Cisco 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

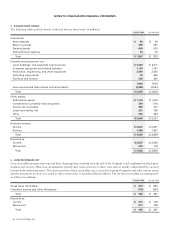

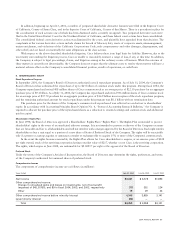

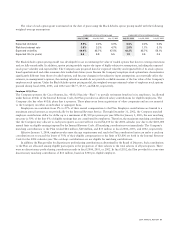

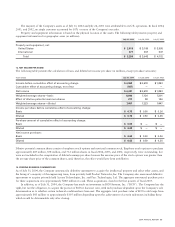

11. INCOME TAXES

The provision for income taxes consisted of the following (in millions):

Years Ended July 31, 2004 July 26, 2003 July 27, 2002

Federal:

Current $ 968 $1,041 $ 929

Deferred 469 6 (480)

1,437 1,047 449

State:

Current 230 138 117

Deferred (19) 2 (68)

211 140 49

Foreign:

Current 274 270 344

Deferred 102 (22) (25)

376 248 319

Total $2,024 $1,435 $817

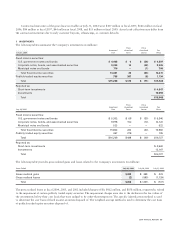

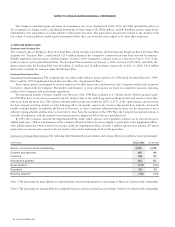

The Company paid income taxes of $644 million, $1.4 billion, and $909 million in fiscal 2004, 2003, and 2002, respectively.

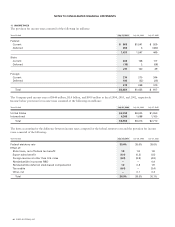

Income before provision for income taxes consisted of the following (in millions):

Years Ended July 31, 2004 July 26, 2003 July 27, 2002

United States $2,743 $3,325 $1,550

International 4,249 1,688 1,160

Total $6,992 $ 5,013 $ 2,710

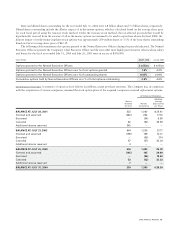

The items accounting for the difference between income taxes computed at the federal statutory rate and the provision for income

taxes consisted of the following:

Years Ended July 31, 2004 July 26, 2003 July 27, 2002

Federal statutory rate 35.0% 35.0% 35.0%

Effect of:

State taxes, net of federal tax benefit 1.8 1.8 1. 8

Export sales benefit (0.4) (0.2) (1.5)

Foreign income at other than U.S. rates (8.3) (8.9) (4.9)

Nondeductible in-process R&D —— 0.9

Nondeductible deferred stock-based compensation 1.2 0.8 1.9

Tax credits (0.4) — (3.4)

Other, net —0.1 0.3

Total 28.9% 28.6% 30.1%

62 CISCO SYSTEMS, INC.

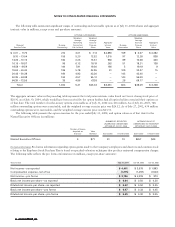

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS