The Company also

entered into a commitment to provide nonconvertible debt funding to Andiamo of approximately $100 million through the close of

the acquisition. Substantially all of the convertible debt funding of $84 million and nonconvertible debt funding of $100 million has

been expensed as research and development costs.

2004 ANNUAL REPORT 49