Cisco 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

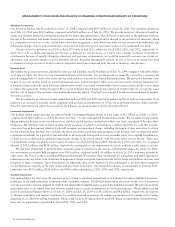

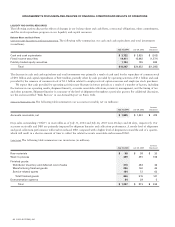

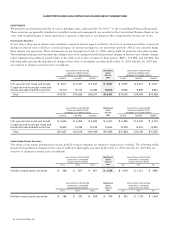

Service Gross Margin

Service gross margin decreased by 1.3% but increased $80 million in absolute dollars. Service gross margin will typically experience

some variability over time due to various factors such as the change in mix between technical support services and advanced services, as

well as the timing of technical support service contract initiations and renewals. Our revenue from advanced services may increase

to a higher proportion of total service revenue due to our continued focus on providing comprehensive support to our customers’

networking devices, applications, and infrastructures.

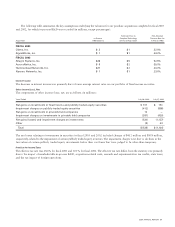

Research and Development, Sales and Marketing, and General and Administrative Expenses

R&D expenses increased primarily due to higher discretionary spending of $87 million, primarily related to higher prototype expenses

and due to an additional week of headcount-related expense of $28 million. The increase in R&D expenses was partially offset by

lower depreciation expense of $61 million. The increase in R&D expenses reflect our continued investment in R&D efforts in routers,

switches, Advanced Technologies, and other product technologies. We have also continued to purchase or license technology in order

to bring a broad range of products to market in a timely fashion. If we believe that we are unable to enter a particular market in a

timely manner with internally developed products, we may license technology from other businesses or acquire businesses as an alternative

to internal R&D. All of our R&D costs have been expensed as incurred. In May 2004, we announced plans to hire additional engineers,

and we expect to incur additional R&D expenses in connection with such new hires.

Sales and marketing expenses increased primarily due to increases in sales expenses of $270 million and marketing expenses

of $144 million. The increase in sales expenses was primarily due to the effect of foreign currency fluctuations, net of hedging, of

approximately $120 million, and an increase in sales commissions of approximately $110 million partially offset by a decrease in

sales program expenses of $86 million. The remaining increase was primarily due to higher discretionary spending. The increase in

marketing expenses was primarily related to an increase of $66 million in our integrated marketing campaign. The increase in marketing

expenses was also attributable to additional expenses of $33 million related to our acquisition of the Linksys business in the fourth

quarter of fiscal 2003. In May 2004, we announced plans to increase the size of our sales force, and we expect to incur additional sales

expenses in connection with such new hires.

G&A expenses increased primarily due to higher amortization of deferred stock-based compensation of $52 million attributable to

our acquisitions, expenses related to investments in internal information technology systems and related program spending of

$42 million, and the effect of foreign currency fluctuations, net of hedging, of approximately $30 million.

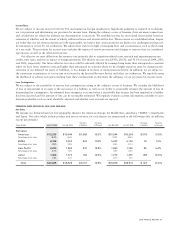

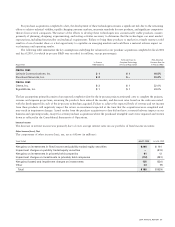

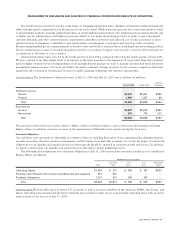

Amortization of Purchased Intangible Assets

Amortization of purchased intangible assets included in operating expenses was $242 million in fiscal 2004, compared with $394 million

in fiscal 2003. The decrease in the amortization of purchased intangible assets was due to the amortization of certain technology and

patent intangibles in the prior year period that were fully amortized as of the end of fiscal 2003. For additional information regarding

purchased intangible assets, see Note 3 to the Consolidated Financial Statements.

In-Process Research and Development

Our methodology for allocating the purchase price relating to purchase acquisitions to in-process R&D is determined through established

valuation techniques in the high-technology communications equipment industry. In-process R&D expense in fiscal 2004 was $3 million,

compared with $4 million in fiscal 2003. See Note 3 to the Consolidated Financial Statements for additional information regarding the

acquisitions completed in fiscal 2004 and fiscal 2003 and the in-process R&D recorded for each acquisition. In-process R&D was

expensed upon acquisition because technological feasibility had not been established and no future alternative uses existed.

The fair value of the existing purchased technology and patents, as well as the technology under development, is determined using

the income approach, which discounts expected future cash flows to present value. The discount rates used in the present value calculations

are typically derived from a weighted-average cost of capital analysis and venture capital surveys, adjusted upward to reflect additional

risks inherent in the development life cycle. We consider the pricing model for products related to these acquisitions to be standard

within the high-technology communications equipment industry. However, we do not expect to achieve a material amount of expense

reductions as a result of integrating the acquired in-process technology. Therefore, the valuation assumptions do not include significant

anticipated cost savings.

26 CISCO SYSTEMS, INC.

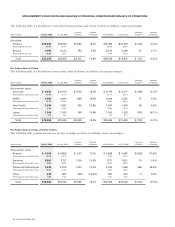

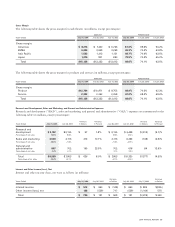

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS