Cisco 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

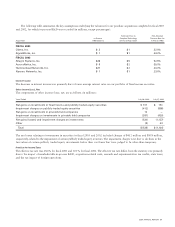

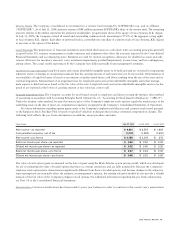

Our equity portfolio consists of securities with characteristics that most closely match the Standard & Poor’s 500 Index or Nasdaq

Composite Index. These equity securities are held for purposes other than trading. The modeling technique used measures the change

in fair values arising from selected hypothetical changes in each stock’s price. Stock price fluctuations of plus or minus 25%, 50%, and

75% were selected based on the probability of their occurrence. During fiscal 2003 and 2002, we recognized charges of $412 million

and $858 million, respectively, attributable to the impairment of certain publicly traded equity securities. The impairment charges

were related to the declines in the fair values of certain publicly traded equity securities below their cost basis that were judged to be

other-than-temporary. There was no impairment charge recorded in fiscal 2004.

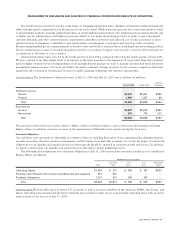

INVESTMENTS IN PRIVATELY HELD COMPANIES

We have invested in privately held companies, some of which are in the startup or development stages. These investments are inherently

risky, as the markets for the technologies or products these companies are developing are typically in the early stages and may never

materialize. We could lose our entire initial investment in these companies. These investments are primarily carried at cost, which as

of July 31, 2004 was $354 million, compared with $516 million at July 26, 2003, and are recorded in other assets in the Consolidated

Balance Sheets. Our impairment charges on investments in privately held companies were $112 million, $281 million, and $420 million

during fiscal 2004, 2003, and 2002, respectively.

Our evaluation of equity investments in private and public companies is based on the fundamentals of the businesses, including,

among other factors, the nature of their technologies and potential for financial return to us.

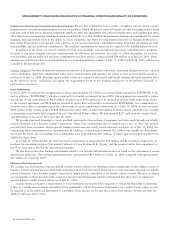

DERIVATIVE INSTRUMENTS

We enter into foreign exchange forward contracts to minimize the short-term impact of foreign currency fluctuations on receivables,

investments, and payables, primarily denominated in Australian, Canadian, Japanese, and several European currencies, including the

euro and British pound. Our market risks associated with our foreign currency receivables, investments, and payables relate primarily

to variances from our forecasted foreign currency transactions and balances.

Approximately 75% of our operating expenses are U.S.-dollar denominated. In order to reduce variability in operating expenses

caused by the remaining non-U.S.-dollar-denominated operating expenses, we periodically hedge certain foreign currency forecasted

transactions with currency options with maturities up to 18 months. These hedging programs are not designed to provide foreign

currency protection over longer time horizons. In designing a specific hedging approach, we consider several factors, including offsetting

exposures, significance of exposures, costs associated with entering into a particular hedge instrument, and potential effectiveness of

the hedge. The gains and losses on foreign exchange contracts mitigate the variability in operating expenses associated with currency

movements. Due primarily to our limited currency exposure to date, the impact of foreign currency fluctuations has not been material to

our Consolidated Financial Statements. In fiscal 2004, the effects of foreign currency fluctuations, net of hedging, increased total research

and development, sales and marketing, and general and administrative expenses by approximately 2.5%, compared with fiscal 2003

and by approximately 1% in fiscal 2003, compared with fiscal 2002. The impact of foreign currency fluctuations on sales has not been

material because our sales are primarily denominated in U.S. dollars.

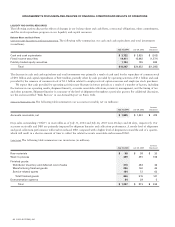

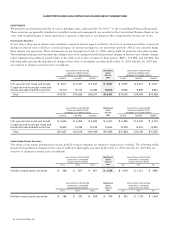

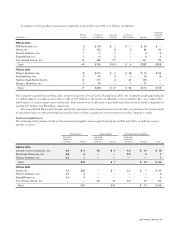

Foreign exchange forward and option contracts as of July 31, 2004 are summarized as follows (in millions):

Notional Amount Fair Value

Forward contracts:

Purchased $862 $(3)

Sold $583 $(2)

Option contracts:

Purchased $389 $ 6

Sold $431 $(1)

Our foreign exchange forward contracts related to current assets and liabilities generally range from one to three months in original

maturity. Additionally, we have entered into foreign exchange forward contracts related to long-term financings with maturities of

up to two years. The foreign exchange forward contracts related to investments generally have maturities of less than one year. Currency

option contracts generally have maturities of less than 18 months. We do not enter into foreign exchange forward and option contracts

for trading purposes. We do not expect gains or losses on these derivative instruments to have a material impact on our financial results.

See Note 8 to the Consolidated Financial Statements.

2004 ANNUAL REPORT 37

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK