Cisco 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

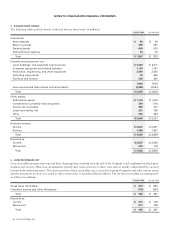

1. DESCRIPTION OF BUSINESS

Cisco Systems, Inc. (the “Company” or “Cisco”) manufactures and sells networking and communications products and provides services

associated with that equipment and its use. The Company’s products are installed at corporations, public institutions, telecommunication

companies, and commercial businesses and are also found in personal residences. Cisco provides a broad line of products for transporting

data, voice, and video within buildings, across campuses, and around the world.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Fiscal Year The Company’s fiscal year is the 52 or 53 weeks ending on the last Saturday in July. Fiscal 2004 was a 53-week fiscal year,

and fiscal 2003 and 2002 were 52-week fiscal years.

Principles of Consolidation The Consolidated Financial Statements include the accounts of Cisco Systems, Inc. and its subsidiaries. All

significant intercompany accounts and transactions have been eliminated.

Cash and Cash Equivalents The Company considers all highly liquid investments purchased with an original or remaining maturity

of less than three months at the date of purchase to be cash equivalents. Cash and cash equivalents are maintained with various

financial institutions.

Investments The Company’s investments comprise U.S. government notes and bonds; corporate notes, bonds, and asset-backed securities;

municipal notes and bonds; and publicly traded equity securities. Investments with original or remaining maturities of more than three

months and less than one year are considered to be short-term. These investments are held in the custody of a major financial institution.

The specific identification method is used to determine the cost basis of fixed income securities disposed of. The weighted-average method

is used to determine the cost basis of publicly traded equity securities disposed of. At July 31, 2004 and July 26, 2003, the Company’s

investments were classified as available-for-sale. These investments are recorded in the Consolidated Balance Sheets at fair value.

Unrealized gains and losses on these investments are included as a separate component of accumulated other comprehensive income,

net of tax.

The Company recognizes an impairment charge when the declines in the fair values of its investments below the cost basis are

judged to be other-than-temporary. The Company considers various factors in determining whether to recognize an impairment

charge, including the length of time and extent to which the fair value has been less than the Company’s cost basis, the financial

condition and near-term prospects of the investee, and the Company’s intent and ability to hold the investment for a period of time

sufficient to allow for any anticipated recovery in market value.

The Company also has investments in privately held companies. These investments are included in other assets in the Consolidated

Balance Sheets and are primarily carried at cost. The Company monitors these investments for impairment and makes appropriate

reductions in carrying values if the Company determines that an impairment charge is required based primarily on the financial condition

and near-term prospects of these companies.

Inventories Inventories are stated at the lower of cost or market. Cost is computed using standard cost, which approximates actual

cost, on a first-in, first-out basis. The Company provides inventory allowances based on excess and obsolete inventories determined

primarily by future demand forecasts. The allowance is measured as the difference between the cost of the inventory and market based

upon assumptions about future demand and charged to the provision for inventory, which is a component of cost of sales. At the point

of the loss recognition, a new, lower-cost basis for that inventory is established, and subsequent changes in facts and circumstances

do not result in the restoration or increase in that newly established cost basis.

Fair Value of Financial Instruments The fair value of certain of the Company’s financial instruments, including cash and cash equivalents,

accrued compensation, and other accrued liabilities, approximate cost because of their short maturities. The fair value of investments

is determined using quoted market prices for those securities or similar financial instruments.

42 CISCO SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS