Cisco 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

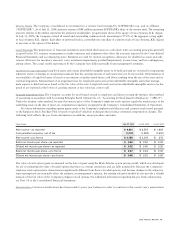

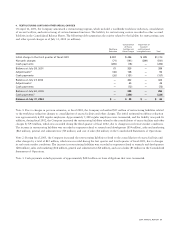

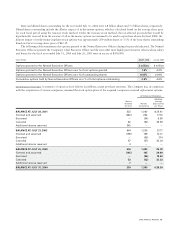

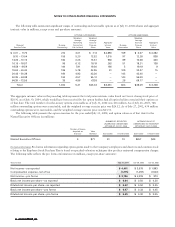

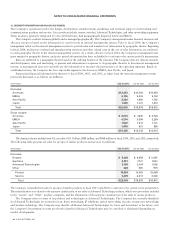

The following table provides the breakdown of the investments with unrealized losses at July 31, 2004 (in millions):

LESS THAN 12 MONTHS 12 MONTHS OR GREATER TOTAL

Gross Gross Gross

Unrealized Unrealized Unrealized

Fair Value Losses Fair Value Losses Fair Value Losses

U.S. government notes and bonds $2,859 $ (18) $ 84 $ (2) $2,943 $ (20)

Corporate notes, bonds, and asset-backed securities 3,883 (38) 189 (4) 4,072 (42)

Municipal notes and bonds 176 (1) — — 176 (1)

Publicly traded equity securities 83 (8) — — 83 (8)

Total $ 7,001 $ (65) $ 273 $ (6) $ 7,274 $ (71)

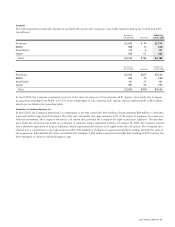

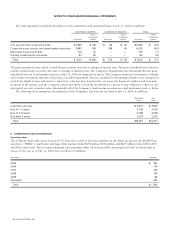

The gross unrealized losses related to fixed income securities were due to changes in interest rates. The gross unrealized losses related to

publicly traded equity securities were due to changes in market prices. The Company’s management has determined that the gross

unrealized losses on its investment securities at July 31, 2004 are temporary in nature. The Company reviews its investments to identify

and evaluate investments that have indications of possible impairment. Factors considered in determining whether a loss is temporary

include the length of time and extent to which fair value has been less than the cost basis, the financial condition and near-term

prospects of the investee, and the Company’s intent and ability to hold the investment for a period of time sufficient to allow for any

anticipated recovery in market value. Substantially all of the Company’s fixed income securities are rated investment grade or better.

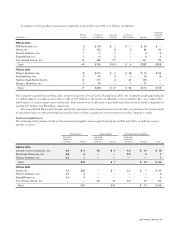

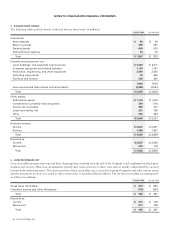

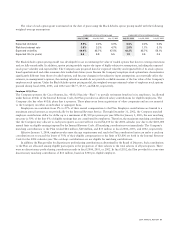

The following table summarizes the maturities of the Company’s fixed income securities at July 31, 2004 (in millions):

Amortized Fair

Cost Value

Less than one year $ 4,951 $ 4,947

Due in 1–2 years3,138 3,130

Due in 2–5 years4,088 4,064

Due after 5 years 2,274 2,270

Total $14,451 $14,411

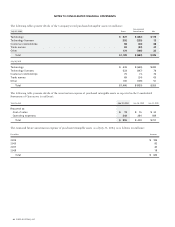

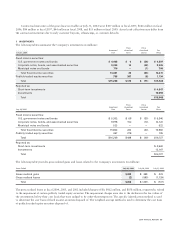

8. COMMITMENTS AND CONTINGENCIES

Operating Leases

The Company leases office space in several U.S. locations, as well as locations elsewhere in the Americas; Europe, the Middle East,

and Africa (“EMEA”); Asia Pacific; and Japan. Rent expense totaled $191 million, $196 million, and $265 million in fiscal 2004, 2003,

and 2002, respectively. Future annual minimum lease payments under all noncancelable operating leases with an initial term in

excess of one year as of July 31, 2004 were as follows (in millions):

Fiscal Year Amount

2005 $ 231

2006 176

2007 130

2008 104

2009 83

Thereafter 632

Total $ 1,356

54 CISCO SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS