Cisco 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The impairment charges on publicly traded equity securities of $412 million, pretax, during fiscal 2003 were due to the declines in the

fair values of certain publicly traded equity securities below their cost basis that were judged to be other-than-temporary. For additional

information regarding our net gains (losses) and impairment charges on investments, see the section of this report entitled “Quantitative

and Qualitative Disclosures About Market Risk.”

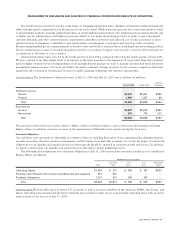

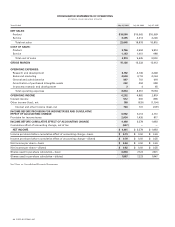

Provision for Income Taxes

The effective tax rate was 28.9% for fiscal 2004 and 28.6% for fiscal 2003. The effective tax rate differs from the statutory rate primarily

due to acquisition-related costs, research and experimentation tax credits, state taxes, and the tax impact of foreign operations.

Our future effective tax rates could be adversely affected by earnings being lower than anticipated in countries where we have lower

statutory rates and higher than anticipated in countries where we have higher statutory rates, by changes in the valuation of our deferred

tax assets or liabilities, or by changes in tax laws or interpretations thereof. In addition, we are subject to the continuous examination

of our income tax returns by the Internal Revenue Service and other tax authorities. We regularly assess the likelihood of adverse

outcomes resulting from these examinations to determine the adequacy of our provision for income taxes.

Cumulative Effect of Accounting Change, Net of Tax

In April 2001, we entered into a commitment to provide convertible debt funding of approximately $84 million to Andiamo, a privately

held storage switch developer. This debt was convertible into approximately 44% of the equity of Andiamo. In connection with this

investment, we obtained a call option that provided us the right to purchase Andiamo. The purchase price under the call option was

based on a valuation of Andiamo using a negotiated formula. On August 19, 2002, we entered into a definitive agreement to acquire

Andiamo, which represented the exercise of our rights under the call option. We also entered into a commitment to provide nonconvertible

debt funding to Andiamo of approximately $100 million through the close of the acquisition. Substantially all of the convertible debt

funding of $84 million and nonconvertible debt funding of $100 million had been expensed as research and development costs.

We adopted Financial Accounting Standards Board (“FASB”) Interpretation No. 46(R), “Consolidation of Variable Interest Entities”

(“FIN 46(R)”), effective January 24, 2004. We evaluated our debt investment in Andiamo and determined that Andiamo was a variable

interest entity under FIN 46(R). We concluded that we were the primary beneficiary as defined by FIN 46(R) and, therefore, accounted

for Andiamo as if we had consolidated Andiamo since our initial investment in April 2001. The consolidation of Andiamo from the

date of our initial investment required accounting for the call option as a repurchase right. Under FASB Interpretation No. 44, “Accounting

for Certain Transactions Involving Stock Compensation,” and related interpretations, variable accounting was required for substantially

all Andiamo employee stock and options because the ending purchase price was primarily derived from a revenue-based formula.

Effective January 24, 2004, the last day of the second quarter of fiscal 2004, we recorded a noncash cumulative stock compensation

charge of $567 million, net of tax (representing the amount of variable compensation from April 2001 through January 2004). This

charge was reported as a separate line item in the Consolidated Statements of Operations as a cumulative effect of accounting change,

net of tax. The charge was based on the value of the Andiamo employee stock and options and their vesting from the adoption of

FIN 46(R) pursuant to the formula-based valuation.

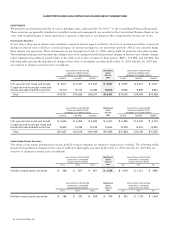

On February 19, 2004, we completed the acquisition of Andiamo, exchanging approximately 23 million shares of our common stock

for Andiamo shares not owned by us and assuming approximately 6 million stock options, for a total estimated value of $750 million,

primarily derived from the revenue-based formula, which after stock price related adjustments resulted in a total amount recorded of

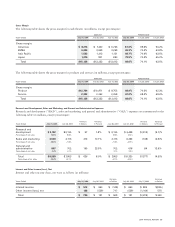

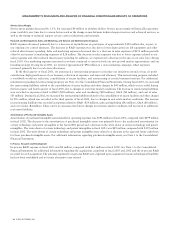

$722 million as summarized in the table below.

Subsequent to the adoption of FIN 46(R), changes to the value of Andiamo and the continued vesting of the employee stock and

options resulted in an adjustment to the noncash stock compensation charge. We recorded a noncash variable stock compensation

adjustment of $58 million in the third quarter of fiscal 2004 to the cumulative stock compensation charge recorded in the second quarter

of fiscal 2004 to account for the additional vesting of the Andiamo employee stock and options and changes in the formula-based

valuation from January 24, 2004 until February 19, 2004. This noncash adjustment was reported as research and development expense

of $52 million and sales and marketing expense of $6 million in the Consolidated Statements of Operations, as amortization of deferred

stock-based compensation in the Consolidated Statements of Cash Flows, and as an increase to additional paid-in capital in the Consolidated

Statements of Shareholders’ Equity. In addition, upon completion of the acquisition, deferred stock-based compensation of $90 million

was recorded to reflect the unvested portion of the formula-based valuation of the Andiamo employee stock and options. See Note 3

to the Consolidated Financial Statements. The amount of deferred stock-based compensation was fixed at the date of acquisition and

will be amortized over the remaining vesting period of the Andiamo employee stock and options of approximately two years.

28 CISCO SYSTEMS, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS