Cisco 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

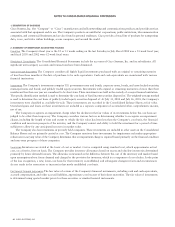

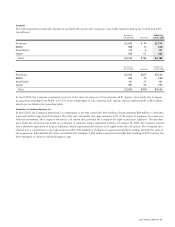

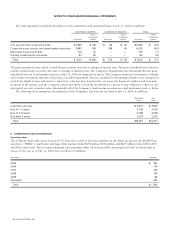

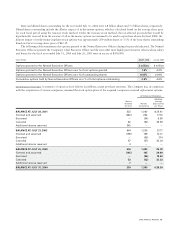

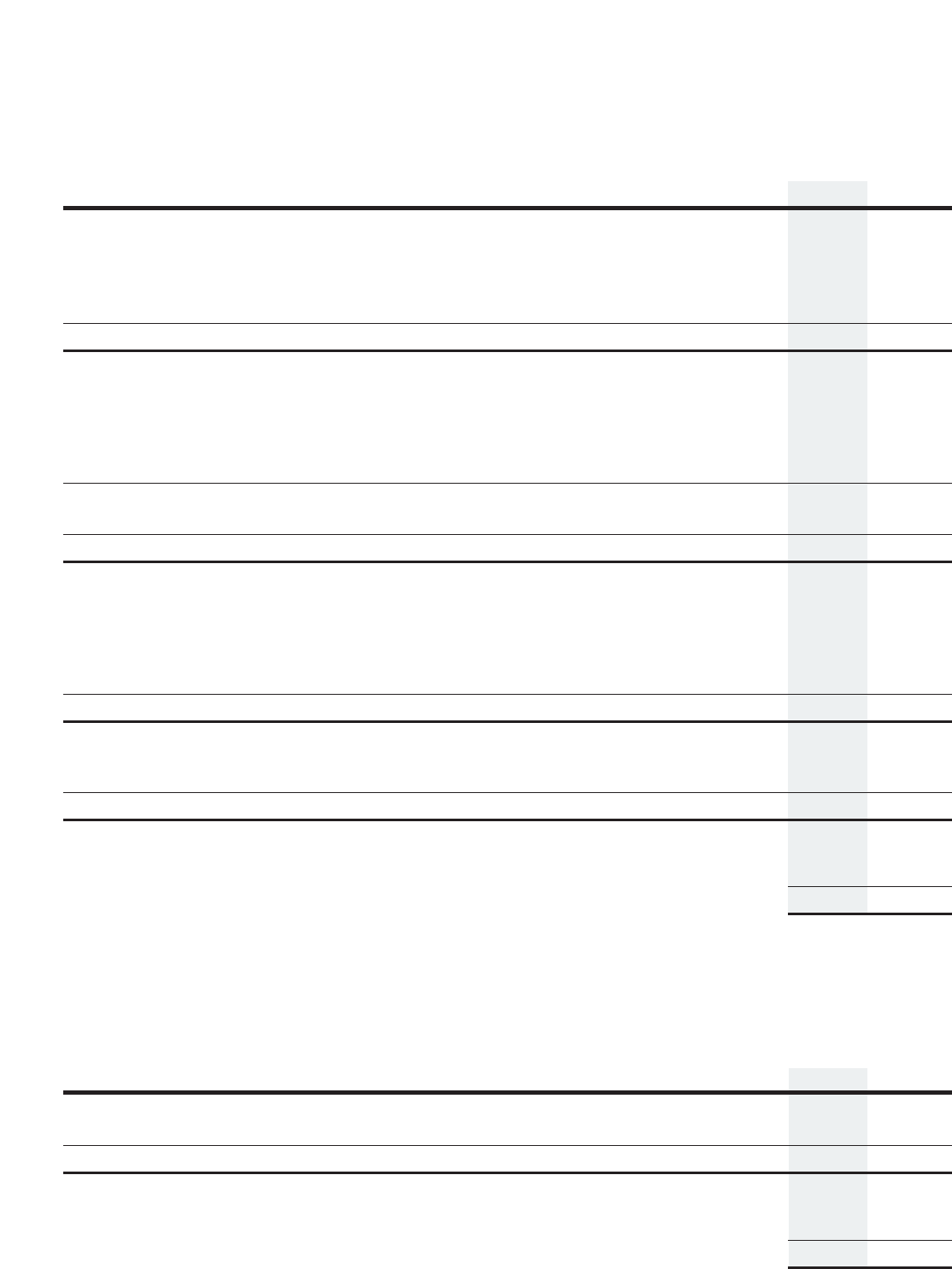

5. BALANCE SHEET DETAILS

The following tables provide details of selected balance sheet items (in millions):

July 31, 2004 July 26, 2003

Inventories:

Raw materials $58 $38

Work in process 459 291

Finished goods 656 515

Demonstration systems 34 29

Total $ 1,207 $ 873

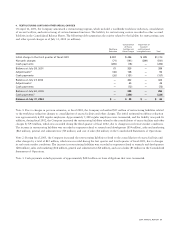

Property and equipment, net:

Land, buildings, and leasehold improvements $ 3,429 $ 3,411

Computer equipment and related software 1,120 1,147

Production, engineering, and other equipment 2,643 2,410

Operating lease assets 94 356

Furniture and fixtures 356 350

7,642 7,674

Less accumulated depreciation and amortization (4,352) (4,031)

Total $ 3,290 $ 3,643

Other assets:

Deferred tax assets $1,130 $1,476

Investments in privately held companies 354 516

Income tax receivable 690 727

Lease receivables, net 231 158

Other 435 384

Total $2,840 $3,261

Deferred revenue:

Service $ 3,047 $ 2,451

Product 1,455 1,357

Total $ 4,502 $ 3,808

Reported as:

Current $3,527 $3,034

Noncurrent 975 774

Total $ 4,502 $ 3,808

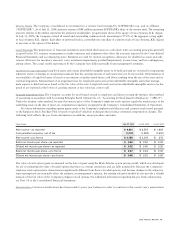

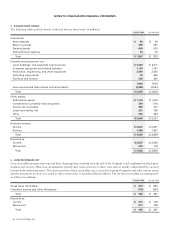

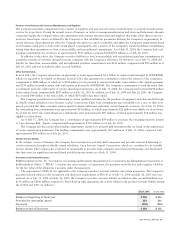

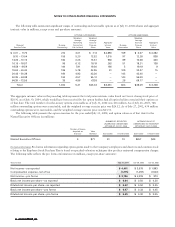

6. LEASE RECEIVABLES, NET

Lease receivables represent sales-type and direct-financing leases resulting from the sale of the Company’s and complementary third-party

products and services. These lease arrangements typically have terms from two to three years and are usually collateralized by a security

interest in the underlying assets. The current portion of lease receivables, net, is recorded in prepaid expenses and other current assets,

and the noncurrent portion is recorded in other assets in the Consolidated Balance Sheets. The net lease receivables are summarized

as follows (in millions):

July 31, 2004 July 26, 2003

Gross lease receivables $ 616 $ 840

Unearned income and other allowances (170) (553)

Total $ 446 $ 287

Reported as:

Current $ 215 $129

Noncurrent 231 158

Total $ 446 $ 287

52 CISCO SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS