Cisco 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

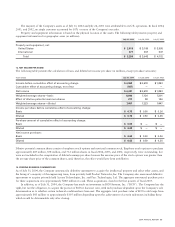

U.S. income taxes and foreign withholding taxes were not provided for on a cumulative total of $4.3 billion of undistributed

earnings for certain foreign subsidiaries. The Company intends to reinvest these earnings indefinitely in its foreign subsidiaries. If these

earnings were distributed to the U.S. in the form of dividends or otherwise, or if the shares of the relevant foreign subsidiaries were

sold or otherwise transferred, the Company would be subject to additional U.S. income taxes (subject to an adjustment for foreign tax

credits) and foreign withholding taxes. Determination of the amount of unrecognized deferred income tax liability related to these

earnings is not practicable.

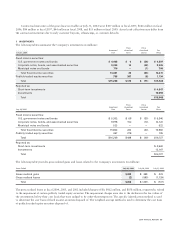

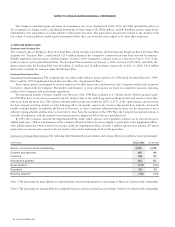

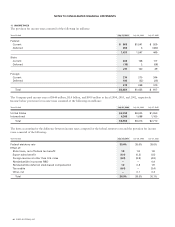

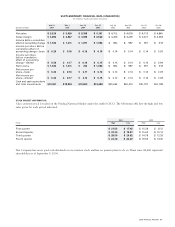

The components of the deferred tax assets (liabilities) are as follows (in millions):

July 31, 2004 July 26, 2003

ASSETS

Allowance for doubtful accounts and returns $ 231 $ 228

Sales-type and direct-financing leases 270 297

Loan reserves 86 123

Inventory allowances and capitalization 228 247

Investment provisions 385 654

In-process R&D, goodwill, and purchased intangible assets 469 375

Deferred revenue 1,170 899

Credits and net operating loss carryforwards 339 261

Other 541 562

Total deferred tax assets 3,719 3,646

LIABILITIES

Unremitted earnings of foreign subsidiaries (450) —

Unrealized gains on investments (100) (142)

Other (212) (53)

Total deferred tax liabilities (762) (195)

Total $ 2,957 $ 3,451

Reclassifications have been made to the fiscal 2003 balances for certain components of deferred tax assets and liabilities in order to

conform to the current year’s presentation.

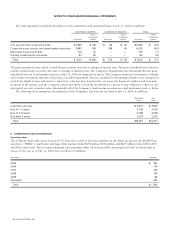

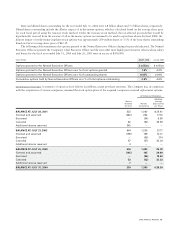

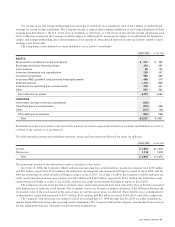

The following table presents the breakdown between current and noncurrent net deferred tax assets (in millions):

July 31, 2004 July 26, 2003

Current $ 1,827 $ 1,975

Noncurrent 1,130 1,476

Total $ 2,957 $ 3,451

The noncurrent portion of the deferred tax assets is included in other assets.

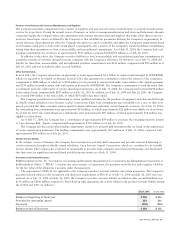

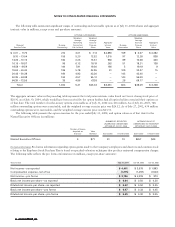

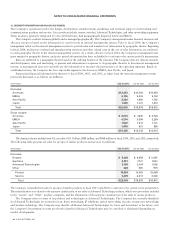

As of July 31, 2004, the Company’s federal and state net operating loss carryforwards for income tax purposes were $234 million

and $17 million, respectively. If not utilized, the federal net operating loss carryforwards will begin to expire in fiscal 2010, and the

state net operating loss carryforwards will begin to expire in fiscal 2005. As of July 31, 2004, the Company’s federal and state tax

credit carryforwards for income tax purposes were $21 million and $362 million, respectively. If not utilized, the federal tax credit

carryforwards will begin to expire in fiscal 2008, and state tax credit carryforwards will begin to expire in fiscal 2005.

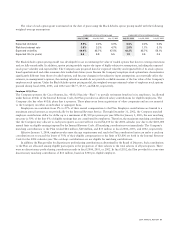

The Company’s income taxes payable for federal, state, and foreign purposes have been reduced by the tax benefits associated

with dispositions of employee stock options. The Company receives an income tax benefit calculated as the difference between the

fair market value of the stock issued at the time of exercise and the option price, tax effected. These benefits were credited directly

to shareholders’ equity and amounted to $537 million, $132 million, and $61 million for fiscal 2004, 2003, and 2002, respectively.

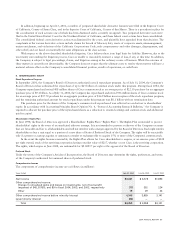

The Company’s federal income tax returns for fiscal years ended July 25, 1998 through July 28, 2001 are under examination,

and the Internal Revenue Service has proposed certain adjustments. The Company believes that adequate amounts have been reserved

for any adjustments that may ultimately result from these examinations.

2004 ANNUAL REPORT 63