Cisco 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

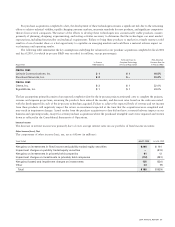

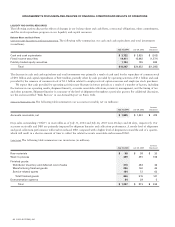

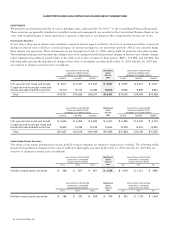

Purchase Commitments with Contract Manufacturers and Suppliers We purchase components from a variety of suppliers and use several contract

manufacturers to provide manufacturing services for our products. During the normal course of business, in order to manage manufacturing

lead times and to help assure adequate component supply, we enter into agreements with contract manufacturers and suppliers that either

allow them to procure inventory based upon criteria as defined by us or that establish the parameters defining our requirements. In certain

instances, these agreements allow us the option to cancel, reschedule, and adjust our requirements based on our business needs prior to

firm orders being placed. Consequently, only a portion of our reported purchase commitments arising from these agreements are firm,

noncancelable, and unconditional commitments. The purchase commitments for inventory are expected to be fulfilled within one year.

In addition to the above, we record a liability for firm, noncancelable, and unconditional purchase commitments for quantities

in excess of our future demand forecasts consistent with our allowance for inventory. As of July 31, 2004, the liability for our firm,

noncancelable, and unconditional purchase commitments was $141 million, compared with $99 million as of July 26, 2003. These

amounts are included in other accrued liabilities in our Consolidated Balance Sheets at July 31, 2004 and July 26, 2003, and are not

included in the preceding table.

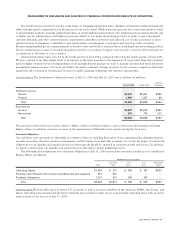

Purchase Obligations Purchase obligations represent an estimate of all open purchase orders and contractual obligations in the ordinary

course of business, other than commitments with contract manufacturers and suppliers, for which we have not received the goods or

services as of July 31, 2004. Although open purchase orders are considered enforceable and legally binding, the terms generally allow

us the option to cancel, reschedule, and adjust our requirements based on our business needs prior to the delivery of goods or

performance of services.

Other Commitments

In fiscal 2001, we entered into an agreement to invest approximately $1.0 billion in venture funds managed by SOFTBANK Corp.

and its affiliates (“SOFTBANK”), which are required to be funded on demand. In fiscal 2003, this agreement was amended to reduce

the amount of our commitment to $800 million, of which up to $550 million is to be invested in venture funds under terms similar

to the original agreement and $250 million invested as senior debt with entities as directed by SOFTBANK. Our commitment to

fund the senior debt is contingent upon the achievement of certain agreed-upon milestones. As of July 31, 2004, we have invested

$290 million in the venture funds and $49 million in the senior debt, of which $19 million has been repaid, and both were recorded

as investments in privately held companies in our Consolidated Balance Sheets. We had invested $247 million in the venture funds

and $49 million in the senior debt as of July 26, 2003.

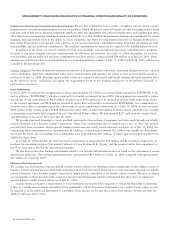

We provide structured financing to certain qualified customers for the purchase of equipment and other needs through our wholly

owned subsidiary, Cisco Systems Capital Corporation. These loan commitments may be funded over a two- to three-year period,

provided that these customers achieve specific business milestones and satisfy certain financial covenants. As of July 31, 2004, our

outstanding loan commitments were approximately $61 million, of which approximately $22 million was eligible for draw-down.

As of July 26, 2003, our outstanding loan commitments were approximately $97 million, of which approximately $38 million was

eligible for draw-down.

As of July 31, 2004 and July 26, 2003, we had a commitment of approximately $59 million and $130 million, respectively, to

purchase the remaining portion of the minority interest of Cisco Systems, K.K. (Japan), and the payment under this commitment is

based on a put option held by the minority shareholders.

We also have certain other funding commitments related to our privately held investments that are based on the achievement of certain

agreed-upon milestones. The funding commitments were approximately $67 million as of July 31, 2004, compared with approximately

$95 million as of July 26, 2003.

Off-Balance Sheet Arrangements

We consider our investments in unconsolidated variable interest entities to be off-balance sheet arrangements. In the ordinary course of

business, we have investments in privately held companies and provide structured financing to certain customers through our wholly

owned subsidiary, Cisco Systems Capital Corporation, which may be considered to be variable interest entities. We have evaluated

our investments in these privately held companies and structured financings and have determined that there were no significant

unconsolidated variable interest entities as of July 31, 2004.

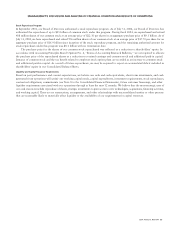

Certain events can require a reassessment of our investments in privately held companies or structured financings to determine

if they are variable interest entities and which of the stakeholders will be the primary beneficiaries. As a result of such events, we may

be required to make additional disclosures or consolidate these entities. As we may not control these entities, we may not have the

ability to influence these events.

34 CISCO SYSTEMS, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS