Cisco 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

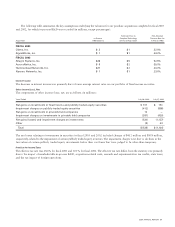

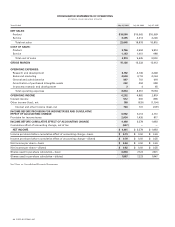

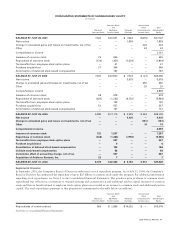

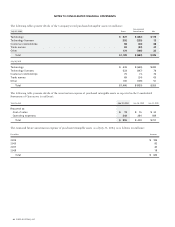

Common Stock Accumulated

and Other Total

Shares of Additional Retained Comprehensive Shareholders’

Common Stock Paid-In Capital Earnings Income (Loss) Equity

BALANCE AT JULY 28, 2001 7,324 $ 20,051 $ 7,344 $(275) $ 27,120

Net income — — 1,893 — 1,893

Change in unrealized gains and losses on investments, net of tax — — — 224 224

Other — — — 24 24

Comprehensive income 2,141

Issuance of common stock 76 655 — — 655

Repurchase of common stock (124) (350) (1,504) — (1,854)

Tax benefits from employee stock option plans — 61 — — 61

Purchase acquisitions 27 346 — — 346

Amortization of deferred stock-based compensation — 187 — — 187

BALANCE AT JULY 27, 2002 7,303 $ 20,950 $ 7,733 $ (27) $28,656

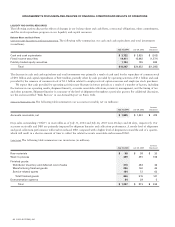

Net income — — 3,578 — 3,578

Change in unrealized gains and losses on investments, net of tax — — — 352 352

Other — — — 29 29

Comprehensive income 3,959

Issuance of common stock 68 578 — — 578

Repurchase of common stock (424) (1,232) (4,752) — (5,984)

Tax benefits from employee stock option plans — 132 — — 132

Purchase acquisitions 51 557 — — 557

Amortization of deferred stock-based compensation — 131 — — 131

BALANCE AT JULY 26, 2003 6,998 $21,116 $ 6,559 $ 354 $28,029

Net income — — 4,401 — 4,401

Change in unrealized gains and losses on investments, net of tax — — — (161) (161)

Other — — — 19 19

Comprehensive income 4,259

Issuance of common stock 122 1,257 — — 1,257

Repurchase of common stock (408) (1,284) (7,796) — (9,080)

Tax benefits from employee stock option plans — 537 — — 537

Purchase acquisitions — 6 — — 6

Amortization of deferred stock-based compensation — 186 — — 186

Variable stock-based compensation — 58 — — 58

Cumulative effect of accounting change, net of tax — 567 — — 567

Acquisition of Andiamo Systems, Inc. 23 7 — — 7

BALANCE AT JULY 31, 2004 6,735 $ 22,450 $ 3,164 $ 212 $25,826

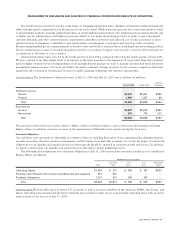

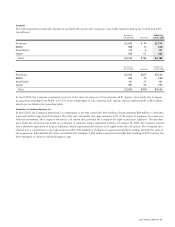

Supplemental Information

In September 2001, the Company’s Board of Directors authorized a stock repurchase program. As of July 31, 2004, the Company’s

Board of Directors has authorized the repurchase of up to $25 billion of common stock under this program. For additional information

regarding stock repurchases, see Note 9 to the Consolidated Financial Statements. The purchase price of shares of common stock

repurchased was reflected as a reduction to retained earnings and common stock and additional paid-in capital. Issuance of common

stock and the tax benefit related to employee stock option plans are recorded as an increase to common stock and additional paid-in

capital. The stock repurchases pursuant to this program are summarized in the table below (in millions):

Common Stock Accumulated

and Other Total

Shares of Additional Retained Comprehensive Shareholders’

Common Stock Paid-In Capital Earnings Income (Loss) Equity

Repurchases of common stock 956 $ 2,866 $14,052 $ — $16,918

See Notes to Consolidated Financial Statements.

2004 ANNUAL REPORT 41

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(in millions)