Cisco 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

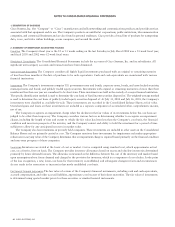

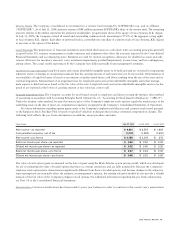

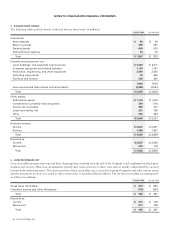

Goodwill and Purchased Intangible Assets Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets”

(“SFAS 142”), requires goodwill to be tested for impairment on an annual basis and between annual tests in certain circumstances,

and written down when impaired. Based on the impairment tests performed, there was no impairment of goodwill in fiscal 2004,

2003, and 2002. Furthermore, SFAS 142 requires purchased intangible assets other than goodwill to be amortized over their useful

lives unless these lives are determined to be indefinite. Purchased intangible assets are carried at cost less accumulated amortization.

Amortization is computed over the estimated useful lives of the respective assets, generally two to five years.

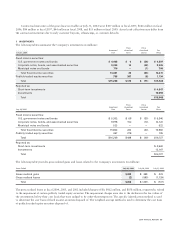

Income Taxes Income tax expense is based on pretax financial accounting income. Deferred tax assets and liabilities are recognized for

the expected tax consequences of temporary differences between the tax bases of assets and liabilities and their reported amounts.

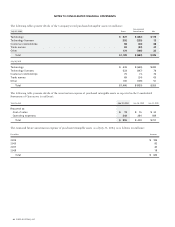

Computation of Net Income per Share Basic net income per share is computed using the weighted-average number of common shares

outstanding during the period. Diluted net income per share is computed using the weighted-average number of common shares and

dilutive potential common shares outstanding during the period. Diluted net loss per share is computed using the weighted-average number

of common shares and excludes dilutive potential common shares outstanding, as their effect is antidilutive. Dilutive potential common

shares primarily consist of employee stock options and restricted common stock.

Foreign Currency Translation Assets and liabilities of non-U.S. subsidiaries that operate in a local currency environment are translated to

U.S. dollars at exchange rates in effect at the balance sheet date, with the resulting translation adjustments directly recorded to a separate

component of accumulated other comprehensive income. Income and expense accounts are translated at average exchange rates during

the year. Where the U.S. dollar is the functional currency, translation adjustments are recorded in other income (loss), net.

Derivative Instruments The Company recognizes derivative instruments as either assets or liabilities in the Consolidated Balance Sheets

and measures those instruments at fair value. The accounting for changes in the fair value of a derivative depends on the intended use

of the derivative and the resulting designation.

For a derivative instrument designated as a fair value hedge, the gain or loss is recognized in earnings in the period of change together

with the offsetting loss or gain on the hedged item attributed to the risk being hedged. For a derivative instrument designated as a cash

flow hedge, the effective portion of the derivative’s gain or loss is initially reported as a component of accumulated other comprehensive

income and subsequently reclassified into earnings when the hedged exposure affects earnings. The ineffective portion of the gain or

loss is reported in earnings immediately.

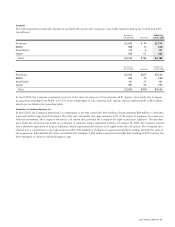

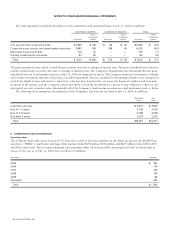

Certain forecasted transactions and foreign currency assets and liabilities expose the Company to foreign currency risk. The Company

purchases currency options and designates these currency options as cash flow hedges of foreign currency forecasted transactions related

to certain operating expenses. The Company enters into foreign exchange forward contracts to minimize the short-term impact of

currency fluctuations on certain foreign currency receivables, investments, and payables. The foreign exchange forward contracts are

not designated as accounting hedges, and all changes in fair value are recognized in earnings in the period of change.

The fair value of derivative instruments as of July 31, 2004 and changes in fair value during fiscal 2004 were not material. During

fiscal 2004, there were no significant gains or losses recognized in earnings for hedge ineffectiveness. The Company did not discontinue

any hedges because it was probable that the original forecasted transactions would not occur.

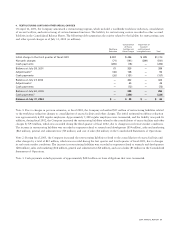

Consolidation of Variable Interest Entities Financial Accounting Standards Board (“FASB”) Interpretation No. 46, “Consolidation of Variable

Interest Entities” (“FIN 46”), was issued in January 2003. FIN 46 requires that if an entity is the primary beneficiary of a variable

interest entity, the assets, liabilities, and results of operations of the variable interest entity should be included in the consolidated

financial statements of the entity. FASB Interpretation No. 46(R), “Consolidation of Variable Interest Entities” (“FIN 46(R)”), was

issued in December 2003. The Company adopted FIN 46(R) effective January 24, 2004, and recorded a noncash cumulative stock

compensation charge of $567 million, net of tax, relating to the consolidation of Andiamo Systems, Inc. (“Andiamo”). For additional

information regarding Andiamo, see Note 3 to these Consolidated Financial Statements. For additional information regarding variable

interest entities, see Note 8 to these Consolidated Financial Statements.

44 CISCO SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS