Cisco 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

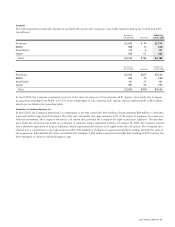

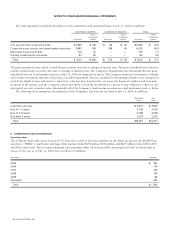

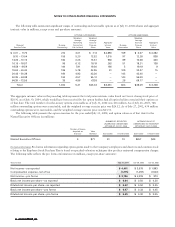

Contractual maturities of the gross lease receivables at July 31, 2004 were $307 million in fiscal 2005, $166 million in fiscal

2006, $84 million in fiscal 2007, $44 million in fiscal 2008, and $15 million in fiscal 2009. Actual cash collections may differ from

the contractual maturities due to early customer buyouts, refinancings, or customer defaults.

7. INVESTMENTS

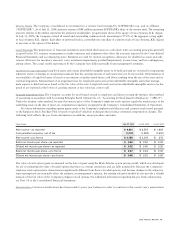

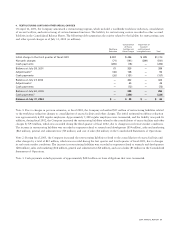

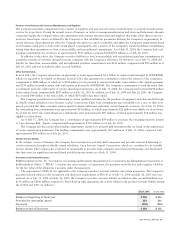

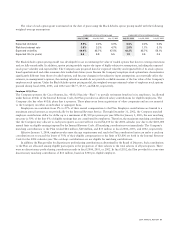

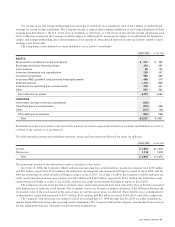

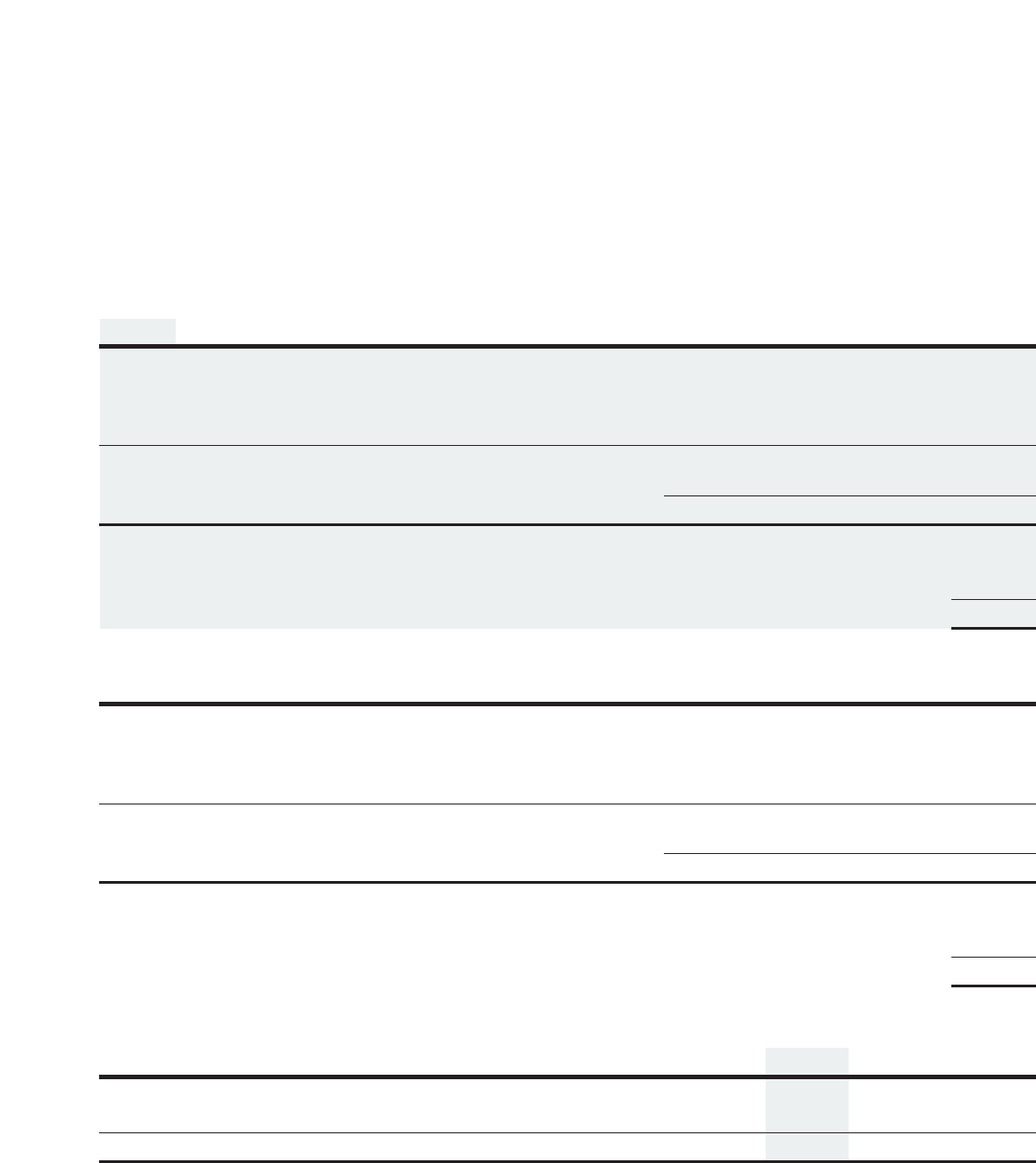

The following tables summarize the Company’s investments (in millions):

Gross Gross

Amortized Unrealized Unrealized Fair

July 31, 2004 Cost Gains Losses Value

Fixed income securities:

U.S. government notes and bonds $ 4,408 $ 9 $ (20) $ 4,397

Corporate notes, bonds, and asset-backed securities 9,333 14 (42) 9,305

Municipal notes and bonds 710 — (1) 709

Total fixed income securities 14,451 23 (63) 14,411

Publicly traded equity securities 755 387 (8) 1,134

Total $15,206 $ 410 $ (71) $15,545

Reported as:

Short-term investments $4,947

Investments 10,598

Total $15,545

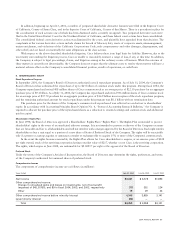

Gross Gross

Amortized Unrealized Unrealized Fair

July 26, 2003 Cost Gains Losses Value

Fixed income securities:

U.S. government notes and bonds $ 5,302 $ 68 $ (30) $ 5,340

Corporate notes, bonds, and asset-backed securities 9,978 152 (10) 10,120

Municipal notes and bonds 522 — — 522

Total fixed income securities 15,802 220 (40) 15,982

Publicly traded equity securities 467 278 — 745

Total $16,269 $498 $ (40) $16,727

Reported as:

Short-term investments $ 4,560

Investments 12,167

Total $16,727

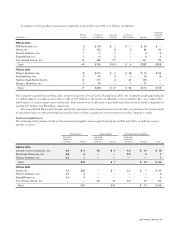

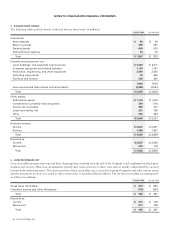

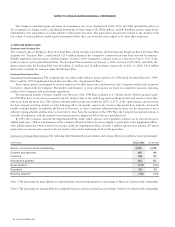

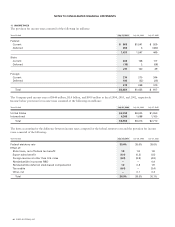

The following table provides gross realized gains and losses related to the Company’s investments (in millions):

Years Ended July 31, 2004 July 26, 2003 July 27, 2002

Gross realized gains $208 $ 339 $ 422

Gross realized losses (2) (590) (1,129)

Total $206 $(251) $ (707)

The gross realized losses in fiscal 2004, 2003, and 2002 included charges of $0, $412 million, and $858 million, respectively, related

to the impairment of certain publicly traded equity securities. The impairment charges were due to the declines in the fair values of

the investments below their cost basis that were judged to be other-than-temporary. The specific identification method is used

to determine the cost basis of fixed income securities disposed of. The weighted-average method is used to determine the cost basis

of publicly traded equity securities disposed of.

2004 ANNUAL REPORT 53